In this month’s roundup of news and views, we share some firsts and foremosts. The Basin is a fertile ground for superlatives and precedent-setters. These are the full versions of the “Drilling Deeper” news items that appeared as abbreviated versions in the print edition of PB Oil and Gas Magazine’s September 2019 issue.

Longest Lateral Ever

Basic Energy Services, Inc., announced that one of its high-spec, 24-hour rig and equipment packages recently completed a record-setting Wolfcamp A well for Surge Energy U.S. Holdings Company, one of its top customers in the Permian Basin.

Rig #1826, based in Big Spring, Texas, along with a bundled Basic high-spec ancillary equipment package, successfully drilled out frac plugs over a total horizontal displacement of 17,935 feet (3.4 miles). To date, this well marks the longest known lateral completed in the Permian Basin. Rig #1826, a high-spec, 600-horsepower Taylor well servicing unit, coupled with Basic’s twin 2,250 horsepower pumps and high-performance ancillary equipment, completed the drill-out of the Medusa Unit C 28-09 3AH safely and efficiently in six days.

“We are honored to partner with an innovative E&P company like Surge to deliver these record-setting results. Reaching this milestone with our customer displays our leadership in well servicing for complex, long lateral completions in the Permian Basin,” said Brandon McGuire, Vice President of the Permian Business Unit at Basic. “This success is a credit to our hard-working employees and Surge’s confidence in those crews. We will continue to focus on driving value through the integration of these high-spec pieces of equipment into a seamless package of services. We are proud to be a part of the outstanding team that made this possible and we will continue to strive to deliver high quality services to help our customers reach their goals.”

About Basic Energy Services

Basic Energy Services provides well site services essential to maintaining production from the oil and gas wells within its operating areas. Basic’s operations are managed regionally and are concentrated in major United States onshore oil-producing regions located in Texas, New Mexico, Oklahoma, Arkansas, Kansas, Louisiana, Wyoming, North Dakota, California and Colorado. The company’s operations are focused in liquids-rich basins that have historically exhibited strong drilling and production economics in recent years. Specifically, Basic has a significant presence in the Permian Basin, Powder River Basin, SCOOP/STACK, Denver-Julesburg Basin, and the Bakken and Eagle Ford shales. They provide services to a diverse group of more than 2,000 oil and gas companies. Additional information on Basic Energy Services is available on the corporate website at www.basicenergyservices.com.

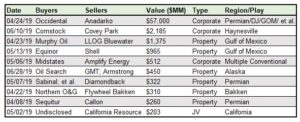

O&G M&A Rebounded in Q2

Drillinginfo, the leading energy SaaS and data analytics company, published on July 2 a list of the Top 10 U.S. upstream M&A deals in the second quarter of 2019 and summary of activity. While deals rebounded off historic lows in Q1 to reach $65 billion, analysts caution the value was overwhelmingly driven by Occidental’s $57 billion acquisition of Anadarko, which is the fourth-largest oil and gas upstream deal ever. That single acquisition contributed 88 percent of total deal value in Q2.

Excluding Occidental-Anadarko, Q2 M&A largely matched Drillinginfo analyst expectations with a modest rebound to $7.6 billion. While nearly a four-fold increase over the $2.0 billion low in Q1 M&A, $7.6 billion is less than half of the average quarterly total of the $19 billion seen 2017-2018.

“Occidental dominated headlines this quarter with assertive maneuvering to beat out much larger rival Chevron and secure a deal with Anadarko,” said Drillinginfo M&A analyst Andrew Dittmar. “While Anadarko’s assets span the globe, the deal is largely a play on U.S. shale —particularly in the juggernaut Permian which continues to power U.S. production growth.”

Moving past that deal, the largest Q2 deals focused on the Haynesville, Gulf of Mexico, and onshore U.S. conventional assets.

Comstock Resources picked up the second-largest deal of Q2 when it acquired private equity-backed Covey Park for $2.2 billion to expand its Haynesville operations. The acquisition relied on the willingness of Dallas Cowboys owner and Comstock controlling shareholder Jerry Jones to open his checkbook and increase his total commitment by $475 million to $1.1 billion.

The support by Jones permitted Comstock to avoid one of the key impediments to acquisitions by public companies—a near complete lack of Wall Street financial support. Halfway through 2019, there has been little-to-no growth capital provided via follow-on equity raises to U.S. public operators. Following suit, bond issuances are on track for a decade low. Public E&Ps are tightly focused on efficiently drilling existing inventory, which they appear to be doing effectively as U.S. production continues to grow despite Drillinginfo analysts observing an expected 20 percent average capex cut for 50+ E&Ps in 2019.

The support by Jones permitted Comstock to avoid one of the key impediments to acquisitions by public companies—a near complete lack of Wall Street financial support. Halfway through 2019, there has been little-to-no growth capital provided via follow-on equity raises to U.S. public operators. Following suit, bond issuances are on track for a decade low. Public E&Ps are tightly focused on efficiently drilling existing inventory, which they appear to be doing effectively as U.S. production continues to grow despite Drillinginfo analysts observing an expected 20 percent average capex cut for 50+ E&Ps in 2019.

“Wall Street, consistent with the message for E&Ps to live within cash flow, has cut off new investment dollars from public markets,” continued Dittmar. “Smaller E&Ps, many of which were focused on growth and counting on continued funding have been particularly impacted. Some of these smaller companies could evaluate whether they would be better off private.”

Private capital is still being deployed, albeit potentially with a different model from past years. “Private money is finding targeted opportunities,” said John Spears, Director of Market Research at Drillinginfo. “Companies like Sabinal (Kayne Anderson sponsored) are buying production-heavy assets as public companies trim their portfolios. The investment timeline may have lengthened from past years, but these companies still see opportunity to generate cash flow.” Other private moves include the merger of Gastar (Ares) with Chisholm (Apollo) and talks between Elliott Management and QEP for a go-private deal.

What didn’t emerge in Q2 was a spate of public company consolidation in the wake of Oxy/Anadarko. Commentary from market participants including management at the majors indicates the wide expectations in price between buyers and sellers makes deals challenging. What could take place are further “mergers of equals” like the Midstates/Amplify deal in May and the recent oilfield services combination of Keane Group and C&J Energy, with both deals leading to a 50-50 ownership structure between existing shareholders in the new companies.

Top Takeaways from Q2 2019:

• $65 billion total in 2Q19 upstream deal activity, but $57 billion is attributable to one deal

• Occidental’s acquisition of Anadarko is a historic bet on shale, particularly the Permian

• Otherwise, deal value bounces off extreme Q1 low to a modest $7.6 billion

• Brigham Minerals joins the ranks of public royalty companies with $300 million IPO

• Gulf of Mexico sees some activity as companies look at cash flow generating assets

• E&Ps look to midstream asset sales and joint ventures as additional capital sources

Outlook for Q3 2019:

• Deal activity likely to remain slow but steady as private capital is put to work

• Some smaller public E&Ps with high-quality assets may get offers to go private

• Companies will evaluate merger of equal deals as one option for gaining efficiencies

• E&Ps will continue to pursue alternative financing (drillcos) with tight capital markets

• Royalty market will keep gaining momentum with more buyers growing their portfolios

• Majors want to grow shale exposure, but may still be some time out from making a move

Midstreamer Announces Open Season

SCM Crude, LLC, a wholly-owned subsidiary of Salt Creek Midstream, LLC, announced on Aug. 2 its binding open season to solicit binding commitments for priority (firm) crude oil interstate gathering and transportation service on its proposed Delaware Basin crude oil gathering and transportation system.

The crude oil gathering and transportation project will be constructed and operated by SCM across multiple segments spanning from various tank battery receipt points in Eddy and Lea Counties, New Mexico, to SCM’s Wink Terminal and Orla Terminal, with interconnects to certain takeaway pipelines, including pipelines with direct, long-haul transportation to the Midland, Texas area and the Corpus Christi, Texas area.

This open season provides an opportunity for shippers to demonstrate support for the Project by making acreage dedications for priority service, thereby becoming priority shippers for the term of their crude oil gathering agreements. The final volume of capacity of the Project will be determined by SCM, in part based on the results of this open season.

Open Season Process:

The binding open season begins August 2, 2019 at 8:00 a.m. CT, and ends on August 31, 2019 at 5:00 p.m. CT. All bids must be submitted during the open season. SCM reserves the right to extend, modify, or cancel the open season period as participation in the open season requires and as determined by SCM. For more information about the Project and open season documents, contact SCM’s Senior Vice President, Midstream Business Development, Paul Williams at paul.williams@armenergy.com.

Open Season Inquiries:

Paul Williams, +1-281-655-3200

paul.williams@armenergy.com

Media Inquiries:

Kelly Kimberly, +1-832-680-5120

kkimberly@sardverb.com

Sard Verbinnen & Co

Service Sector Merger “Marker”?

By Dean Price and Kevin Cannon

On June 17, 2019, C&J Energy Services and Keane Group announced a $1.8-billion all-stock merger agreement, with the assumption of $225 million in debt. The deal, expected to close in the fourth quarter this year, would create a combined company with about 2.3 million hydraulic fracturing horsepower and make it the third-largest U.S. pressure pumping firm behind Schlumberger NV and Halliburton Co. The deal comes after ProPetro’s closing of its acquisition of Pioneer Natural Resources’ pressure pumping assets earlier this year, and Patterson-UTI Energy Inc. reportedly exploring a potential $1 billion divestment of its pressure pumping business. With C&J/Keane set to merge, does this signal the start of a wave of consolidation in the oilfield services sector?

Oilfield services companies, which provide drilling, fracking and a variety of other services for oil and gas producers in major shale plays, were greatly impacted by the 2014 downturn and have since tried to recover. The North American rig count fell to 1,076 in the week ended June 14, 122 lower than a year earlier, according to data from General Electric Co.’s Baker Hughes energy services firm.

Today, as oil prices have declined from 2018 highs, oilfield services companies are now left with seeking M&A opportunities to boost the value of their stock, all the while serving an E&P sector that is either paring back drilling new wells or are looking for cheaper rates as investors demand that cash be used for dividends and buybacks rather than pursuing growth.

Additionally, since the beginning of the downturn in 2014, oilfield service firms have diligently worked to reduce their general and administrative (G&A) costs. This has been an underreported drag on earnings and operational growth. As the energy industry continues to adjust to the lower commodity price environment, focusing on the business

operations to become more efficient is necessary to generate positive cash flow.

The proposed C&J/Keane merger should allow the combined company to better compete on price and service offering against larger oilfield service players, potentially leading to enhanced market share.

More Services M&A Coming?

The much-anticipated consolidation of public oilfield service companies appears to be moving forward with the C&J/Keane merger. Offshore rig companies began the trend last year with the expectation of further consolidation in 2019.

More oilfield service deals are forthcoming as investors are pushing management of oilfield service companies to act. Given limited access to capital in the current environment, smaller oilfield service companies will need to partner in order to grow. We could potentially also see more reverse mergers in the oilfield services sector and throughout the energy industry as a whole. Therefore, smaller private oilfield service companies will need to look for ways to access the public markets, and smaller publicly-traded companies will need to improve their scale and scope of offerings.

For shareholders, consolidation can be a reward for their investment in the companies and supporting their management teams during volatile times. In general, smaller oilfield service companies are having a difficult time gaining access to capital, limiting their ability to grow. For those in capital-intensive segments of the industry, lack of capital can be detrimental to their business as equipment ages and needs to either be refurbished or replaced. Management teams have to rationalize their businesses and the prospects for future growth otherwise there will be limited upside for investors.

About the Authors:

Dean Price is an Opportune Partner responsible for the Oilfield Services Sector and the Valuation Advisory and Tax Service Lines. He has 29 years of experience in valuation advisory and energy consulting serving clients in various segments of the Energy Industry. Dean has extensive experience in performing valuations of businesses and assets for acquisition, divestiture, financing, financial reporting and tax. He has conducted engagements throughout the United States and abroad. Dean’s engagement highlights include performing valuations for various segments of the energy industry, such as exploration and production, midstream, downstream, oilfield services and petrochemicals. He has conducted valuations and consulting engagements in Eastern Europe, South America and Asia for privatization purposes. Dean’s 29 years of valuation advisory experience includes eight years with Duff & Phelps as practice leader of the Houston office and 17 years in public accounting with Deloitte and KPMG. Prior to entering public accounting, he spent five years at Marathon Oil Company in the accounting and tax department.

Kevin Cannon is a Director in Opportune’s Valuation practice based in Houston. He has 14 years of experience performing business and asset valuations and providing corporate finance consulting. His specific experience includes valuations of businesses and intangible assets for purchase price allocations, impairment, tax planning and portfolio valuation purposes with a focus on upstream oil and gas and oilfield services.

Robotics Marching Your Way

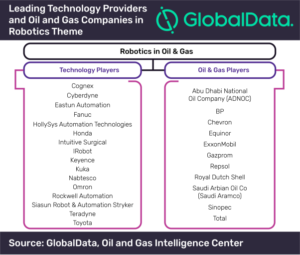

Oil and gas industry gearing up for robotics adoption to drive productivity and efficiency, says GlobalData.

The oil and gas industry is gearing up to deploy robotics across a wide range of applications in the upstream, midstream and downstream segments, primarily to drive productivity and efficiency amid volatility in crude prices, according to GlobalData, a leading data and analytics company.

The company’s latest thematic report, “Robotics in Oil and Gas,” reveals that the complex challenges, particularly in the exploration and production of hydrocarbons, are prompting companies to explore the potential of complexly engineered robotics solutions to work autonomously or in conjunction with field operators.

According to GlobalData, the global robotics industry is set to grow at a compound annual growth rate of 16% from US$98.2bn in 2018 to US$277.8bn in 2025. GlobalData’s thematic report identifies oil and gas companies such as Shell, ExxonMobil, Chevron, BP, Gazprom, Repsol, Equinor, Total, Saudi Aramco, Sinopec and ADNOC, as having considerable exposure to the robotics theme.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “Recent technological advancements are enabling operators to deploy robots in terrestrial, aerial and underwater configurations to carry out tasks that may be too risky to be undertaken by field personnel. Moreover, aging infrastructure is necessitating regular inspection of these assets, and autonomous drones are being used due to their sheer number and issues related to accessibility.”

However, the two major challenges in deploying robotics technologies in any industry are cost and reliability. Robotics are proving to be fairly reliable in enhancing operational efficiency in certain applications, such as material handling and preparation of land for drilling, especially when they are remotely managed by field operators. Nevertheless, it is yet unclear if the total cost of ownership of robots and drones has a positive effect on overall operational expenditure.

Puranik concludes: “To overcome this concern, robotics technology providers and oilfield service providers are devising new business models, such as Robotics-as-a-service (RaaS) to drive the deployment of these technologies in field operations and reduce uncertainty over the total cost of ownership of robots.”

For more information:

To gain access to GlobalData’s latest press releases: GlobalData Media Center

Gas Below $3/mmbtu in Next 10 Years

McKinsey Energy Insights, the global market intelligence and analytics arm of McKinsey & Company focused on the energy sector, launched its 2019 North American Gas Outlook on July 23, highlighting various changes in gas demand and supply through 2030. The report reveals U.S. gas economics will reach below $3/mmbtu in the next ten years due to ample supply, which will support North American gas exports and unlock further demand growth domestically.

North American gas demand will reach 125 bcfd by 2030 from 95 bcfd today, with 20 bcfd of growth coming from gas and LNG exports. The share of gas in the power mix will grow by 5 bcfd—driven by coal retirements—but renewables will start to displace gas post-2025 as part of the power sector’s decarbonization.

“North America is endowed with abundant gas resources, which will play a major role in the energy mix domestically and provide security of supply through LNG exports to Europe and Asia” said Dumitru Dediu, Partner at McKinsey. “We see over 1,000 TCF of gas resources—which is sufficient to meet demand for the next 2 decades—at cost economics well below $3/mmbtu.”

In terms of supply, Appalachia will increase production to ~55 bcfd and will supply ~40% of the North American market by 2030. As a result, Appalachian gas production is expected to displace the Western Canadian Sedimentary Basin and Rockies in the Midwest and will supply the southern Mid-Atlantic region. The building of pipeline infrastructure post-2023 will ensure Appalachian supply will continue to grow and limit price fly-up potential.

Associated gas, primarily from the Permian basin, is expected to increase production by ~12 bcfd and supply 25% of the North American market by 2030. Permian production will limit Appalachian flows South and will help meet US Gulf Coast demand for global LNG exports.

The 2019 North American Gas Outlook discusses gas exports to Mexico, renewables, storage, and power generation, and provides a detailed look at supply and prices until 2030. To read the summary, download a copy here.

Water Midstream Commitments

UL Water Midstream LLC announced July 25 that it has added a new strategic equity partner (the “Strategic Partner”) that will provide further alignment with University Lands along with additional capital to fuel the continued growth of ULWM. The original ULWM partners, H2O Midstream LLC and Layne Water Midstream LLC will retain joint control of ULWM with the strategic and financial support of its sponsors, EIV Capital LLC, Genesis Park LP, and Post Oak Energy Capital LP, along with the new Strategic Partner.

In January 2019, ULWM signed a long-term contract with University Lands to serve as the exclusive preferred water services provider on 167,000 acres located in Ward, Winkler and Loving counties in the Delaware Basin to develop and operate water infrastructure on the University Lands acreage. University Lands manages the surface and mineral interests of 2.1 million acres of land across nineteen counties in West Texas for the benefit of the Permanent University Fund.

Stephen McNair and Byron Bevers, the President of UL Water Midstream and Vice President of UL Water Midstream, respectively, jointly stated, “This new strategic investment facilitates ULWM growth organically and through acquisitions. The support of all of our investors demonstrates the importance of the development of water infrastructure across the Delaware Basin.”

About UL Water Midstream

UL Water Midstream was formed to provide full-cycle water midstream services to oil and gas producers across University Lands acreage in the Delaware Basin. ULWM is a partnership of H2O Midstream, Layne Water Midstream and the new Strategic Partner. As the preferred water service provider for University Lands on it 167,000 acres in Ward, Winkler and Loving counties, ULWM is uniquely positioned to provide efficient and creative solutions to the water needs and demands of producers on that acreage. ULWM is led by President Stephen McNair, an industry veteran who headed the development of Pioneer Natural Resources’ water business before joining H2O Midstream as EVP and Chief Development Officer. For more information, visit www.ulwatermidstream.com.

About Layne Water Midstream

Layne Water Midstream (“LWM”) is a full cycle water midstream business providing upstream oil and gas companies with water sourcing, disposal and recycling services in the Delaware and Midland Basins. Anchored by an exclusive long-term contract with the State of Texas General Land Office and an experienced water management team, LWM operates significant source water, water transportation and produced water management infrastructure and is committed to further growth to support its upstream customers in the Delaware and Midland Basins. LWM is a portfolio company of Post Oak Energy Partners LP and Genesis Park LP. For more information, visitwww.laynewatermidstream.com.

About H2O Midstream

H2O Midstream was founded on the vision that water should be treated as a commodity, not a waste, and partners with producers, landowners, and other stakeholders to improve the efficiency, reliability and safety of water operations while lowering costs across the entire value chain. Led by an executive team with over 150 years of collective midstream experience, H2O Midstream currently owns and operates the Permian’s only truck-free, third-party produced water hub and pipeline network consisting of 1,000,000 barrels of storage and 290,000 barrels per day of permitted disposal capacity from 14 owned and third-party disposal wells, all interconnected via 150 miles of pipeline tied to seven producers. H2O Midstream is a portfolio company of EIV Capital LLC. For more information, visit www.h2omidstream.com.

Bolster Your Company’s Culture

By Jason O. Harris

Each day you walk into your office, are you giving consideration to what type of culture you are cultivating? Are you and your team of leaders aware that your actions will dictate whether you are cultivating a culture of compliance or a culture of connection, commitment, and community?

Daily, you are faced with important decisions, and how you handle those decisions as well as how you interact with your team, will dictate the culture. Your organization’s culture will ultimately determine what kind of experience your customers and clients will have.

If you were to be placed at the helm of a multimillion-dollar Air Force cargo jet or commercial airliner, under stress and other challenges, there is an absolute necessity for cohesiveness, communication, and commitment in order to be the high performance team required to operate these jets. You already have a great team, but is your team ready to handle their job along with the stress of combat? This is where it is critical to have the right skillsets that will enable you and your team to Trust the Training, Trust the Process, and Trust the People.

In order to cultivate cohesiveness, connection, and commitment in these fast-paced, high-performance teams, there are seven critical skillsets that are always present and encouraged.

If you or your organization are ready to soar to new heights, take a look at the seven skillsets and decide how you can apply personally and within your organizations.

1. Professional Knowledge

Professional knowledge is critical, and is the foundation to any high-performance individual and team. When your people are equipped with the professional knowledge essential to their jobs, it makes it easier to empower them and trust them to make decisions when things get challenging. Think about a professional pilot and consider how knowledgeable you want them to be. Would you consider your team trained to have that level of knowledge, to execute their job, when hundreds of lives are on the line?

2. Situational Awareness

Situational Awareness (or SA) is the ability to understand and comprehend environmental elements, events, and possible scenarios as it applies to time, space, and the collective comprehension of their possible interpretation. There are multiple types of SA to include individual, team, and organizational SA. In order to make the right decisions at the right time, it is critical that SA be present. SA has been cited as being fundamental to successful decision making in aviation, healthcare, emergency response and many other high stress environments. The lack of SA, according to scholarly documents, has been a driving factor in accidents attributed to human error. In order to keep your operation performing at its best and being positioned for continued improvement, your people need to have collective SA for any threats that might harm the operations. What kind of training has been put in place that helps to cultivate and reinforce this skillset?

3. Assertiveness

Assertiveness is defined as confident, forceful, self-assured behavior. Further, assertiveness is being self-assured and confident without being aggressive. When it is time to make business decisions and the fate of your organization is on the line, like flying a commercial airliner with hundreds of passengers onboard, it is imperative that your people are trained, ready and willing to speak up and assert their voice to avert a disaster. When the success of your organization is on the line, your people need to be empowered to speak up and assert themselves, appropriately, to ensure the operation continues smoothly and, in many cases, in order for the operation to improve. Can your people trust that the leadership team will be ready to listen and acknowledge when they speak up and assert themselves for the greater good of the organization?

4. Decision-Making

Decision-making is the process and action of making choices, especially important choices, by identifying a decision, gathering information, and assessing alternative possibilities. When you look at decision-making and its application to your environment and how it relates to high-performance teams, you need to be ready and able to make important and significant decisions. Sometimes these decisions will have to be made in very short order, without supervision. In order to make these time-sensitive decisions, your people will need to be empowered, knowing that they are prepared and trusted to make decisions that can be very critical to the operation and success of the organization. Consider what you can do to equip, prepare, and empower your people to make the right decision, in a moment’s notice, at the right time.

5. Communication

Communication is defined at the exchange of information or news. When it’s crunch time and critical decisions need to be made, whether in flight at 35,000 feet in the air flying at 600 mph, or when a major deal is on the table for your organization, communication is absolutely essential. When it’s time to make decisions, given the time critical scenario, you want, need and expect your people to communicate. Have your people been empowered and trusted to communicate the critical information at the right time and right place?

6. Leadership

Leadership is defined as the act of leading a group of people or an organization. Every organization, especially high performing organizations, need true and authentic leadership. They need leadership that is effective at all levels of execution. Leadership in your teams and organization has to be further defined as the people that influence others to accomplish the team and organizational objectives in a manner that makes the team more cohesive and more committed to each other, the mission at hand, and the organization.

7. Adaptability

Adaptability means being able to adjust to new conditions. When your organization or team is moving at the speed of success, it is imperative that members are adaptable. The organization has to empower its people to be ready and prepared to adapt to many different scenarios. When flying commercial jets across the world, there is likely to be some turbulence and there is likely to be some weather formations along the route. In order to get to the intended destination safely, the crew has to be adaptable to go over, under, and around the turbulence and thunderstorms. Being adaptable can only happen when the people have been empowered.

The next time you walk into your office, you should be clear on the culture you are cultivating! The seven skillsets laid out will support the cultivation of a culture of connection, commitment, and community. When you start to implement these seven skillsets your team will begin to soar to new heights, you and your team will begin to Trust the Training, Trust the Process and Trust the People!

About the Author:

Jason O. Harris is a leadership and trust speaker, consultant, and certified character coach. As a decorated combat veteran, Jason brings unique perspectives gained from his battlefield experience to your organization. Jason’s No Fail Trust™ methodology was crafted from his own harrowing, life-altering experiences, and conveys the importance of cross-generational communication and mutual trust. Jason enjoys working with organizations and leaders that are no longer willing to settle for cultures of compliance and are ready to build and cultivate cultures of commitment. For more information on Jason O. Harris, please visit: www.JasonOHarris.com.

Five Steps to Better Meetings

By Rich Horwath

Are your meetings creating valuable new insights for the business or are they a series of multitasking-filled monologues? Are they productive conversations about key business issues or a rehashing of the same stuff you’ve been talking about for months? Are your meetings getting better or worse?

Answer these five sample questions from the Strategic Meetings Assessment for the meetings you typically attend:

1. Relevant information is sent out prior to meetings to avoid one-way presentations during

the meetings. Yes No

2. Meetings start at their scheduled time. Yes No

3. People are fully attentive and not engaged in multitasking (e.g., checking phones).

Yes No

4. People leave meetings with a clear understanding of who is doing what by when.

Yes No

5. I decline meeting invitations when the purpose and/or agenda have not been communicated.

Yes No

In this brief sample, a score of three or more “No’s” indicates an opportunity to dramatically improve the efficacy and productivity of your meetings.

A meeting can be defined as a gathering of two or more people featuring collective interaction and engagement using conversations to make progress toward a purpose. Note the use of the words “interaction” and “conversations” in the definition. If you find yourself in meetings and especially teleconferences on a regular basis where the format is primarily one-way presentation, there’s ample opportunity to improve your situation.

Research shows that meetings consume about 40 percent of working time for managers. Key data points from research to consider:

• Up to half of the content of meetings is either not relevant to participants or could be delivered outside of a meeting.

• 20 percent of meeting participants should not be there.

• 40 percent of meeting time is spent on information that could be delivered before the meeting.

• 50 percent of meetings executives attend are rated as “ineffective” or “very ineffective.”

There are five critical steps you can follow to help your organization take a more strategic approach to meetings and teleconferences:

1. Conduct a meetings audit

Before a doctor prescribes a medication, she first diagnoses the patient’s condition. In the same spirit, before you prescribe new meeting guidelines, it’s helpful to first baseline what’s happening today. Look at factors such as the types of meetings you attend, the frequency of meetings, and the length of meetings. Then identify the reasons these meetings exist and if there are any meetings that are not necessary. Once the audit is complete, it provides a bounty of useful information to shape the future state of meetings.

2. Identify current meeting mistakes

Meeting mistakes occur in three phases: pre-meeting, in-meeting, and post-meeting. They can also be categorized as either leader or participant mistakes. For example, a common in-meeting mistake by the leader is failing to rein in off-track conversations. A common in-meeting mistake by participants is multitasking, which conveys a lack of interest in the topic and/or a lack of respect for the person speaking at the time. There are approximately 25 mistakes to look for in the three phases to ensure that the group is not sabotaging their own efforts at improvement.

3. Educate managers on what good looks like

Begin this step by collecting the current best practices being used by managers within the organization. Then look externally to see what principles and guidelines are being used by other organizations within and outside your industry as it relates to meetings. Examples of best practice principles include things such as “identify decisions to make in the meeting” and “create a virtual table of participants for teleconferences.” Use these best practices to compile a list of new meeting standards.

4. Utilize meeting tools

One of the keys to leading effective and efficient meetings is aligning the goals of the meeting with the appropriate tools and processes to get there. For instance, if you’re leading a strategy development meeting, there are more than 70 different strategic thinking tools you can choose from to help your team think and plan strategically. The key is to select the handful of tools that make the most sense based on the context of the team, business goals, competitive landscape, etc. Be clear on your meeting goals and then choose the process and tools to get there.

5. Develop meeting checklists

Research in the social sciences on habits shows that in order to effectively change someone’s behavior, it’s helpful to provide physical or environmental triggers. One highly effective trigger is the use of meeting checklists. These physical reminders ensure that teams across the organization are aware of the basic meeting principles, techniques, and tools to optimize their meeting time. However, the checklists are only valuable if they are accompanied by the corresponding discipline to utilize them on a consistent basis.

Effective meetings can be energizing forums to help your team set direction, make decisions, and unify efforts. Ineffective meetings can be anchors that weigh people down with irrelevant information, didactic presentations, and unclear priorities. Which type do you attend today? Do you think it will be different tomorrow?

About the Author:

Rich Horwath is a New York Times bestselling author on strategy, including his most recent book, StrategyMan vs. The Anti-Strategy Squad: Using Strategic Thinking to Defeat Bad Strategy and Save Your Plan. As CEO of the Strategic Thinking Institute, he has helped more than 100,000 managers develop their strategy skills through live workshops and virtual training programs. Rich is a strategy facilitator, keynote speaker, and creator of more than 200 resources on strategic thinking. To sign up for the free monthly newsletter Strategic Thinker, visit: www.StrategySkills.com.

Vanguard to Become Grizzly

Vanguard Natural Resources, Inc. announced July 16 that it successfully completed its financial restructuring and emerged from Chapter 11 as a new limited liability company under the name of Grizzly Energy, LLC.

Through its financial restructuring, the Houston-based company eliminated more than $500 million of secured debt from its balance sheet and significantly enhanced its financial flexibility. At its emergence, the Company is entering into an amended and restated $65 million reserve-based revolving credit facility, a first lien term loan A facility of $65 million and a “last out” first lien term loan B facility of $285 million. The initial borrowing base under the revolving credit facility shall be $65 million, with the first scheduled redetermination of the revolving credit facility borrowing base in April 2020. Grizzly will emerge from Chapter 11 with approximately $375 million of funded debt and $47 million of liquidity comprised of more than $7 million in cash and $40 million of unused revolver capacity.

R. Scott Sloan, President and CEO, commented, “We are very pleased to have completed this reorganization and look forward to working with our stakeholders and Board members in charting a course for the Company with this firmer financial footing. I want to also add a special thanks to all of our employees whose dedication and hard work managing and administering our assets has been exceptional during this process.”

The new Board of Directors collectively echoed Sloan’s comments stating, “The Board recognizes and appreciates the efforts of management, employees, the advisors and the other stakeholders in collectively completing the restructuring process in under four months. The Board looks forward to working closely with management to maximize value for our stakeholders.”

The following are highlights of the Company’s reserves (including proved undeveloped reserves) as of June 30, 2019:

•Total estimated proved reserves of 1,044 Bcfe, of which approximately 64% were natural gas reserves, 20% were oil reserves and 16% were NGLs reserves. 91% of our reserves are considered proved developed and we have an average ten year proved developed decline rate of 9%.

•Our assets in the Green River, Piceance, Arkoma, Permian and Big Horn Basins account for approximately 86% of our proved reserves.

•Total estimated reserve PV-10 value of $967 million (97% proved developed and 3% undeveloped) using June 30, 2019 SEC commodity pricing.

The following are highlights of the Company’s capital expenditures as of June 30, 2019:

•Total capital expenditures were approximately $22 million during the first half of 2019. We currently anticipate a total capital expenditures budget ranging from $43 million to $50 million for the full year of 2019.

•These expenditures consist of ongoing drilling and uplift projects in the Woodford play of the Arkoma, the Red Lake area of the Permian, and the Pinedale Field of the Green River basin, as well as maintenance capital across all of the assets.

The Company also announced its new Board of Directors, comprised of the following individuals:

•Kevin Asarnow, executive director at RPA Advisors, LLC

•Patrick Bartels, managing member at Redan Advisors LLC and formerly at Monarch Alternative Capital, LP

•Stephen McDaniel, an oil and gas consultant formerly at EnerVest, Ltd.

•Dean Swick, a former managing director at Alvarez & Marsal, North America, LLC

•Mike Wichterich, founder and CEO of Three Rivers Operating Co., a private upstream oil and gas company

Evercore Partners Inc. served as financial advisor to the company, Kirkland & Ellis LLP served as the company’s legal counsel, and Opportune LLP served as the restructuring advisors to the company.

About Grizzly Energy, LLC

Grizzly Energy is a U.S. onshore energy company. Its primary focus is on operating and investing in high quality, long-lived producing properties predominantly in the Rockies, Permian and Midcontinent. Grizzly Energy is committed to creating a stable production portfolio and promoting cash flow throughout mid-cycle pricing. Active portfolio management remains an area of emphasis for delivering its strategy. Also core to its culture is Grizzly’s attention to the wellbeing of its employees, communities, and the environment. More information on Grizzly can be found at www.grizzlyenergyllc.com.