The overall oil and gas industry’s disclosed contract value witnessed a significant quarter-on-quarter (QoQ) increase of 60 percent in Q2 2023, mainly driven by a mega contract for Qatar’s North Field South (NFS) LNG project, according to GlobalData, a data and analytics company.

GlobalData’s latest report shows that the overall contract value increased from $35.4 billion in Q1 2023 to $56.7 billion in Q2 2023. However, the contract volume was unable to keep up the pace and saw a decrease from 1,625 in Q1 2023 to 1,256 in Q2 2023.

Pritam Kad, Oil and Gas Analyst at GlobalData, comments: “The big boost on the value front is attributed to Technip Energies and Consolidated Contractors Company (CCC) joint venture’s landmark $10 billion engineering, procurement, construction, and commissioning (EPCC) contract to build 16 million tonnes per year North Field South (NFS) LNG project in Qatar.”

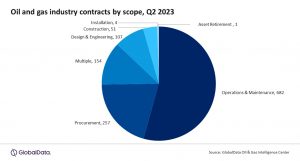

Operation and Maintenance (O&M) represented 54 percent of the total contracts in Q2 2023, followed by procurement scope with 18 percent, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, accounted for 11 percent.

Some of the other notable contracts during the quarter include Hyundai E&C’s two lump-sum turn-key contracts combined worth approximately $5 billion from Saudi Aramco and TotalEnergies, covering the detailed design EPC for a mixed feed cracker (MFC), and utilities, flares, and interconnecting facilities at the Amiral petrochemicals facility expansion in Jubail Industrial City, Saudi Arabia.

Maire Tecnimont subsidiaries also secured two lump-sum turn-key contracts worth around $2 billion from Saudi Aramco and TotalEnergies for the EPC of derivatives units and high-density polyethylene (HDPE) units for the Amiral expansion.