Volatility at the start of the Trump Administration might present the last chance to buy Delaware Basin oil and gas stocks on the cheap, in my opinion.

The recent goal of maximizing oil production over gas production seems to be flipping and the investing public is not quite in emotional chase mode yet. That gives forward-looking investors an opportunity.

What we know about the natural gas equation is that domestic natural gas demand is growing again, largely in line with data center buildouts and increasing LNG exports. U.S. LNG exports are projected to grow by over 2 Bcf/d in both 2025 and 2026.

U.S. natural gas demand alone is estimated to grow by over a billion MMBtu in 2025. Asia is accounting for about half of the global growth in gas demand in coming years, as India sees a projected increase of more than 50 percent by 2030.

We have recently seen signs of tightening natural gas supply as inventories have gone from flattened to fallen, depending on the week. According to the EIA, natural gas inventories are near the bottom of the seasonally adjusted five-year range.

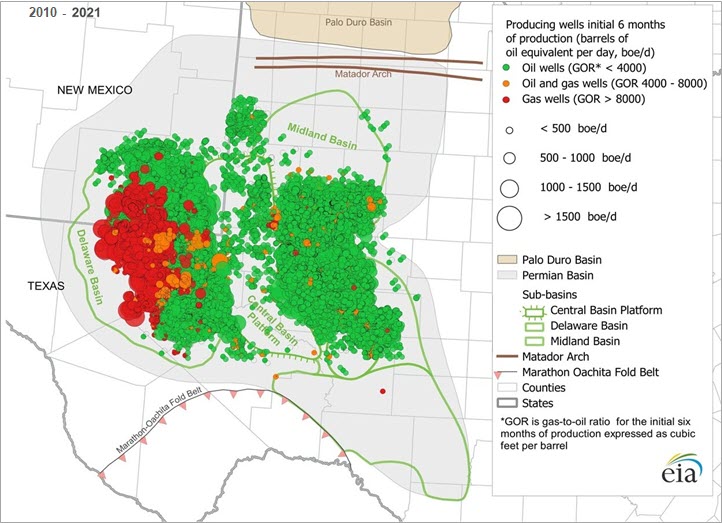

The Delaware portion of the Permian Basin is more gassy than the Midland region and less developed so far. In general, companies have lower valuations due to the prior focus on oil from the Midland.

I believe that as demand for gas increases, inventories see more pressure, and companies produce more in the Delaware, then their share prices will appreciate. The increase in revenues from higher gas prices, coupled with better outtake from new pipeline capacity, should drive margins higher, creating upside surprises in earnings that investors are not usually forward-looking enough to forecast.

On top of that, the Trump Administration is likely to allow the bigger players to acquire again and that bodes well for the midsize players, especially those who can command some price premium by threatening to go it alone.

If you have read my prior articles, then you know that my two favorite plays in the Delaware are Permian Resources (PR) and Coterra Energy (CTRA).

Permian Resources (PR) is a pure play Permian player and, depending on how you interpret the numbers, Permian Resources is between the 5th and 7th largest producer in the Delaware.

Permian Resources (PR) is returning capital to shareholders via reduced debt, dividends, and share buybacks. Based on a discounted cash flow model for EBITDA, the fair value of the company is about $22/share at today’s oil and gas prices.

Coterra Energy (CTRA) is the 7th or 8th largest producer in the Delaware. They are also returning money to shareholders via dividends and share repurchases. I believe they will retire significant debt on the sale of their Oklahoma assets at some point. Based on a discounted cash flow model for EBITDA, the fair value of the company is about $47/share at today’s oil and gas prices.

I anticipate oil is range-bound the next five years, but that natural gas prices rise, which offers upside surprise potential.

Both companies are M&A targets in the new regulatory environment. Larger players with ambitions include EOG Resources (EOG), Devon Energy (DVN), Chevron (CVX), and ConocoPhillips (COP). Interestingly, after listening to Madador Resources (MTDR) CEO Joseph Foran in May at the Hart Energy conference, I could see Matador making a play for both as well.

For those looking for leverage to undervalued companies with natural gas upside, I think buying the dips on both Permian Resources (PR) and Coterra is advisable. Consider this me “pounding the table.” I don’t do that often. Next month I will delve into alternative energy investment developments in the Permian.

This EIA map indicates how much gassier the wells are in the Delaware Basin (left half of image), as opposed to the Midland Basin. Gas wells are shown in red.

My firm and I own stock in Coterra and Permian Resources. For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A change analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.