As production increases in the Permian Basin, there is a second-stage challenge to the push to ensure success in the crude oil boom in West Texas and southeastern New Mexico: takeaway capacity.

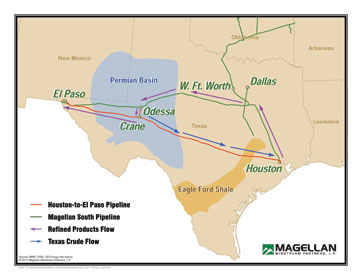

Producers need to get their crude oil to refiners at the highest possible price with the least expensive transportation costs. Tulsa-based Magellan Midstream Partners L.P. announced earlier this year their plans to reverse the Longhorn Pipeline so it will be able to carry crude oil directly from Crane to Houston. Bruce Heine, the director of government and media affairs for Magellan, said there is currently no pipeline transporting crude oil directly from the Permian Basin to Houston.

“We believe our project represents the most direct and cost-efficient route to safely deliver growing West Texas crude oil production to the refineries in the Houston and Texas City area,” Heine stated, “providing alternative transportation options that will help alleviate the current crude oil oversupply situation in Cushing, Okla.”

The Longhorn reversal is one of a number of proposed projects that will greatly impact the ability to get Permian crude to Gulf Coast refineries. To understand the importance of takeaway capacity and what it means to Permian Basin producers, one must first understand where Permian crude goes and how the region’s increased production could mean a bottleneck in Cushing, adversely impacting the price that Permian Basin producers realize for their crude oil.

According to Bentek Energy, a leading analyst of the nation’s oil and gas markets, crude oil production remained flat at between 800,000 and 900,000 barrels a day between 2005 and early 2011 before production numbers began an incline for the first time since the 1970s. Thanks to the increased production from the Wolfberry play, coupled with expanding horizontal drilling in the Wolfcamp and Bone Spring plays, as well as the emerging Cline Shale play, production climbed to 1.2 million barrels a day by July of this year. And Bentek predicts that production will continue to grow, reaching 1.8 MMB/d by mid-2016.

The Alon refinery at Big Spring uses only about 300,000 barrels per day. Most of the remaining daily crude oil production moves out of the Permian Basin via three pipelines—the Plains All American Basin Pipeline that delivers 450 MB/d from Midland to the hub in Cushing, Okla., the 175 MB/d Occidental Centurion Pipeline that runs from southeastern New Mexico to Cushing, and the 350 MB/d Sunoco Logistics West Texas Gulf Pipeline that runs east across Texas from Colorado City to Longview where it meets the Mid Valley Pipeline with access into the Midwest.

Each of those pipelines is running at or near capacity. When the crude oil reaches Cushing, it can be moved on to any one of a number of refineries in the Midwest. Some of it will also move south from Cushing to the Texas and Louisiana refineries on the Gulf Coast.

Efforts are being made to alleviate the bottleneck at Cushing and improve the ability to take more of that crude oil to the Gulf Coast refineries. The capacity of the Seaway Pipeline that delivers oil from Cushing to Houston will increase by 250 MB/d to 400 MB/d with a larger expansion to 850 MB/d anticipated by mid-2014.

Then, of course, there is the Keystone XL Pipeline that generated so much national attention when President Barack Obama blocked the construction of the pipeline from Canada to the Gulf Coast earlier this year. Although the northern section of the Keystone XL Pipeline is still in political limbo until after the November election, construction has begun on the southern segment of the Keystone from Cushing to the Gulf Coast. It is expected to be in service by late 2013.

With the dramatic increase in production in the Bakken Shale in North Dakota, coupled with the potential of crude oil coming from the tar sands in Canada as well as burgeoning Mid-Continent production from the Granite Wash and Mississippi Lime plays in the Texas Panhandle, Oklahoma, and Kansas, it is not hard to see that even with increased takeaway capacity, the Cushing hub won’t be able to handle Permian Basin production when it reaches 1.8 MMB/d in a little more than three years.

With the dramatic increase in production in the Bakken Shale in North Dakota, coupled with the potential of crude oil coming from the tar sands in Canada as well as burgeoning Mid-Continent production from the Granite Wash and Mississippi Lime plays in the Texas Panhandle, Oklahoma, and Kansas, it is not hard to see that even with increased takeaway capacity, the Cushing hub won’t be able to handle Permian Basin production when it reaches 1.8 MMB/d in a little more than three years.

Longhorn Reversal

Heine called Magellan’s plan to reverse the 18-inch Longhorn Pipeline a “return to its original purpose.”

“The Longhorn Pipeline was built in the 1950s by Humble Oil to take crude oil from the Permian Basin to Houston,” he said.

Then in the 1990s, a partnership that included Exxon bought the pipeline. After being out of service for several years, the pipeline was enhanced when an extension was built from Crane to El Paso. All of this was done with an eye toward reversing the direction of flow within the pipeline itself. That step came in 2005 as the pipeline was put back into service—only this time it was delivering refined petroleum products (gasoline, diesel, and jet fuel) from Houston to El Paso.

Magellan was the operator of the pipeline, according to Heine. Then, in 2009, Magellan purchased the Longhorn Pipeline from

Flying J, which had acquired it from the partnership.

“We continued to safely transport refined petroleum products to El Paso,” Heine continued.

In late 2011, however, Magellan announced plans to reverse the pipeline and to convert it—from Crane to Houston, at least—for crude oil service. In January, it launched the first of two separate binding open seasons to solicit capacity commitments from shippers to transport crude oil from West Texas to its East Houston terminal for further delivery to the Houston and Texas City-area refineries through Magellan’s distribution system.

In March, after a second open season, Magellan announced it planned to expand the capacity of its Crane-to-Houston crude oil pipeline to 225,000 barrels per day. Heine said the expanded pipeline capacity is fully committed with long-term agreements. The project is estimated to cost $375 million, including the cost to expand the system to its maximum capacity of 225,000 barrels per day.

“We are moving forward,” Heine explained. “Once we obtained a commitment (from shippers), we began working with the U.S. Department of Transportation and the Pipeline and Hazardous Material Safety Administration on an environmental assessment. The public comment period has ended, and we are in the final stages of the regulatory process.”

Heine said Magellan expects to start service on the Longhorn Pipeline in the first quarter of 2013, with full service anticipated by mid-2013.

“We are taking some pressure off Cushing, and we are taking Texas crude on a Texas pipeline to Texas refineries,” he pointed out. “That is a good thing. And it creates jobs.”

Part of the $375 million total cost is an upgrade to another Magellan pipeline that runs from Houston to Frost to Odessa to El Paso to deliver refined petroleum products to far West Texas, meaning the company still has a way to service the El Paso market after the Longhorn pipeline is reversed.

BridgeTex Pipeline

The Longhorn reversal is one of two projects Magellan has on the charts to take crude oil from the Permian Basin directly to Houston and the Gulf Coast. Magellan and Occidental Petroleum are also forming a new project

company to jointly execute the BridgeTex Pipeline project, 400 miles of newly constructed 20-inch pipeline that will be capable of transporting 278,000 barrels of crude oil per day from Colorado City to Texas City. The project includes an expansion of its distribution system between East Houston and Texas City.

The two companies have already held an open season to assess customer interest and are moving forward with the regulatory process. Heine said Magellan will serve as the operator of the new pipeline, which is expected to begin service by mid-2014.

Other projects

Magellan’s two projects aren’t the only expansions and new extensions planned to improve takeaway capacity from the Permian Basin. Sunoco Logistics has announced a 30MB/d expansion of the West Texas Gulf pipeline that runs from Colorado City to Wortham and then east to Longview. That project also calls for a reversal of an existing crude pipeline that runs from Nederland near Port Arthur on the Gulf Coast north to Wortham, which will allow 40 MB/d of crude oil to flow directly from Colorado City to Wortham to the Texas Gulf Coast. It is expected to be operating by the first quarter of 2013.

Sunoco Logistics is also reversing an existing pipeline running from the Texas/Oklahoma border at Wichita Falls, south to Wortham and then continuing south on a new pipeline running alongside the existing West Texas Gulf pipeline down to Nederland. It will have an interconnect with the Basin pipeline that runs from the Permian Basin to Cushing, allowing oil flowing on the Basin into Cushing to make a right turn at Wichita Falls on the Permian Express, thus avoiding Cushing and heading to the Gulf Coast instead. Phase one of that project, with an initial capacity of 90 MB/d, will start in the first quarter of 2013 and will expand to 150 MB/d in the second phase.

Energy independence

Heine pointed out that additional pipeline construction is necessary as North American crude oil production increases in the Bakken, in Canada, and in the Permian Basin.

“There is a need for infrastructure and Magellan is in good position to play a role in that,” he stated. “We are excited about being able to safely take crude oil directly from the Permian Basin to Houston by pipeline. The project for growth in the Permian Basin is significant, and our projects will help our country’s goal of energy independence. We see it as a win-win for the nation and the producers in West Texas.”