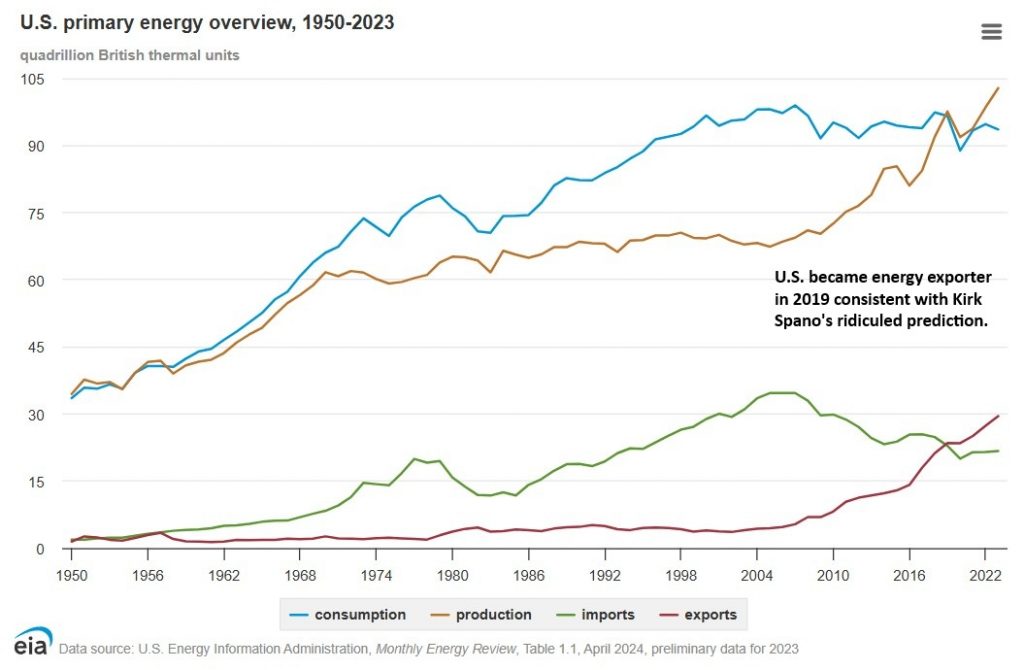

Fourteen years ago, in 2011, I wrote an article for MarketWatch that described how frac’ing for oil and gas would “change everything” for American energy. Among my assertions was the prediction that the United States would be an energy exporter by 2019. The negative comments on the piece were overwhelming. I was told that I was stupid and naive to think that American oil and gas production would surge.

Fast forward to 2025 and President Trump has promised to accelerate and expand upon American energy exports. While I applaud the idea, there are certainly some roadblocks to making it happen in practice.

U.S. Oil and the Permian

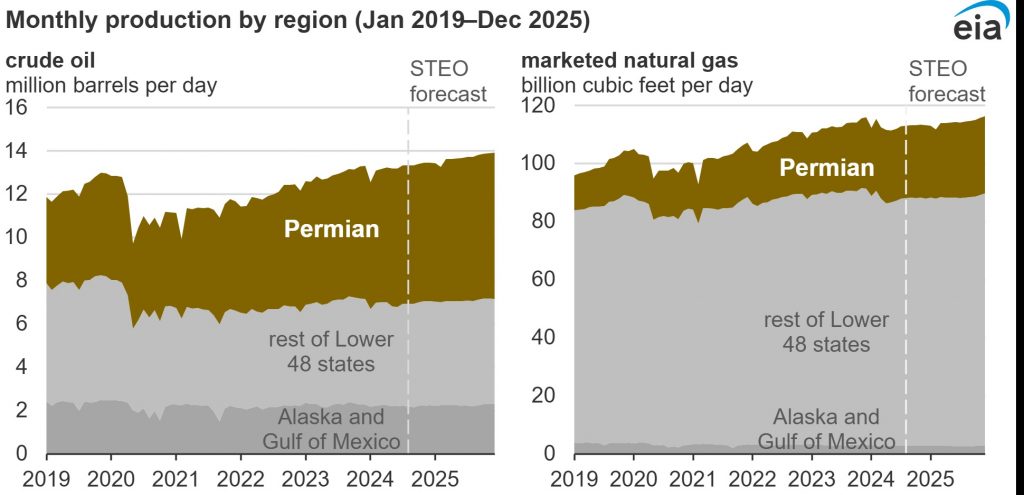

Incoming U.S. Treasury Secretary Bessent has a goal of increasing U.S. oil production by 3 million barrels per day (bpd). The quickest path to any U.S. increases in oil production run through the Permian Basin, the only American oil basin showing any capacity for real growth in the next four years.

The EIA has pegged Permian Basin oil production at 6.3 million bpd in 2024, a roughly 8 percent increase over 2023. Their forecast is for an increase to 6.6 million barrels per day in 2025, or an uptick of .3 million bpd. A far cry from 3 million bpd.

While U.S. production might grow by a bit more from 2026-28 as Trump policies take hold, the potential for a 3 million bpd increase is unlikely.

At the same time, demand remains strong with slow growth. Inventories are globally low, there is decreasing spare capacity at OPEC, and the potential for an oil disruption involving Iran seems higher than normal.

This bodes well for E&Ps that can maintain or marginally increase production while managing expenses. I have covered a number of these companies in recent months, including Occidental Petroleum (OXY), Coterra (CTRA), and Permian Resources (PR), all of which I own shares in.

If the United States is going to make a run at increasing production by 3 million barrels per day, though, a lot of it will have to come from the majors—Exxon (XOM) and Chevron (CVX).

Exxon, fueled by its acquisition of Pioneer, is planning to try to increase its Permian output to 2 million bpd by 2027. The company has committed to $20 billion per year in capital spend the next 3 years.

Exxon’s large Permian presence, newer Guyana production, Brazil investments, and other legacy production makes it a strong play for dividend investors looking for growth tied to rising energy demand.

Chevron, meanwhile, has pivoted to maximizing free cash flow versus pushing for growth. In 2025, Chevron’s Permian production is likely to only grow a middle single digit percentage, in line with overall Permian growth.

In fact, Chevron CEO Mike Wirth projects Chevron’s Permian growth to plateau by decade end. We’ll see how the Trump administration feels about that. What we do know is that Chevron’s margins will be good and their dividend is a top one in the patch.

While getting to the Trump administration’s goal of 3 million barrels per day of increased oil production will be tough within four years, the free cash flow equation is setting up to be very favorable in the consolidating O&G space. I think this might be the last great opportunity to buy Permian stocks in 2025.

Investment Quick Take

I think the entire energy complex is undervalued right now. We are headed into a period of:

- rising energy demand

- constrained growth

- low global inventories and spare OPEC capacity

- potential disruptions in the Middle East

- favorable regulatory and tax environment

While I have favored the Permian pure plays, any company with a major part of their production in the Permian is worth a look. The majors are not my cup of tea individually, but their presence in the energy ETFs are fine by me.

I like the SPDR Energy ETF (XLE) now that refiners have fallen back too, and the Invesco Dynamic Energy E&P ETF (PXE). I own both in managed accounts. Look for spots to buy the dips in 2025.

My firm and I own stock in Occidental Petroleum, Coterra, Permian Resources, SPDR Energy ETF, and Invesco Dynamic Energy E&P ETF. For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A change analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.