MIDLAND, TEXAS—The assembled membership of the Permian Basin Petroleum Association welcomed Omar Garcia as its luncheon speaker when the association resumed its monthly luncheon meetings here at the Midland Petroleum Club on Thursday, Sept. 19.

The keynote speaker for this occasion was Omar Garcia, Chief External Affairs Officer for the Port of Corpus Christi Authority.

After being introduced by PBPA Executive Vice President Stephen Robertson, Garcia delivered a detail report, complete with charts, highlighting the enormous changes in Corpus, especially the work that is being done to dredge the port to deepen and widen the ship channel. With a deeper channel, the port can accommodate larger vessels, thus eliminating much of the need for “reverse lightering,” the offshore process of pumping outbound crude from a smaller vessel to a supertanker (one vessel tethered to the other) awaiting its cargo out in those deeper waters. Having a deeper port will radically transform the functionality of the Port of Corpus Christi. Reverse lightering is not nearly so efficient as direct loading of a VLCC (very large crude carrier), and so significant economies can be achieved just on the crude loading aspects alone.

We promised a transcript of Mr. Garcia’s remarks, but our recording on this day was not fully transcribable, due to the sound quality. What follows is our transcript, with this notation [ indistinct ] provided where the words could not be reliably deciphered.

Omar Garcia:

Thank you Stephen. It’s a pleasure to be here with the Permian Basin Petroleum Association. I want to thank Ben Shepperd, as well, for the invite. I know you guys have heard a lot about the connections we now have to this region. You know, prior to the oil export ban being lifted, the Port of Corpus Christi wasn’t part of your daily conversation. But now it is, and [ indistinct ]. But things have certainly changed since December of 2015. [ indistinct] There are 18 seaports on the Texas Gulf Coast. They’re very interesting because they’re independent political subdistricts governed by the water code. So… we’re not really a state agency, but we are. We have seven commissioners. These commissioners are appointed by the city of Corpus, [indistinct ]

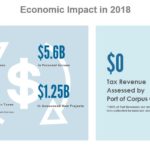

On most ports on the Texas Gulf Coast, your port commissioners are elected. That means every two or four years you’re getting new port commissioners. The way our port is structured, our port commissioners serve three four-year terms. So we’ve, we’ve got some, some continuity in commissioners working together. Because it is a big task and they are volunteer. They get paid a total sum of $0 and they, we do have a lot of time requests for them. We’re a large national energy hub, gateway to global markets… we’re a landowner, land developer, and a landlord… What we are is we are a developer with a better ship channel. We want to lease you some land. We charge for wharfage fees, ships coming in, ships going out. That’s how boards generate their revenue. And as you might imagine, for the last five years, our revenues have increased tremendously thanks to the oil and gas industry and in particular from what’s coming out of Midland.

(Refers to a slide]

These are our seven port commissioners. Just to give an overview, these are highly, highly sought after positions. These seven commissioners… probably if you were to ask a local, they probably would say they would rather be a port commissioner than a mayor. These are highly, highly sought after appointments. So these are, this is our great group of port commissioners. Our latest port commissioner is Catherine Hilliard. She replaced Barbara Canalis who went on to become county judge. She won the election back in November of last year.

So, just a quick overview of the port. We have world class facilities. Right now we’re at 47 feet (deep) going to 54. We have quick access to the Gulf of Mexico. We have interstate 37 that runs to the port. the port. We’ve got all of our major class one railroads at the port of Corpus. We’ve got 15 owned liquid docs and 33 customers that own liquid docks. So we do it both ways. Of the 33 customer liquid docks, those are specific to that one company. Those aren’t public docks. It is for exclusive use for those companies.

I think a lot of folks prior to the oil boom didn’t understand the role of the port and how important they are. There are huge economic driver not only for Corpus but for Texas. I won’t bore you with those details, but ports along the Texas Gulf Coast, some of them can levy taxes. We don’t levy any taxes. Our money stays local. The money that we raise goes back into infrastructure for our customers and it goes back out into the community. One of the things that we’re very proud of, if you look at the region of the Corpus Christi, which is growing, which includes Nueces County and San Patricio County—the companies along the port make up over a third of the employment base [in those counties].

If you look at the Port of Corpus Christi… we’ve got interstate, we’ve got rail. And of course we got a lot of new pipes come into the port.

If you look for the one thing that changed the port of Corpus Christi, it was very simple. The oil export ban being lifted December 2015. Prior to that, the port of Corpus Christi was a sleepy little port. Ships came in. We had three major refineries: Flint Hills, Citgo, and Valero. We had some growth, but nothing like we’ve seen in the last several years.

Lifting the ban on the oil exports has transcended the region to the point that we’ve never seen this kind of growth. Now, I’ll tell you a quick story. I started my career in Corpus back in 2001 in economic development. I was the vice president of economic development for the Corpus Christi Regional Economic Development Corporation. In 2001 you couldn’t give away land at the port. You couldn’t give it away in the Inner Harbor. As of today, we have less than a hundred acres in the Inner Harbor left to develop. Less than a hundred acres. We’re out of land, which is a great thing for us to experience. But that’s how things have changed for since 2001 and it’s happened relatively quickly. Here’s just a slide of some of our [customers?] logos?. You’ll, you will recognize many of these—just a sample of the companies we’re working with right now. We have several major projects that are still coming online and a lot of it is because cost-effective natural gas coming from the Eagle Ford.

There’s a lot of reasons why we’re seeing a manufacturing renaissance in Corpus Christi. We just announced a $2 billion pipe manufacturer from Fort Wayne, Indiana. Steel dynamics. You know, they came into town and they said, ‘We came into town with our $2 billion project. We thought we were gonna be the toast of the town. Well, when you’re dealing with others that are at $10 and $15 billion, this is a cute little $2 billion project.’ And they quickly realized that they were. But they’re going to add 600 jobs to the region. We’re excited about that.

Exxon [ indistinct ] is constructing their ethylene cracker plant. [ Indistinct ]

I don’t need to bore you with this [next] slide. You know the production and the numbers that are coming out in the Permian, the stuff that’s coming out from the Eagle Ford, and how these have positioned the United States as the number one oil producer in the world. This is all information from Wood MacKenzie.

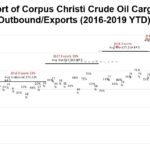

I’m going to try to highlight this if I can. Here’s January of 2016. This light green is our exports, right? Eleven percent. So as soon as the old export ban was lifted, we started exporting. Let’s look at right here—77 percent in, like, March of ’18 and look where we are now, in April of ’19—69 percent. I will tell you that this is a little outdated because it’s April. So if you looked at April numbers, we were exporting 700,000 million barrels of crude a day. Three weeks ago we reached the 1 million mark per day, and that’s because Epic pipeline came online. So now you’re at 1 million barrels of crude being exported out of the Port of Corpus personally on a daily basis.

So here’s a little sample of kind of our infrastructure. Here’s the Gulf of Mexico right here, and here’s the entrance to the ship channel. It’s a 36-mile channel from the entrance to the Gulf, all the way to the Inner Harbor. So you’ve got Harbor Island, which we’re looking at doing a project with the Carlyle Group to build an oil export terminal. And what that means is that’ll be the terminal that will allow for VLCCs to come in and fill up and head back out… We’ve got to Phillips 66 than wants to do an offshore buoy project, off Harbor Island. They’re going to put their booster station and tanks on Harbor Island and they’re going to go out 21 miles into the Gulf, which will [let them] fully fill VLCCs as well.

You’ve got to go 20 miles to get to the really deep water. Now, they’ll be at 90 feet out there. Then [in Ingleside] you have three terminals. You have Moda Midstream, you have Flint Hills, and you have South Texas Gateway. South Texas Gateway is Buckeye and Marathon. That’s their partnership. They’re going to be online in March of next year. Moda Midstream is in operation right now. Moda right now is exporting anywhere from 300,000 to 400,000 barrels a day out of their facility in Ingleside. The Flint Hills facility has been in the paper—it is for sale. So I’m not sure what’s going to happen with that, but that is certainly something that we’re looking at very closely. And then of course you got the Inner Harbor and you’ve got NuStar, Citgo, and Valero, Flint Hills.

And then Buckeye had a terminal on the Inner Harbor. So you can quickly see, if you were to start adding these numbers. If we’re at a million barrels, today, you know, we anticipate, conservatively, that in the next two to three years, that number could reach to 2-3 million if not more. So certainly the infrastructure is coming to Corpus. We have companies invested in the port, and the future is bright. We want your crude, guys. Keep producing your crude—we want it.

So, here’s new pipeline capacity. This kind of talks a little bit about what I’m talking about. Here’s Epic’s new line coming in from the Permian. Two or three weeks ago, this came online and it boosted our exports to over a million barrels. We’re anticipating 2.8 million barrels of incremental pipeline capacity from the Permian Basin. The numbers I just talked about, this is what we’re expecting from the GrayOak, the Cactus I, and the Cactus II. You know, we really want to be the energy hub of the Americas. That’s kind of our tagline for the Port of Corpus Christi for the last couple of years. We were kind of beating the Port of Houston as far as the number one for with the most exports. They overtook us maybe three months ago. We’ll soon overtake them. It’s kind of a competition with them. But both the Port of Houston and the port of Corpus [alike] are positioning themselves to take that crude and get it out into the international market.

Here’s just more of a Permian pipeline utilization forecast. This is just more of a slide to show you all the pipes that are coming to Corpus, and utilization rates. You know you see some are at 90%, 80 to 90%, some of them—the yellow—70%, that’s, those are all things that we’re anticipating in. What we’re getting ready for. This is just a slide just to show the Red Oak project. You saw some recent press on this and the connectivity we’ve got from the Permian, from Cushing on [indistinct]… Been a lot of discussion about these offshore buoy projects. You guys have heard about it, you know… nine of them right now are being proposed along the Texas Gulf coast. Some of the experts say two to three of these will be built.

You know, I wish I had a crystal ball. I could tell you how many are going to be built. We really don’t know, but this industry is trying to get their product out. We understand that. We are not against these floating buoy projects. And matter of fact, uh, you know, we’re working with Phillips 66 on their project. We’re one of the ports that are working in partnership with these. You’ve got Enterprise, you’ve got Enbridge, and I believe you’ve got Energy Transfer talking about doing one as well too. There’s a lot of discussion about these projects. Our senior leadership and our port commissioners were just in the UK and they went to visit the Phillips 66 floating buoy project that’s been in operation almost for 40 years off the coast of the UK.

You can bring in a VLCC, fully load them, then turn around and go to the market. So the economic support is there for these projects. The problem with this is that the permitting process is anywhere from 18 to 24 months. It’s a lengthy permitting process to get these things done. So we’ll see. You know what the market will do in the next two years. We’ll see how quickly these come online. But this kind of just gives you a snapshot of what a lot of our mainstream companies are looking at it right now as it relates to these offshore floating buoy projects.

Just a headline… Corpus Christi is set to be the top crude export hub, and that is based on information from Wood Mackenzie, just given all the growth and all the pipes coming into Corpus. They know what’s coming and they’ve deemed us to be the top U.S. export hub. We’re very excited about about that.

So, there’s been lots of discussion about bottlenecks, and how we’re going to alleviate that. You know, what is coming into Corpus, right? One of the biggest things that we’ve been working on is our channel improvements project. What is that? That is the project to deepen and widen the ship channel. So, you see, again, here’s the Gulf of Mexico… Phase One of our channel improvement product is to go from the Gulf of Mexico to Harbor Island, which will take us to 54 feet. This project has taken us 30 years.

It has taken us 30 years to start dredging. That is unacceptable, you know, that is unacceptable in the time that we live today. We’ve got to get our product out. If you look at it—once this project is complete, the Port of Corpus will have the deepest channel along the Texas Gulf Coast at 54, which is great. It sounds really great, right? But you still can’t fill a VLCC—there are 2 billion barrels that’s needed. Can you tell me which state has a port that has 75 feet? Long Beach. Of all the states, Long Beach, Calif., has a 75 foot channel. They can fill up a VLCC.

But, it’s California. So when this project first started, the 1990s, the cost, since then, has, as you might imagine, escalated. We were supposed to be at 409 million. That cost is now over 500 million because of all the delays over the last 30 years. It has been a long, long project. We’re in DC every two months making sure that we have the funding. So just to go back to this, we have dredgers in the waters. Today. They started dredging I think back in March. They are literally right here about to complete… we anticipate Phase One being completed by February or March of next year. Okay, so that six months to dredge those six miles costs $92 million. $92 million. Total project costs $409 million. Of that 409, the Port will pick up a third of that cost.

The federal government picks up the remaining two thirds. All right—the issue again is permitting. The Army Corps of Engineers is responsible for all the [indistinct] waterways and they’re also responsible for saving lives, for hurricanes, the levies, the dams. What we saw after what happened with Katrina, any one can understand that they’re stretched very thin, but we need the army Corps of Engineers to expedite this process. We really need that. And then after you get your project permitted and you’re on your way, you’ve still got a dredging capacity issue. There are so many ports that need dredgers. Well, because of the Jones Act, we can’t get foreign pledged dredgers. So things are complicated worse. And it’s the same thing that the Port of Houston is going through. Freeport. Brownsville. I’m not telling you anything that’s specific to the Port of Corpus Christi. It’s just the reality, guys. It’s just the reality of the situation. So after we get past Harbor Island, we will then come to Ingleside.

[Portion missing here – about ten seconds]

Then eventually all the way into the inner Harbor. It could take three or four years to complete and get this all the way into the Inner Harbor. It’ll take three or four years to completely get this funded, dredge it, the works. We’re excited about it. We also want to make sure that we’re continuing to make our push in DC. You said your guys are in DC and meeting with congressional delegations, so if you are, make sure they know the Port of Corpus Christi needs to expedite this process.

So, good. We’re getting to 54 feet. That’s great. So what we’re also doing right now with the Carlisle Group, a big investment firm in DC, once we get to 54, again, they want to build their own own export terminal on Harbor Island with their own money, private equity. They’re going to dredge to 75 feet from the Gulf of Mexico to Harbor Island.

That’ll be at their expense. That’s so they can bring in two VLCCs and fully laden them. Right now, what happens is, at 47 feet, for example, you would to those terminals and they can pull up a VLCC to about 1.2, 1.3, and then they take a smaller ship and they “reverse lighter,” to top off that VLCC. We get to 54 feet, you’re probably looking at 1.5, 1.6. So the economics look better, the cost looks better. So having a ship channel get to 54 is going to help everybody out. I mean economics work better and it’s something that will give us a competitive advantage and give you all an advantage as well, too. You can get your product out to the market.

Another thing about Corpus is, we don’t have a containers facility. We don’t have container ships. So we don’t have traffic issues. Right now we don’t. We don’t have the congestion. The ship channel—when we deepen and widen the channel—that will also help with our two-way traffic. So that’s gonna help increase the volumes as well too. This is why the ship channel is very, very important to the CIP project. And this is a federal waterway, guys. So the state doesn’t have any really oversight over it. So when we go to the state and the governor, they’re very supportive of this project, as they are of all the other port projects. But they really can’t influence things to help make this a reality quicker.

But we also face a very bright future and you can see, from the numbers, that we’re very excited about what’s going on in Corpus. We want to continue to build a relationship with Midland and the Permian Basin, with the great companies that are here. Because like I said, we want to see your crude come to the region, to add jobs and prosperity to the region. We’ve given you the cost estimates of our share—about 132 million. The federal is about 277 million. But, again, that number has gone up because of project delays. Phase two, which will take it to Ingleside, those contracts were supposed to go out in September. But because of delays, they did not. They will now not go out until December. So again, we keep pushing it back and keep pushing this project back and causing the cost to go up. There is legislation where the Port can take over the project, but it’s a long road ahead. But we certainly have the financial wherewithal to get this project done.

I hope that gives you a good overview of what’s going on at the Port of Corpus Christi. Again, we’re excited. The industry here [in the Permian Basin] has been a game changer for us in the region. Whatever the Port of Corpus Christi can do to support your company, please let us know. We are open for business. I appreciate the opportunity from Steven and Ben to come speak here. I encourage you to go to our Facebook page, our Twitter, our LinkedIn. We provide updates on a daily basis. I thank you for your time and appreciate all you do for the Port of Corpus Christi and for the State of Texas as well. Thank you.