Sometimes the expected result is not what we get. That’s how the word “disruptive” entered the business world’s vocabulary. And overturned expectations go beyond matters of technology. In this month’s assemblage of articles, the idea of “things taking a turn” could be thought of as a unifying thread. These are the full versions of the “Drilling Deeper” news items that appeared as abbreviated versions in the print edition of PBOG’s December 2018 issue.

Get Ready for EV Onslaught

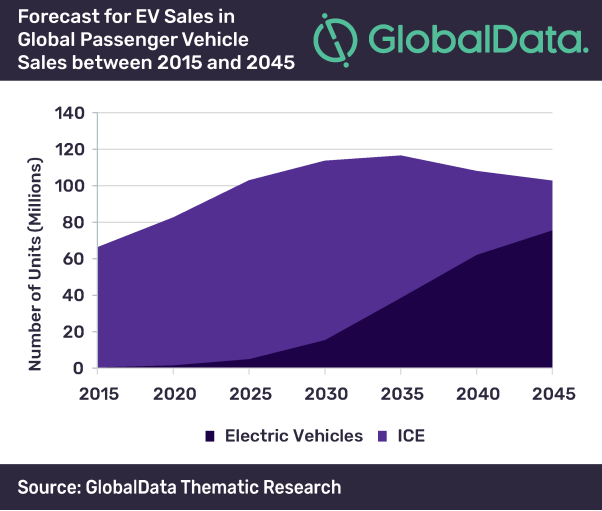

Digitization and electrification are spreading across all industries and the auto industry is no exception. As charging technology for electric vehicles (EVs) gradually takes the reins from the internal combustion engine as the king of the road in the rapidly evolving energy landscape, oil and gas companies are acknowledging the rise of EVs, observes leading data and analytics company GlobalData.The company’s latest report, “Electric Vehicles in Oil and Gas,” reveals that due to a combination of factors such as growing environmental awareness and improvements in battery technology, oil and gas companies are gearing up for the EV onslaught by contributing to the development of battery technology and deployment of EV charging points.

In their bid to function on a different playing field and compete with tech-savvy counterparts, oil and gas companies are diversifying into power generation and battery manufacturing, two areas where demand is set to increase with the growing adoption of EVs.

Ravindra Puranik, oil and gas analyst at GlobalData, says: “As fossil fuels are chief sources of greenhouse gas emissions, environmentalists worldwide have lobbied time and again for their usage to be reduced through mandates on fuel efficiencies and imposition of stringent vehicular emission norms. With improvements in battery technology the costs of batteries, and in turn, EVs are coming down and becoming more viable options for ICE-based vehicles. This has encouraged select countries around the world to begin the process of phasing-out of gasoline-powered vehicles.”

As a result, in their bid to function on a different playing field and compete with tech-savvy counterparts, oil and gas companies are diversifying into power generation and battery manufacturing, two areas where demand is set to increase with the growing adoption of EVs.

For example, Norwegian oil company Statoil dropped “oil” in its name and rebranded itself as “Equinor” in an effort to diversify beyond oil and gas business mainly into renewable energy projects, to reduce its carbon footprint, and to appear more relevant in these evolving energy dynamics.

GlobalData’s thematic research identifies Royal Dutch Shell, BP, Total, and Repsol as some of the key companies at the forefront of the deployment of EV technology over the next two to five years.

Puranik concludes: “EVs consume more power than a typical household, hence the addition of each EV would drive the power demand significantly. This has prompted oil and gas companies to partner with or acquire utility companies to expand their electricity generation capabilities beyond captive power.”

Set to Disrupt? Not Yet, CEOs Say

Despite the rapid speed of technology and innovation pressuring the industry, oil and gas CEOs see technological disruption as more of an opportunity than a threat but acknowledge that more work is to be done. Eighty-five percent of oil and gas CEOs report they’re piloting AI or have already implemented AI for some processes. However, only 59 percent feel their organization is an active disruptor in their own sector, and 57 percent feel that the lead times to achieve significant progress on transformation can be overwhelming, according to KPMG’s 2018 Global CEO Outlook.

“Technology is disrupting the status quo in the oil and gas industry. AI and robotic solutions can help us create models that will predict behavior or outcomes more accurately, like improving rig safety, dispatching crews faster, and identifying systems failures even before they arise. This level of predictability can have a profound impact on our industry,” said Regina Mayor, Global Sector Head, Energy and Natural Resources, KPMG. When asked about the biggest long-term benefits of AI, 46 percent of CEOs indicate acceleration of revenue growth, 39 percent indicate increased agility as an organization, and 39 percent point to improved risk management, all within a three-year time frame. Further, they indicate high levels of confidence in their organizations’ digital transformation programs, AI systems, and robotic process automation.

Further, 58 percent of O&G CEOs feel AI and robotics technologies will create more jobs than they eliminate. In fact, 93 percent of CEOs expect an increase in industry-wide headcount over the next three years.

Continued confidence in the market

As oil prices remain elevated, industry confidence is up and CEOs are setting their sights on growth opportunities, with 85 percent very confident or confident on industry growth, and 88 percent very confident or confident on company growth prospects.

As part of their growth strategies, 83 percent of O&G CEOs anticipate a moderate to high appetite for M&A activity over the next three years, largely driven by the need to reduce costs through synergies/economies of scale; a speedy transformation of business models; increased market share; and low interest rates.

“The higher price of oil is playing a significant role in driving a more positive sentiment across the industry,” said Mayor. “Executives are really honing in on ways they can improve internal efficiencies through strategic M&A moves and the use of robotics, AI, and other means of digitalization across the industry.”

Despite a rosy outlook, there are still concerns about threats to achieving growth. As for the kinds of threats they face, 23 percent of CEOs point to emerging/disruptive technology risk, 20 percent say environmental and climate change risks, and 18 percent point to a return to territorialism are most concerning.

For information on the full study, please visit the KPMG 2018 Global CEO Outlook landing page.

PDC Logic Becomes Taurex Drill Bits

PDC Logic LLC, an industry leader in high-performance drilling and completion bits, has gone through a major rebrand, including a new name. Today, the company announces that PDC Logic is now Taurex Drill Bits, LLC. The change comes on the heels of ownership and management changes that have led to expanded growth initiatives for the company, which has strong roots in the oil and gas industry spanning more than six decades.

PDC Logic has rebranded their high performance drill and completion bit company to Taurex Drill Bits. The change comes following ownership and management changes that have led to expanded growth initiatives for the company, whose roots in the oil and gas industry span more than six decades. Taurex is introducing its next-generation suite of drill bits adopting the latest material science and cutter technologies, including a proprietary line of Steel PDC bits. They have operations in all major US basins.

In early 2018, Intervale Capital, a leading private equity firm in the oilfield manufacturing and services space, acquired a majority stake in PDC Logic. In April 2018, the company named respected industry veteran Warren Dyer as President and Chief Executive Officer.

Taurex currently has established U.S. service locations in the Permian, Mid-Continent, Eagle Ford, Bakken, and Rocky Mountain Basins. Additionally, the company recently entered the Appalachian Basin, and further expansion into the Haynesville and Western Canada Sedimentary Basins is planned for early 2019. Taurex is also introducing its next-generation suite of drill bits adopting the latest material science and cutter technologies, including a proprietary line of Steel PDC bits.

In addition to a new company name, the rebrand includes a new bull-themed logo, messaging, brand positioning, color scheme, website, video, and tagline – Run with the Bull.

“The rebrand, including the name change to Taurex Drill Bits, is representative of the transformational initiatives the company has been successfully executing throughout 2018,” said Dyer. “The hard work by the team is already paying off, resulting in near daily record-setting runs in key basins. We are well positioned for accelerated growth going into 2019 and beyond as we continue to invest in people, technology, and product-line expansion with the support of Intervale.”

For additional information on Taurex visit www.taurexbits.com

Independent Chemical Company Becomes Basin’s Biggest

WadeCo Specialties, Impact Chemical Technologies, and FloCap Injection Services announce the formation of Imperative Chemical Partners, LLC (Imperative). Headquartered in Midland, Texas, Imperative is a leading provider of specialty chemicals, chemical program management, and in-field technical support primarily to operators and midstream companies in the most active shale plays in the United States. Imperative strives to set a new standard in chemical services with a focus on effective chemistries, best-in-class service, and proven program management — all coordinated and supported by an organization with the combined resources, experience, and expertise to deliver results. With more than 30 service locations across Texas, New Mexico, Oklahoma, Illinois and North Dakota, Imperative has the capability to service major integrated production companies and transportation infrastructures, yet maintains the flexibility and responsiveness to service independent operators.

“We are extremely proud of what we’ve built here,” said Randy McMullen, CEO of Imperative. “This new partnership brings together the strengths of these highly complementary companies, allowing us to offer our customers the best products, laboratory capabilities, regional coverage, and technical expertise in the industry. Our customers are seeing immediate benefits from the combined platform. It’s an honor to work with such a talented management team, many of whom are the founders of the original companies. Without them, Imperative would not be the success it is today.”

Ted Patton, founder of Hastings, had this to add: “Hastings Equity Partners has been an investor in Imperative for the past five years and has developed a domain expertise in oilfield chemicals over its more than 15-year history investing. Imperative was founded to fill a white space in the market that Hastings identified early on. Until Imperative, the market lacked an independent production and pipeline chemical platform of scale that had the products, infrastructure, and laboratory capabilities to serve both large and small customers while maintaining the service quality and customer-first approach of a small independent company.”

100% Renewables? Poor Policy

By Steve Goreham / Originally published in Master Resource.

Two states and more than 80 cities and counties have now announced a goal of receiving 100 percent of their electricity from renewable sources. Wind, solar, and biofuels are proposed to replace electricity from coal, natural gas, and nuclear power plants. But evidence is mounting that 100 percent renewables is poor policy for U.S. households and businesses.

More than 80 cities announced commitments to get 100 percent of their energy from renewable sources. Minneapolis committed to attaining 100 percent renewable electricity by 2030, Salt Lake City by 2032, and St. Louis by 2035. Nine counties and two states, California and Hawaii, have also made 100 percent renewable pledges.

Some cites already claim to get all power from renewables, generally by using a little electricity “sleight of hand.” Rock Port, Missouri claims to be the first U.S. community powered by wind because it has a local wind farm. But when the wind doesn’t blow, Rock Port gets power from other generators in Missouri, a state that gets 77 percent of its electricity from coal and 97 percent from non-renewables in total.

On September 10, Governor Jerry Brown signed Senate Bill 100, committing California to 100 percent renewable electricity by 2045. Brown stated, “It’s not going to be easy. It will not be immediate. But it must be done… California is committed to doing whatever is necessary to meet the existential threat of climate change.”

But cities and states pursuing 100 percent renewable electricity lay the foundation for a future painful lesson. Households and businesses will experience the shock of rapidly rising electricity prices as more renewables are added to the system.

Wind and solar cannot replace output from traditional coal, natural gas, and nuclear power plants, despite claims to the contrary. Wind and solar are intermittent generators. Wind output varies dramatically from high output to zero, depending upon weather conditions. Solar output is available for only about six hours each day when the sun is overhead and disappears completely on cloudy days or after a snowfall. Hydropower is a renewable source that can replace traditional power plants, but even this source is insufficient in years of drought or low snow runoff.

Experience shows that utilities can only count on about 10 percent of the nameplate capacity of a wind or solar facility as an addition to power system capacity. For example, on December 7, 2011, the day of peak winter electricity demand in the United Kingdom, the output of more than 3,000 wind turbines in the UK was less than five percent of rated output. The UK House of Lords recognized the problem a decade ago, stating “The intermittent nature of wind turbines…means they can replace only a little of the capacity of fossil fuel and nuclear power plants if security of supply is to be maintained.”

To achieve “deep decarbonization,” states will need to keep 90 percent of traditional power plants and add increasing amounts of wind and solar to existing systems. Total system capacity must first double and then triple as 100 percent renewable output is approached. A 2016 study by Brick and Thernstrom projected that California’s system capacity would need to increase from 53.6 gigawatts to 90.5 gigawatts at 50 percent renewables and to 123.6 gigawatts at 80 percent renewable output.

Rising system capacity means enormous electricity cost. In 2017, California received 20 percent of its electricity from renewable sources, excluding power from large hydroelectric plants. California 2017 residential electricity rates were 18.24 cents per kilowatt-hour, 50 percent higher than any other US western state.

From 2008 to 2017, California power rates rose 25 percent compared to the U.S. national average increase of about 7 percent. But the worst is yet to come. As California adds renewable capacity to approach 100 percent renewables, generated cost of electricity will likely triple.

International examples show soaring electricity prices from renewables penetration. High levels of wind and solar in Germany and Denmark produced household electricity prices four times U.S. rates. Renewable programs pushed power prices in five Australian provincial capital cities up 60 to 160 percent over the last decade. Wind, solar, and biofuel penetration in Ontario, Canada drove electricity prices up more than 80 percent from 2004 to 2016. Renewable output in these locations remains far below 100 percent.

Green energy advocates recognize renewable intermittency and hope that advances in battery technology will save the day. Large-scale commercial batteries, they claim, will be able to store power during high levels of renewable output and then deliver power to the grid when wind and solar output is low.

But batteries are not the answer because of the large seasonal variation in renewable output. For example, wind and solar output in California in December and January is less than half of the output in summer months. Commercial large-scale batteries available today are rated to deliver stored electricity for only two hours or ten hours duration. No batteries exist that can store energy in the summer and then deliver it during the winter when renewable output is very low.

Superstition is powerful. There is no evidence that 100 percent renewable efforts, all combined, will have a measurable effect on global temperatures. Instead, cities and states that pursue 100 percent renewable policies will learn the hard lesson of skyrocketing electricity prices.

Steve Goreham is a speaker on the environment, business, and public policy and author of the book Outside the Green Box: Rethinking Sustainable Development.

The Emerging U.S. Energy Powerhouse

By Steve Goreham

Republished with permission of The Washington Times.

The United States is emerging as the world’s energy powerhouse. Two months ago, the United States became the largest producer of crude oil. Exports of crude oil, oil products, and natural gas are rising rapidly. The “keep it in the ground” movement is losing ground.

U.S. crude oil production in August reached 10.8 million barrels per day, more than double the 5 million barrels per day produced in 2008. Last February, U.S. output surpassed that of Saudi Arabia. In August, U.S. production exceeded that of Russia, making the United States the world’s largest producer of petroleum.

U.S. natural gas production is up 40 percent from 2007 to 2017. The U.S. surpassed Russia as the world’s leading producer of natural gas in 2011.

Driving American energy dominance is the hydrofracturing revolution. Over the last two decades, U.S. geologists and petroleum engineers perfected the techniques of hydraulic fracturing and horizontal drilling, permitting cost-effective extraction of oil and gas from low-permeability shale rock formations. U.S. companies hold about a 10-year experience lead in shale extraction techniques over international competitors.

In 2000, only about 7 percent of U.S. natural gas came from hydraulically fractured wells. Today about 70 percent of U.S. gas production and over 50 percent of crude oil production comes from fractured wells. Fracking operations are active in more than 20 states.

U.S. oil and gas production surged despite strong opposition from environmental groups. For more than a decade, green advocates have opposed drilling, fracking, pipeline transport, export terminals, and even investments in oil and gas. But the “keep it in the ground” movement is being trampled by the US energy juggernaut.

Along with the rapid rise in production, U.S. oil and gas exports are exploding. U.S. exports of refined petroleum products increased by a factor of five from 2004 to 2017. Our nation became a net exporter of refined petroleum products in 2011. In 2015, the Obama administration lifted a 40-year ban on U.S. crude oil exports. Crude exports rose by 400 percent since 2014. The United States still remains a net importer of crude oil, but oil imports have dropped to the lowest level since 2000.

In 2017, the United States became a net exporter of natural gas, with Mexico the largest customer. Prior to 2010, terminals were under construction to import liquefied natural gas. But the fracking revolution produced a huge volume of gas at one-half of the price of gas in Europe and one-third of the price in Japan. Liquefied natural gas (LNG) export terminals started operation in 2016 at Sabine Pass in Louisiana and in 2018 at Cove Point in Maryland. Four other new LNG export terminals are scheduled to come on line by 2020.

Propane, a hydrocarbon fuel used for heating and cooking, is a notable example of success. Prior to 2010, the United States was a net importer of propane. But U.S. propane field production doubled since 2010 and exports now approach one million barrels per day.

About three billion people around the world do not have modern fuels for heating and cooking. India has a program to get liquid propane gas to 80 percent of households by March, 2019. Exports of U.S. propane are meeting this need in India, along with needs in China and other nations. The Panama Canal expansion completed in 2016 allows supertankers to deliver U.S. propane and natural gas to Asia.

A major benefit of US energy resurgence is an improved balance of trade in energy. In 2011, U.S. energy imports exceeded exports by $325 billion. With growing production of oil and gas and rising exports, the U.S. trade imbalance in energy fell to $57 billion in 2017. Energy plays a major role in the strength of today’s US economy.

The U.S. plastics industry now enjoys a large cost advantage in global markets. U.S. oil and gas refineries produce the lowest-cost ethylene and propylene in the world, the basic materials for plastics. U.S. natural gas also provides a cost advantage for chemical and steel firms. Gas fuels generation of cheap electricity for aluminum, cement, paper, and other industries.

Despite environmental opposition, the United States is emerging as the world’s energy powerhouse. U.S. energy production is not only good for U.S. industry and the U.S. economy, but exports increasingly provide low-cost energy for Europe, Asia, and the rest of the world.

Steve Goreham is a speaker on the environment, business, and public policy and author of the book Outside the Green Box: Rethinking Sustainable Development.

Forbes Recognizes a Leader

Benedict Peters, CEO and Founder of Aiteo Group, was bestowed the recognition of Oil and Gas Leader 2018 by Forbes Africa Magazine at a VIP reception in New York Sept. 27. The Forbes Award recognized not only the entrepreneurial achievement of Mr. Peters in building Aiteo Group in the past 10 years since its 2008 formation into one of Africa’s fastest growing integrated energy businesses, but also his commitment to bettering the life of people and societies across Africa by philanthropic engagement. Since 2014, “Benny” has been Chairman of the Joseph Agro Foundation, a community level-based charity aiming to improve the lives of rural farmers through a combination of education and practical assistance

International Recognition: Mike Perlis, CEO and Vice-Chairman of Forbes Media (L), presenting the Africas Oil and Gas Leader of the Year Award won by Benedict Peters, Executive Vice Chairman, Aiteo Group, at the Best of Africa event by Forbes International, to Francis Peters, Deputy Group Managing Director, Aiteo Group, at Forbes Headquarters in New York recently. (PRNewsfoto/Aiteo Group)

Working with the Face Africa organization he has helped bring clean drinking water and improved sanitation to some 25,000 people in Liberia. A keen believer in the power of sport to motivate and inspire youth, Benny has also provided support to sports, sponsoring the Nigeria Football Federation for a five-year period, providing assistance to the Confederation of African Football Awards and the Aiteo Cup.

Another initiative pursued by Mr. Peters is tackling the issue of internally displaced persons within Nigeria through contributions to the Adamawa State Emergency Management Agency. Some 2 million people face economic hardship and poverty which is a barrier to social well-being and economic prosperity which he is determined to champion.

On presenting the award Mike Perlis, Vice-Chairman of Forbes Media, said, “recipients are singled out for their work in bringing prosperity to all 55 countries of the African continent.”

On Receiving the Oil & Gas Leader 2018 Award from Forbes, Peters commented, “This award motivates us to broaden our vision for the continent, despite all odds, and accelerate her economic transformation. We believe that Africa has what it takes to lead the world and we will continue to push the frontiers of development through our investments in people and technology.”

Fitch Says Exports Driving Midstream

Record crude production in the United States and the prospect of increased exports is prompting midstream energy companies to build pipeline, storage and export terminals that accommodate very large crude carriers (VLCCs), according to Fitch Ratings. However, near-term credit risk from heightened investment activity should be limited as most projects are in the early stages, require permits and long-term shipper commitments, and are joint ventures (JVs) that enable a more cost efficient way to expand.

U.S. crude production increased to 11.1 million barrels of oil per day (bpd) in September from 9.5 million bpd in the same period last year, according to the US Energy Information Administration, which expects crude production to average 10.7 million bpd in 2018 and 11.8 million bpd in 2019, versus 2017’s average of 9.4 million bpd. With increased production, U.S. crude oil exports have grown from less than 100,000 bpd prior to 2013 to more than 2 million bpd. The top five destinations are Canada, China, South Korea, Taiwan, and the UK. However, a lack of pipelines to move oil from shale oil fields to the Gulf Coast and VLCC-capable export terminals that improve export economics could limit shipments. Supertankers that cruise offshore to receive oil from small vessels as they near destinations add time and cost to the process.

Costs associated with most of these projects were not disclosed. However, large scale projects tend to be complex, require significant spending and are subject to regulatory approvals. Fitch expects most projects to be JV arrangements that are less detrimental to balance sheets and credit profiles, given the historical capital discipline demonstrated by the industry.

Fitch also views MPLX (BBB-/Stable) as well positioned to benefit from increased U.S. oil exports due to its planned Swordfish pipeline JV with Crimson Midstream LLC and 40.7% minority ownership in the Louisiana Offshore Oil Port LLC (LOOP). MPLX’s Swordfish JV is a system that would carry crude from St. James and Raceland, Louisiana down to the LOOP, which is currently the only deepwater port that can fully load a VLCC and handle both imports and exports of domestic crude. Aside from a connection to the Zydeco (Ho-Ho) pipeline, it lacks significant connectivity to crude produced onshore. Connectivity would improve with the Swordfish pipeline, allowing LOOP to increase export volume, cash flow and dividends to MPLX. Swordfish is targeted for completion in first-half 2020.

TallGrass Energy, LP (BBB-/Stable) and Drexel Hamilton Infrastructure Partners plan to build a $2.5 billion pipeline and an import/export terminal in Louisiana to accommodate VLCCs. Upon completion by the middle of 2020, an offshore pipeline extension that can be connected to VLCCs is intended. TallGrass’ financial obligations associated with these projects could be further lessened given interest from other midstream companies to partner in this project.

Oiltanking, Kinder Morgan (BBB-/Positive) and Enbridge (BBB+/Stable) intend to build an export terminal 30 miles off the coast of Freeport, Texas. This facility will connect to the Gray Oak pipeline which is owned by Phillips 66 and Marathon Petroleum (BBB/Stable). Trafigura plans to build a deepwater export terminal for crude in the Gulf of Mexico outside of Corpus Christi, Texas. The Port of Corpus Christi, in partnership with The Carlyle Group (BBB+/Stable), plans to build a crude export terminal to compete with Trafigura’s planned export terminal by late 2020.

Other midstream companies such as Enterprise Products Operating (BBB+/Stable) partially load VLCCs to enhance export economics but plan to build deepwater terminals to fully load VLCCs to increase capabilities. Enterprise’s plans to construct the new terminal 80 miles from the Texas coast with permits are not expected for 18-24 months.

Develop People with Coaching

by Jeffrey W. Foley

Effective one-on-one coaching is one of the most important skills a great leader must possess. Effective coaching inspires in others an internal drive to act ethically, without direction, to achieve goals. Effective coaching drives performance, builds competence and confidence, and ultimately enhances relationships. The best coaches help people find ways to make things happen as opposed to creating excuses why they can’t.

Effective coaching also requires you to believe in yourself. You need to believe that you can have an impact in the workplace, and that you can inspire others to achieve their goals they might not otherwise achieve. The real question is not if you will make a difference, but what difference you will make.

Respectful, transparent, and regular face-to-face communication between leaders and their people breaks down barriers and builds trust. What you can see in a person’s eyes or other body language can be revealing. While technology can be effective at times, it will never replace human contact for discovery and inspiration.

The most impactful leaders are adept listeners, and don’t allow their egos to become roadblocks. When egos are alive and well, listening ceases, effective coaching environments disappear, and organizations suffer.

Here are three recommendations that can help you raise the bar on your ability to coach others.

- Create a positive and open environment for communication

People listen to and follow leaders they trust. They engage in meaningful dialog with people they trust. They are not afraid to disagree with people they trust. Trust provides the foundation for a positive and open communication environment where connections between people can thrive.

When people connect, they learn about each other. They enable understanding of cultures, individual strengths and challenges. Knowing your people’s unique capabilities and desires helps focus on how to help them be successful.

Knowing your people also reduces the probability of promoting someone into a management position who does not want it or is not otherwise qualified. Not all physicians want to be managers. Not all sales people want to be sales managers. Not all technicians want to be a shop foreman. The costs can be exorbitant to an organization that wrongly promotes someone into a management position.

There are three questions that can help establish this open line of communication: What is on your mind? What can I do for you? What do you think? How am I making your life more difficult? When asked with the genuine interest, people respond with more honesty.

Meet with your people regularly helps break down barriers. Not just in your office, but on the manufacturing floor, outside the operating room, in the cafeteria, or the warehouse. Talk to folks outside the work area like the jogging track, grocery store or the kid’s soccer game. The informal sessions can be wonderful enablers of opening the line of communication.

- Establish agreed upon goals and strategies to achieve

Most people want to know what success looks like. They want to be clear in their goals as an individual and, if appropriate, the leader of a team. Well-defined, measurable, relevant goals on paper help people gain clarity on success for them. Assigning responsibility with authority helps inspire an individual’s commitment to be successful.

Success also includes how to reach their goals. Strategies are developed and agreed upon by the manager and team member so that both understand each other’s roles. The probability of success increases dramatically when strategies and accountabilities are well defined.

- Enforce accountability by assessing performance

There are many and significant consequences when people are not held accountable for achieving goals or otherwise performing to standard. Integrity disappears. Discipline erodes. Morale evaporates. Leaders are not taken seriously. Problem employees become a cancer in the organization. The best people leave. Results are not achieved.

Effective coaching demands assessment of performance. Without this assessment, no system of accountability will be achieved. If the senior leader does not hold his or her executive team accountable, subordinate leaders are likely to think “Why should I?”

Consistent, regularly scheduled coaching sessions with your people are the key to ensuring effective follow-up assessments to celebrate successes and identify areas to improve.

Summary

Coaching session agendas will vary based on a variety of conditions. A good place to start is outlined below.

First, review the individual goals and those of the organization. Ensure alignment of both to clarify where the individual is contributing to the mission of the organization.

Second, discuss what is going well. Where do both the coach and the individual agree on successes? Provide positive recognition for achievements where important.

Third, discuss the challenges or areas for improvement. Underwrite honest mistakes in the pursuit of excellence so people can learn. Determine how you as the manager can help. Gain a clear understanding of the shortfall in the individual’s ability and desire to achieve the goal and what resources or assistance the individual needs to be successful. When unsatisfactory performance occurs, managers must address it. Leaders who never take action to remove an underperformer are doing a great disservice to their institution. All too often, good people serving in leadership positions fear the task of confrontation. They hope, magically, that something will happen which will turn the underperformer around and all will be well in the end. Hope is not a strategy; the magic seldom happens. Your goal as a leader and coach is to inspire a willingness to succeed. When coaching, it is often easier to criticize and find fault. Think before you speak—find ways to praise.

Fourth, as the manager, seek suggestions for how you can be a more effective leader for them. This question can change the dynamic of the coaching session and can provide powerful feedback for the manager in his or her quest to be the best they can be. Doing so will enhance their trust in you and help build confidence in their own capabilities.

Remember, effective one-on-one coaching can be the catalyst for attracting and retaining the best people, and that will ultimately help your organization to unprecedented results.

For more information on Jeff Foley, visit www.loralmountain.com.