In this month’s roundup of news and views, we share some progressive views and expansive pronouncements. These are the full versions of the “Drilling Deeper” news items that appeared as abbreviated versions in the print edition of PB Oil and Gas Magazine’s October 2019 issue.

Upstream Sector Emerging As Epicenter for Industrial Internet

The upstream sector is witnessing considerably more implementations of the Industrial Internet compared to other oil and gas sectors. This is driven by the need to reduce operational risks and maximizing returns from their assets through digitialisation, according to GlobalData, a leading data and analytics company.

The company’s latest thematic report: “Industrial Internet in Oil and Gas,” reveals that the adoption of the Industrial Internet would enable companies in digitalizing oilfield operations and creating digital twins to reduce risks and optimize performance.

Industrial Internet has the potential to transform traditional processes and workflows and boost the technological capabilities of oil and gas firms. This could help them achieve two primary objectives: firstly, companies would be able to overcome operational challenges while venturing into new frontiers in search of hydrocarbon resources; and secondly, Industrial Internet adoption will improve productivity and efficiency, thereby strengthening market competitiveness in a challenging environment.

Ravindra Puranik, oil and gas analyst at GlobalData, comments: “In general, adoption of the Industrial Internet would make organizations more dynamic and adaptable to external factors. This concept is expected to play a central role in simulation and modelling of projects against different market scenarios, optimizing inventory levels, demand forecasting, decision support, and logistics optimization, and setting up long-term objectives for an organization.”

Ravindra Puranik, oil and gas analyst at GlobalData, comments: “In general, adoption of the Industrial Internet would make organizations more dynamic and adaptable to external factors. This concept is expected to play a central role in simulation and modelling of projects against different market scenarios, optimizing inventory levels, demand forecasting, decision support, and logistics optimization, and setting up long-term objectives for an organization.”

Adoption of digital technologies has surged of late, largely as a reaction to the crash in crude oil prices. However, companies have been quite methodical in their approach to enable this transformation and ensuring maximum possible value can be derived through Industrial Internet implementations.

Puranik explains: “This is particularly evident in the case of digital twins, wherein companies have chosen fields that have recently entered into production or are on the verge, to allow for the integration of advanced sensors and connectivity with oilfield infrastructure for remote monitoring and analysis. To highlight one such instance, BP created a digital twin at the Claire Ridge project in the North Sea, which started producing oil in 2018. The company was assisted by WorleyParsons in the creation of a digital replica of the field.”

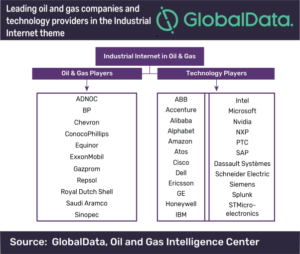

GlobalData’s thematic research identifies oil and gas companies, such as BP, Shell, Chevron, ExxonMobil, ConocoPhillips, Gazprom, Repsol, Equinor, Saudi Aramco, Sinopec, and ADNOC as the major players in the adoption of the Industrial Internet theme in the oil and gas industry. These companies are adeptly assisted by technology providers, such as Microsoft, IBM, Amazon, PTC, Cisco and Intel, which are gradually assuming leadership in delivering Industrial Internet solutions to the oil and gas industry.

Oil Industry Shakeup Looming in the Permian

In April 2019, the United States became the largest oil producer in the world as a result of increased output in the Permian Basin. Enhanced seismic data gathering capabilities, horizontal drilling, hydraulic fracturing, and multi-pad development techniques have allowed operators to realize a cost savings of nearly 40 percent to drill and complete a well.

“With the Permian Basin predicted to produce an incremental one million barrels per day each year and the pipeline takeaway issue soon to be resolved with several major new pipelines due to come online in the second half of 2019, Hastings Equity Partners commissioned the University of Houston to find out where the incremental oil is going and to understand the downstream impact that new production levels will have,” said Ted Patton, founder and managing partner of Hastings Equity Partners. “Some facts came out of the research that we didn’t anticipate. Namely, the impact of the industry consolidation in the Permian Basin and the challenge of how to capture and transport the natural gas that is a byproduct of the process.”

The research found that major oil operators are projected to produce more than half of the oil in the Permian over the next four years, representing a historic shift in economic power. These large companies are consolidating production, resources and supply chains that will meet the majority of domestic needs. Their acquisitions of acreage in the Permian, as well as ownership stakes in the pipelines and downstream refineries and petrochemical facilities, means that smaller independent producers who traditionally sell to the majors will now need to market internationally and export overseas.

In the early days of this oil revolution, the independent oil and gas companies were nimble and profitable. They acquired leases, assets, and mineral rights with more alacrity than their major counterparts. As the industry matures, major companies like Exxon and Chevron are speeding up production and decreasing margins and pushing out the independents. “The Permian Basin used to be a place where wildcatters reigned and now, with technology, the economy is being driven by manufacturing,” said Patton.

Independents are facing new limitations from the investment community to limit production volume to what can be achieved with cash on hand. At the same time, Exxon and Chevron have each announced plans to produce one million barrels a day. “The inevitable result will be consolidation by independents in an effort to survive,” he added.

With major producers owning their own refineries and petrochemical facilities, they no longer need to purchase crude from independent producers. Finding new, foreign customers has become the priority for independents. The findings of the study are clear: independents must combine balance sheets to buy downstream assets, or form a combined marketing organization to sell their product internationally.

“While refineries have increased processing to keep up with production, supply of crude oil will soon outstrip demand and the producers will need to find new customers,” said Dr. Ramanan Krishnamoorti, chief energy officer at the University of Houston and co-author of the research. “Even though there is more than $90B in construction projects for terminals, LNG, refining and petrochemical facilities along the Texas and Louisiana Coast right now, and another $200 billion planned for the next decade, construction can’t keep pace with the supply of oil coming out of the Permian.” The majority of the recent incremental capacity is, and will continue to be, directed at the Port of Corpus Christi.

An existing obstacle forecasted to persist for the next three years is the ability of Very Large Crude Carriers (“VLCC’s”) to navigate Gulf Coast waterways to refill for export. Waterways along the Gulf Coast don’t provide the 75 feet of depth needed to accommodate fully-loaded carriers, requiring ship-to-ship transfers (known as “lightering”) offshore. The demand for U.S. crude has highlighted the need for deep-water terminals off the coast of Freeport, Texas City, Corpus Christi, Brownsville and Louisiana. These projects have been proposed, but permitting and execution permissions will delay progress, thereby creating additional bottlenecks.

While the report presented many challenges being faced by the dynamic oil industry, it also presented emerging opportunities.

As crude production creates more natural gas, the ability to capture, market and deliver it to potential customers will provide new revenue streams from this byproduct for both producers and service providers.

“Commodity service providers will face continued margin erosion in the fact of customer consolidation and ultimately witness the destruction of enterprise value. However, differentiated service providers will thrive as long they are able to demonstrate either cost savings or incremental production for their customers. These companies provide the rigs, pressure pumping equipment, wireline, wellhead, cement, chemicals and delivery services, and the need is not forecasted to diminish,” concluded Patton.

Permian Basin Tests Limits Of Midstream Infrastructure

Enverus, the leading energy SaaS and data analytics company, has released “Permian to Gulf Coast Midstream,” the latest installment of their “FundamentalEdge” series, which presents an overview of oil, gas, and natural gas liquids (NGL) infrastructure currently proposed between the Permian basin and Gulf Coast export terminal locations. Underscoring the lack of adequate takeaway capacity in 2018-2019, plus the expected importance of coastal oil, natural gas, and NGL exports, in this report Enverus highlights the expected impact of upcoming long-haul takeaway capacity projects and the price differentials they’ll create.

“The Permian Basin has experienced unprecedented production growth and remains the world’s focus, from producer to private equity, to service and supply companies,” said Bernadette Johnson, vice president of strategic analytics at Enverus. “But the Permian continues to be challenged by existing pipeline constraints and the inability to efficiently and effectively move oil, natural gas, and NGLs to the market. All hydrocarbons are tied at the drill bit and one affects the other. Although many players in the Permian are targeting crude oil primarily, natural gas processing and pipeline bottlenecks can have a negative impact on that crude oil production. However, a light at the end of the tunnel may soon be visible—at least for those that can hang in there through 2020,” said Johnson.

In Permian to Gulf Coast Midstream, Enverus (formerly DrillingInfo) analyzes numerous planned pipeline projects and the bottlenecks they expect will be cleared providing relief to America’s most prolific, but congested basin.

Key Takeaways from the Report:

• Production growth in the Permian basin is testing the limits of existing midstream and downstream infrastructure, requiring further capital investment in long-haul pipelines, gas processing plants, NGL fractionators, and coastal export terminals.

• Crude oil production continues to rise in the Permian basin despite economic headwinds resulting from sub-$60/bbl WTI prices. Nevertheless, the pace of growth is at risk of slowing significantly if the low flat-price environment persists. With additional long-haul pipeline capacity coming online in the second half of 2019, noncommitted shippers will likely find themselves squeezed out as spot arbs shut. As volumes are further increased to the Gulf Coast (and away from Cushing), additional export capacity will be required, and there is an acute need for new export facilities capable of fully loading VLCCs. A race to the finish has begun, with numerous onshore and at least seven offshore terminals currently proposed or in development.

• Although natural gas production is mostly a by-product of drilling for crude in the Permian basin, flaring is just not a long-term option. In Enverus’s high case scenario, dry gas production could increase by 50% (~5 Bcf/d) over the next five years.

• Market participants are also facing weak regional pricing, with Waha basis trading at levels more than $1.00/MMBtu under Henry Hub. Hence, at least five projects are currently proposed to alleviate this constraint. All projects will be transporting the gas east toward South Texas and Louisiana to feed LNG exports as well as growing power and industrial demand.

NGL production out of the Permian is expected to continue to grow, with most of the production destined for the Gulf Coast. To allow for the extra production, a number of pipeline projects are under construction or in planning to transport the NGLs. As NGLs arrive at the Gulf Coast, they are then fractionated. Fractionation capacity has been running tight since mid-2018, resulting in numerous fractionation projects along the coast. The fractionation bottleneck was relieved slightly in early 2019, when two projects hit the market. However, with most projects scheduled to come online in early 2020 and after, it is possible the bottleneck will reappear in late 2019 and early 2020.

Lea County Airport Gets New Route to Denver

After a recently completed expansion of its regional airport, Lea County will be augmenting its existing non-stop United Express daily flight service to Houston with a new route to Denver, Colo.,which begins on October 27.

The remote areas of southeastern New Mexico are experiencing unprecedented growth and economic activity as the oil and gas industry continues to explore the potential of the Permian Basin. Ever since the United States Geological Survey (USGS) announced in late 2018 that the Delaware Basin, part of the larger Permian Basin, is one of the largest continuous oil and gas resources ever assessed in the nation, the modern mid-sized city of Hobbs has been working to meet the needs of the oil and gas industry.

Missi Currier, president and CEO of the Lea County Economic Development Corporation (EDCLC) said the new direct Denver flight will provide easier access for oil and gas industry professionals in Colorado and North Dakota to the booming fields in Lea County.

The oil-rich Permian Basin represents huge potential for oil and gas industries worldwide. The oil field has been ranked at the world’s second-most productive oil field for several years, and recent information has proposed that it may actually hold the number one spot. A recent bond offering disclosed operational details for Saudi Ghawar, the world’s largest conventional onshore oil field, which produced 3.8 million Barrels Per Day (BPD) for 2018. Analysts were quick to note that the Permian Basin produced 3.8 million BPD by October 2018, with two months of production still remaining in that calendar year.

Lea County is the top oil-producing county in the entire Permian Basin and has been developing the New Mexico side for many years. The county has been very proactive in facilitating multiple sectors of the energy industry and meeting its needs. The Lea County Energyplex not only encompasses oil and gas companies but also renewable energy businesses and nuclear operations. Non-stop daily flight service to Houston was established in 2011 and has proven to be a valuable resource for Texas-based oil industry consultants, workers, and executives. “We wanted to find a way to open up our oil fields to Colorado, North Dakota, Calgary, and other companies north of New Mexico,” said Currier. The EDCLC branded the new flight service as FlyHobbs and invested in a marketing campaign to introduce it to the oil and gas industry and the entire community.

The EDCLC was first established in Lea County in 1963 to help recruit new, quality businesses to the area and assist with the retention and expansion of existing industry. As a private, non-profit organization, the EDCLC helps to identify incentives, locate real estate, supply data, contact community leaders and support their memberships through networking events and conferences. FlyHobbs operates in conjunction with United Airlines to maintain and expand flight service to key cities that also serve as major air transportation hubs to better facilitate economic development in Lea County.

Greater Transparency Urged For Users of Type Curves

By Steve Hendrickson

Unconventional reservoirs present challenging problems for reservoir engineers tasked with predicting the future performance of undrilled and recently completed wells. In conventional reservoirs, there are many analytical techniques that can be used, but unconventional reservoirs present too many complexities, variations, and unknowns to apply these methods. In particular, the extent, geometry, and conductivity of the fracture network is unknown and perhaps impossible to model.

A common solution is to use production data from existing wells as analogues for future wells to generate a “type well profile” (TWP). TWPs, also called “type curves,” are derived by selecting analogous wells, collecting their production history and key well information, and applying several mathematical adjustments to generate the prediction. The adjustments include steps like estimating the future production of existing wells; normalizing the data to the first month of production; scaling the data to account for differences in lateral length or fracture design; and binning the data according to other parameters, such as formation or operator. The scaled and normalized production can be used to generate average production forecasts for each of the bins.

Operators use TWPs to make investment decisions, prepare reserve estimates and to inform their investors about the expected economics of their undrilled wells. Many of them are disclosed to the public in investor presentations and public filings. Although they are widely used, typically there is very little disclosure about how they are derived. There are no industry standards for the preparation of TWPs. Rather, they are created under many different circumstances and engineers have personal opinions about the best way to prepare them. However, some of these opinions are certainly better than others.

The development of best practices for TWP generation is currently under consideration by a committee of the Society of Petroleum Evaluation Engineers (SPEE).

Ahead of that work, however, we at Ralph E. Davis Associates (RED) believe that improved disclosure about how a TWP was created would help users better understand the quality and reliability of the estimate. It would also provide more transparency to help them understand why different engineers in the same play and area generate different TWPs.

Recommendations for Better TWP Disclosure

We recommend that TWPs presented to the public or to other consumers be accompanied by a voluntary disclosure that explains or addresses the following items. A sample disclosure is provided at the end of this paper.

Selection of Analogous Wells – A list of API numbers, a map or a description of the area that includes the analogous wells. If certain well types, operators, vintages, etc. were used to filter the list of wells, that should be disclosed. If the list of API numbers is not disclosed, the number of wells used should be disclosed for each TWP. The goal is to make it clear which wells were used and why.

Source of the Production Data – Describe whether the data came from internal or public sources and cite the source. If lease-level data has been allocated to individual wells, that should be disclosed.

Frequency of the Production Data – Describe whether daily or monthly production was used. Some public data is reported quarterly, so if the monthly data is calculated from quarterly values, that should be disclosed.

Months of Production History Used – The disclosure should discuss how many months of production data was available and used in the TWP. One approach would be to provide the minimum, maximum and median number of producing months.

Scaling and Binning – How was the production data for each analogue well scaled to account for variations in relevant variables (lateral length, for instance) and how were the analogues binned to generate the TWPs?

“Project the Average” or “Average the Projections”? – Petroleum engineers may average the analogue wells’ production-month-normalized historical data and then project the average into the future, or they may project the future performance of the analogues and then average the wells’ combined history/projection data. If projections were used, what engineering methods were used to make them? Engineers that have access to detailed production and pressure history data will sometimes employ additional reservoir engineering techniques to project the analogue wells before aggregating them.

Form of TWP Equation – What form of production rate versus time equation (Arps, etc.) is used to represent the type well?

TWP Parameters – What are the relevant parameters of the resulting TWP? For example, initial rate, initial effective decline, b-factor, minimum decline, final rate, well life, expected ultimate recovery, etc.

Reliability Measures – Statistical measures should be presented that allow the user to understand the uncertainty and reliability of the TWP. These could include confidence intervals around the TWP or standard deviation as a function of time (absolute or a percentage of the expected value).

Summary

There are many approaches to creating TWPs and they often rely on very limited data. We believe that their users should have enough information to understand how they were made so they can make informed decisions. A thorough disclosure of the data and methods used would be a good first step.

About the Author

Steve Hendrickson is the President of Ralph E. Davis Associates, an Opportune LLP company. Steve has over 30 years of professional leadership experience in the energy industry with a proven track record of adding value through acquisitions, development and operations. In addition, Steve possesses extensive knowledge in petroleum economics, energy finance, reserves reporting and data management, and has deep expertise in reservoir engineering, production engineering and technical evaluations. Prior to joining Opportune, Steve was Principal of Hendrickson Engineering LLC, a licensed petroleum engineering firm focused on reserves assessment and property valuation supporting property acquisitions and corporate restructurings. Steve began his career at Shell Oil as an engineer in Permian Basin waterfloods and CO2 floods. Since then, he has focused on leading upstream oil and gas reserves evaluation/engineering projects serving in management or as an executive at several E&P companies, including El Paso Production Company, Montierra Minerals & Production LP and Eagle Rock Energy Partners LP. Steve is a licensed professional engineer in the state of Texas and holds an M.S. in Finance from the University of Houston and a B.S. in Chemical Engineering from The University of Texas at Austin. He currently serves as a board member of the Society of Petroleum Evaluation Engineers (SPEE)

CO2 Direct Air Capture: Good for the Climate?

By James Mulligan and Dan Lashof

Earlier this year, Occidental Petroleum announced plans to draw half a million tons of carbon dioxide (CO2) out of the atmosphere each year with Carbon Engineering’s “direct air capture” technology. Occidental will then pump that CO2 into its oil fields in Texas, where it will release trapped oil and increase production. The pumped CO2 will remain stored underground.

On its face, boosting oil production seems counterproductive: To limit global temperature rise to 1.5 degrees C (2.7 degrees F) and prevent the worst climate impacts, the Intergovernmental Panel on Climate Change (IPCC) tells us we need to cut oil consumption roughly 40-80% by 2050. Can pumping CO2 into the ground to extract more oil actually help in the fight against climate change?

Surprisingly, yes—but the details matter.

Right now, coupling direct air capture with enhanced oil recovery (known together as CO2-EOR) is the most economically viable strategy to develop the technology further and lower its cost enough to scale it around the world.

CO2-EOR, largely overlooked to date, could also be a powerful strategy to reduce emissions from oil consumption until the world completes the transition to clean energy. Under the right conditions it is even possible to achieve net CO2 removal from the atmosphere by combining direct air capture with CO2-EOR. But whether this technology will reduce net emissions depends on several key factors, which we discuss below.

What Is Direct Air Capture and Why Does It Matter?

Direct air capture is a chemical scrubbing process that directly removes CO2 from the outside air. Most climate models indicate the world will need to be removing several billion tons of CO2 from the atmosphere each year by 2050—as much as double the current annual emissions of the United States—in order to stabilize global temperature rise to 1.5 or 2 degrees C.

A recent study examining least-cost pathways for doing so found that direct air capture makes the task much easier—significantly lowering the marginal cost of achieving either temperature target according to the preliminary models used for this analysis. Although direct air capture is just one of several ways to remove CO2 from the atmosphere, the technology is easier to scale up than other options identified to date. The authors warn, however, that these preliminary results should not be used as an excuse to slow down investment in clean energy or other carbon removal options, like restoring forests or using soil to store carbon.

What Does Direct Air Capture Have to Do With Oil?

With an adequate price on carbon emissions or subsidies for carbon removal, it would be economic to use direct air capture to pull CO2 from the atmosphere and simply store it underground. But existing federal policy incentives in the United States are not enough to support the cost of direct air capture and storage. Like with any new technology, the direct air capture industry will need years to drive costs down by gaining manufacturing experience, accumulating many minor innovations over time, and standardizing supply chains.

Enter enhanced oil recovery, which is the most economically attractive way to use captured CO2 today. Other markets for CO2 will emerge but today’s markets, like carbonated beverages, are relatively small. The National Academies of Sciences have said the cost of existing direct air capture technology could fall from several hundred dollars per ton of CO2 to about $100 per ton. Each ton of captured CO2 can be used to produce as much as two to three barrels of oil. At today’s $60 per barrel, the process might even pay for itself—and the federal government offers an additional $35 per ton tax credit for CO2-EOR.

In sum, deploying direct air capture in the near-term is critical if the technology is going to be affordable at a truly large scale in the coming decades. Enhanced oil recovery is the most economic way to do that.

New Book Explores Fossil Fuel “Revolution”

The boom in tight oil and shale gas in the last two decades, fueled by a combination of directional drilling and staged hydraulic fracturing, has revolutionized the energy industry, revitalized reserves once thought depleted, changed the global energy market, and raised environmental concerns. In their new book The Fossil Fuel Revolution: Shale Gas and Tight Oil, authors Daniel Soeder and Scyller Borglum, Ph.D., delve into these issues and describe the energy resources now being recovered from shales and other tight formations that have opened up substantial new energy reserves for the 21st Century.

The book includes the history of shale gas development, the technology used to economically recover hydrocarbons and descriptions of the 10 primary shale gas resources of the United States. The book also addresses international shale resources, environmental concerns, and policy issues. Soeder is the director of the Emergu Resources Initiative at the South Dakota School of Mines and Technology. Borglum co-authored the book while completing her doctorate degree in geology and geological engineering at SD Mines.

This book is intended as a reference on shale gas and tight oil for industry members, engineers, geoscientists and college students.

It provides a cross-cutting view of shale gas and tight oil in the context of geology, petroleum engineering and production. It includes a comprehensive description of productive and prospective shales, allowing readers to compare and contrast production from different areas. The book also addresses environmental and policy issues and compares alternative energy resources in terms of economics and sustainability.

About the Authors:

Dr. Scyller J. Borglum, left, and Daniel J. Soeder, authors of The Fossil Fuel Revolution: Shale Gas and Tight Oil.

Daniel J. Soeder has been the director of the Energy Resources Initiative at SD Mines since 2017, bringing 25 years of experience as a research scientist for the federal government with the U.S. Geological Survey (USGS) in Nevada and the Mid-Atlantic region, and with the U.S. Department of Energy (DOE) at the National Energy Technology Laboratory in Morgantown, West Virginia. Prior to joining the USGS in 1991, Soeder spent a decade studying the geology of unconventional natural gas resources at the Institute of Gas Technology (now GTI) in Chicago, and collected and characterized drill cores on the Eastern Gas Shales Project as a DOE contractor from 1979 to 1981. He has authored multiple reports and scientific papers on shale properties and the impacts of shale gas development on the environment, including a special paper published by the Geological Society of America in 2017 chronicling the development of natural gas resources in the Marcellus Shale. He holds a B.S. degree in geology from Cleveland State University, and an M.S. degree in geology from Bowling Green State University (Ohio).

Dr. Scyller J. Borglum is a geomechanical engineer at RESPEC, a consulting and lab testing company in Rapid City. She also serves as State Representative for South Dakota House District 32. She is a candidate for the US Senate. She completed her doctorate in geology and geological engineering in 2018 at South Dakota School of Mines & Technology, working as an intern at the National Energy Technology Laboratory (NETL) in Morgantown, West Virginia, and as a research assistant for the Energy Resources Initiative on the SD Mines’ campus. In addition to her Ph.D., Borglum holds an M.S. and B.S. in petroleum engineering, along with a bachelor’s degree in business and a master’s degree in theology. Before starting her Ph.D. program, she worked as a petroleum engineer in the Bakken Shale in North Dakota for Packer’s Plus Energy Services and Marathon Oil Company and held a summer position with Anadarko Petroleum Corp. in Colorado.

Priority Midland Releases Economic Impact Study

Priority Midland has released the Midland Economic Impact Study, a comprehensive report from economist Dr. Ray Perryman and The Perryman Group that was commissioned to define the implications of Midland’s anticipated growth. The study quantifies the magnitude of the expected industry, population, and economic expansion, and identifies the challenges and opportunities that the energy sector’s surge presents to Midland and its residents.

“The rapid growth we’ve seen in Midland over the last few years is expected to continue into the foreseeable future. Ignoring that future is not an option,” said Bobby Burns, chair of Priority Midland and president and CEO of Midland Chamber of Commerce. “Priority Midland is a forum for the community to work together to meet Midland’s challenges and leverage its opportunities. We commissioned this detailed Economic Impact Study so everyone can better understand the expected scale of Midland’s growth and transformation and make well-informed, strategic decisions about how to deploy resources.”

Within the Study, summarized below, the economic forecast analysis covers both the Permian Basin and the Midland metropolitan statistical area (MSA), and the energy sector impact analysis provides separate forecasts for three energy price scenarios – baseline, low and high energy price impact.

State of the Industry

Recent advances and developments in the energy sector have led analysts and energy companies to anticipate enormous increases in Permian Basin production over the next few years. Technological and infrastructure advances, new resource discoveries, cost reductions and global demand are widely expected to lead to more stable and less erratic industry activity. This is expected to result in:

• Less market volatility;

• Larger scale drilling programs and increased cycle times;

• More permanent workforce with high earnings; and

• Increased permanent population.

What It Means for Midland

Much of this activity will be centered in the Midland area, the headquarters for the Permian Basin energy sector and a location for substantial drilling and extraction activity. The resulting growth of the industry in the Midland area brings both potential benefits and profound implications for workforce requirements, housing, education, job training, infrastructure, healthcare capacity and other socioeconomic needs.

Population Growth

Midland County is the most populated county in the Permian Basin Region. From 2010 to 2018, the City of Midland, with an annual increase of 3.12 percent, greatly outpaced state (+1.62 percent) and national (+0.70 percent) population growth. This expansion is expected to continue and intensify as the area adjusts to a “new normal,” and resulting workforce demand is expected to grow in all categories.

Opportunity Growth

Midland is also a magnet for the benefits of the surging Permian Basin energy sector. More than 85 percent of the regional gross product (value-added) in the Permian Basin oil and gas sector flows to the Midland MSA, and that percentage is expected to increase in the future under all the oil price scenarios.

Housing

Over the past few years, growth in the energy sector has contributed to rapid growth in population and, therefore, housing demand. The tight market has led to housing shortages – particularly in lower price ranges – and higher housing prices. Midland-area home values and gross rents are higher than in other areas and have been increasing.

At baseline oil price assumptions, the expected rate of population and economic expansion leads to the need for an estimated increase of 16,207 single-family residences and 9,938 multi-family residences in the MSA by 2030. This will require a sizeable net increase over the current pace of production of both multi- and single-family homes.

One critical factor that will influence Midland’s ability to provide for the increased housing demand is the availability of construction workers. Under the baseline oil price scenario, the demand for building and specialty construction workers is expected to top 6,000 over the 2019-30 time period, competing with the oil and gas industry for workers.

Infrastructure

The expansion of the oil and gas industry has put a major strain on roadways, with traffic counts on many of the roads in the Permian Basin increasing by 65 to 150 percent between 2016 and 2017. This increased roadway usage is due to intensified commercial traffic and personal transportation use. Additionally, a greater proportion of the Midland-area population (85.4 percent) drove themselves to work compared to the state (80.6 percent) and nation (76.4 percent), while a much lower percentage took advantage of public transportation or carpooling.

The City of Midland has been building up its water infrastructure over the past decade. It has increased the miles of storm sewer by 36.2 percent and sanitary sewer by 13.4 percent since fiscal year 2010, and expanded system capacity from 51 million gallons to 55 million gallons in fiscal year 2015. However, population and industry growth projections could put substantial pressure on reserve levels, especially under high oil prices and drought conditions.

Further, Midland’s expected economic and population growth will lead to the need for additional occupied real estate (housing, industrial, warehouse, retail and office space), requiring continued expansion of roadways and water/wastewater infrastructure.

Future demand for workers in heavy and civil engineering occupations is expected to remain strong.

Education

Throughout the Midland MSA, the school-aged population is projected to grow by a total of more than 11,200 through 2025, and nearly 20,300 through 2030, under the baseline scenario. The majority of the growth will occur at the elementary school level (57.7 percent of growth through 2025, and 56.7 percent of growth through 2030).

The Study’s detailed forecast of demand for additional workers also indicates significant needs within the education system. When growth and replacement needs are considered, an estimated 919 additional workers in education occupations will be needed by 2025, and 2,248 by 2030, under baseline oil price assumptions, with even more needed if prices are higher. In particular, large numbers of postsecondary teachers, teacher assistants and elementary teachers will be needed.

The percentage of the population which has completed high school is higher in the Midland area than for the state but is somewhat below the U.S. A slightly higher proportion of people in the area have attained a Bachelor’s degree than the statewide rate, but the percentage lags the nation.

The Study’s detailed occupational forecasts were compared to degrees and certificates awarded by regional universities and colleges. In most categories, the projected need for workers with certain skills is larger than the number of awards. Some of the most notable projected education gaps include degrees in the categories of business, management and marketing; transportation and materials moving; engineering; computer/information sciences and support; and health services and sciences.

Health & Wellness

While Midland County has experienced 28 percent growth in physicians over the past ten years, it falls behind the 39 percent growth experienced in the state. The county is experiencing a shortage of medical professionals, including primary care physicians, dentists and mental health professionals, compared to the rest of the state and nation.

The detailed forecast of demand for additional workers indicates strong growth in demand for healthcare occupations, especially registered nurses and licensed practical/vocational nurses. An estimated 922 additional workers across all healthcare fields will be needed by 2025, and 1,304 by 2030, under baseline oil price assumptions when growth and replacement needs are considered, with even more demand if prices are higher.

Quality of Place

Quality of place is critical to workforce retention and recruitment. It includes community features like entertainment and cultural amenities, parks and green space, low crime rates, restaurants and strong university enrollment.

Midland has a variety of entertainment and cultural amenities, with even more in development. Some of these include performing arts groups and facilities, museums, world-class venues and sports facilities, a planetarium, skate and BMX parks, a wildlife preserve, and acres of neighborhood, community and regional parks.

The crime rate in the City of Midland has generally fallen since 2010, though there have been fluctuations year-to-year. In general, Midland has less violent crime per 100,000 residents than Texas, though the area reported more property crime in 2017. Compared to similarly-sized metropolitan areas and the state as a whole, Midland currently employs fewer persons in protective services occupations – firefighters, detectives and police officers. Midland’s need for additional workers in this area is projected to be led by police and sheriff’s patrol officers.

Over 25 percent of new jobs demanded through 2025 and 2030 will require at least some form of postsecondary award or degree. It is projected that the area will need 14,820 workers with a bachelor’s degree through 2030. Meeting this need will necessarily involve attracting new workers from other areas of the state and nation. Nearly 70 percent of new jobs demanded will involve short-term to moderate on-the-job training.

As a center for regional business activity, the Midland economy currently employs more food service workers per 100,000 residents than many areas. Over the next few years, thousands more food preparation workers will be required.

Conclusion

Midland stands at the epicenter of an economic phenomenon of global importance. A unique combination of events has created an enormous opportunity for the Midland area. If harnessed properly, we can prepare for the challenges and ensure the opportunities benefit the full community.

Enhancing educational performance, healthcare delivery, infrastructure availability, housing options and amenities will enrich and invigorate the area with its own brand of energy and open new avenues for progress. A failure to act will sacrifice the potential bounty and leave conditions deteriorating despite the explosion in oil and gas production.

Midland-area leadership and organizations are working hard to manage the current challenges and prepare for future needs. The Study indicates these efforts are worthy of significant support given anticipated future growth.

This is the purpose of Priority Midland, a proactive initiative to mobilize the community’s commitment, help access new and creative resources, catalyze efforts to accommodate expected growth, and position Midland to fully capitalize on emerging opportunities.

Additional information on the Study can be found at prioritymidland.com. The complete study will be made available by mid-month.

About Priority Midland:

Priority Midland is an initiative designed to bring together Midland-area taxing entities and other stakeholders into a collaborative forum to provide input into the development of a roadmap for the community, increase overall funding available for projects, and reduce timeframes in which projects are started and completed. The initiative will provide a framework and blueprint to help guide Midland’s future growth and development. For more information about Priority Midland, please visit www.prioritymidland.com, and follow and connect with the initiative on Facebook, Instagram, LinkedIn and Twitter.

Midland Economic Impact Study Q&A

The Study

Q: What is the purpose of the Midland Economic Impact Study?

A: The Midland Economic Impact Study (the Study) was commissioned by Priority Midland to define the implications of Midland’s anticipated growth. Produced by economist Dr. Ray Perryman and The Perryman Group, the Study quantifies the magnitude of the expected industry, population and economic expansion, and identifies the challenges and opportunities that the energy sector’s surge presents to Midland and its residents.

Q: Why did Priority Midland commission this study?

A: Today, Midland has the fastest growing population in the nation, and that explosive growth is putting immense pressure on five interconnected areas of critical need – education, health & wellness, housing, infrastructure and quality of place. Priority Midland commissioned the Study so everyone can better understand the expected scale of Midland’s growth and transformation and make well-informed decisions about resource deployment, both to manage the challenges and capitalize on the opportunities.

Q: How much did the Study cost, and how was it paid for?

A: The Perryman Group has a Master Services agreement with Midland Development Corporation (MDC) for up to $500,000, and approximately $450,000 having been approved through the completion of the study. This amount is funding not only the study, but also multiple presentations by Dr. Perryman, an extensive electronic database, and participation in numerous meetings and strategic discussions.

The cost of the The Perryman Group’s participation is funded through the MDC’s original $4 million seeding of the Priority Midland initiative at the start of 2019. In its bylaws, the MDC is mandated with presenting to the City Council a comprehensive economic development plan for the City of Midland, to include both short- and long-term goals for Midland’s economic development. MDC’s appropriation for Priority Midland is intended to accomplish this task.

Further, the Study is emblematic of the value of MDC’s original investment in Priority Midland, with community-wide benefits and high return.

Q: Was there anything unexpected in the Study?

A: The Study certainly reinforced what we knew – that Midland is currently experiencing explosive growth, and that population growth is putting tremendous pressure on our educational system, healthcare delivery, infrastructure availability, housing options and community amenities. This is, in fact, why Priority Midland was created. What the Study defined for us was the scale and scope of the need in each area so we can make well-informed decisions as a community about where to invest, how best to use resources, what areas need additional support and how much.

New Normal

Q: What is the most important takeaway from the Study?

A: The most critical takeaway from the Study is that Midland’s explosive population growth is expected to continue for some years to come. Midland County is the most populous county in the Permian Basin Region. From 2010 to 2018, the City of Midland, with an annual increase of 3.12 percent, greatly outpaced state (+1.62 percent) and national (+0.70 percent) population growth. This expansion is expected to continue and intensify as the area adjusts to a “new normal,” and resulting workforce demand is expected to grow in all categories. The whole community will benefit if we commit to accommodating that growth.

Q: We have a history in this region of boom-bust cycles. What is different about this moment? Why is the growth expected to last this time?

A: Recent advances and developments in the energy sector have led analysts and energy companies to anticipate enormous increases in Permian Basin production over the next few years. Technological and infrastructure advances, new resource discoveries, cost reductions and global demand are widely expected to lead to more stable and less erratic industry activity. This is expected to result in:

• Less market volatility;

• Larger scale drilling programs and increased cycle times;

• More permanent workforce with high earnings; and

• Increased permanent population.

Q: In Midland’s past experience, market fluctuations have led to major consequences for the region, including consolidations, corporate headquarters exiting the market, layoffs and job reductions. Why should we not assume that will happen again?

A: It is difficult to predict future actions from individual companies, but macro-level market fluctuations and technological evolution have been anticipated in this forecast analysis. The Study does not suggest that the market will not fluctuate, but that the consequences will not be the same as in the past. It is logical to assume companies will drill more at higher oil prices, but they are far less likely than they once were to severely contract or exit the market at lower prices. We have already seen this occur, as drilling began to expand in 2016 at a price about $20 per barrel lower than was the case in 2009.

Opportunities

Q: We hear a lot about Midland’s challenges. Does this growth also bring opportunities?

A: Midland stands at the epicenter of an economic phenomenon of global importance. A unique combination of events has created an enormous opportunity for the Midland area, which is a magnet for the benefits of the surging Permian Basin energy sector. More than 85 percent of the regional gross product (value-added) in the Permian Basin oil and gas sector flows to the Midland metropolitan statistical area (MSA), and that percentage is expected to increase in the future under all the oil price scenarios.

Enhancing educational performance, healthcare delivery, infrastructure availability, housing options and amenities will enrich and invigorate the area with its own brand of energy and open new avenues for progress. If harnessed properly, we can prepare for the challenges and ensure the opportunities benefit the whole community.

Looking a few years down the road, with proper planning and investments Midland could emerge as a major hub of energy technology, water technology, and other areas that will be necessary to meet the energy needs of a growing global economy.

Our Future

Q: How will Priority Midland use this data? What are the next steps?

A: The forecasts and data provided in the Study will allow Priority Midland to work with the community to create a roadmap for the community’s future that directly correlates with the anticipated needs. In the coming weeks, we will release Priority Midland’s objectives and the strategies identified and being implemented by the passionate Midlanders in our Working Groups and on our Steering Committee.

Q: Does all of this mean we have not been doing enough to prepare for Midland’s future?

A: Midland-area leadership and organizations are working hard to manage the current challenges and prepare for future needs. The Study indicates these efforts are worthy of significant support given anticipated future growth.

Q: What if Midland does not take proactive measures to implement initiatives that accommodate continued growth?

A: A failure to act will sacrifice the potential bounty and leave conditions deteriorating despite the explosion in oil and gas production. In financial terms, inaction could potentially cost the Midland MSA $22.7 billion in gross product and 180,500 in job-years* over 2020-2030 under the baseline oil price scenario.

* A job-year is one year in one job. Thus, if an individual holds a job for five years, that equates to five job-years.

Focus Areas

Q: What is the expected impact of industry, population and economic expansion on Midland’s …

Housing

Over the past few years, growth in the energy sector has contributed to rapid growth in population and, therefore, housing demand. The tight market has led to housing shortages – particularly in lower price ranges – and higher housing prices. Midland-area home values and gross rents are higher than in other areas and have been increasing.

At baseline oil price assumptions, the expected rate of population and economic expansion leads to the need for an estimated increase of 16,207 single-family residences and 9,938 multi-family residences in the MSA by 2030. This will require a sizeable net increase over the current pace of production of both multi- and single-family homes.

One critical factor that will influence Midland’s ability to provide for the increased housing demand is the availability of construction workers. Under the baseline oil price scenario, the demand for building and specialty construction workers is expected to top 6,000 over the 2019-30 time period, competing with the oil and gas industry for workers.

Infrastructure

The expansion of the oil and gas industry has put a major strain on roadways, with traffic counts on many of the roads in the Permian Basin increasing by 65 to 150 percent between 2016 and 2017. This increased roadway usage is due to intensified commercial traffic and personal transportation use. Additionally, a greater proportion of the Midland-area population (85.4 percent) drove themselves to work compared to the state (80.6 percent) and nation (76.4 percent), while a much lower percentage took advantage of public transportation or carpooling.

The City of Midland has been building up its water infrastructure over the past decade. It has increased the miles of storm sewer by 36.2 percent and sanitary sewer by 13.4 percent since fiscal year 2010, and expanded system capacity from 51 million gallons to 55 million gallons in fiscal year 2015. However, population and industry growth projections could put substantial pressure on reserve levels, especially under high oil prices and drought conditions.

Further, Midland’s expected economic and population growth will lead to the need for additional occupied real estate (housing, industrial, warehouse, retail and office space), requiring continued expansion of roadways and water/wastewater infrastructure.

Future demand for workers in heavy and civil engineering occupations is expected to remain strong.

Education

Throughout the Midland MSA, the school-aged population is projected to grow by a total of more than 11,200 through 2025, and nearly 20,300 through 2030, under the baseline scenario. The majority of the growth will occur at the elementary school level (57.7 percent of growth through 2025, and 56.7 percent of growth through 2030).

The Study’s detailed forecast of demand for additional workers also indicates significant needs within the education system. When growth and replacement needs are considered, an estimated 919 additional workers in education occupations will be needed by 2025, and 2,248 by 2030, under baseline oil price assumptions, with even more needed if prices are higher. In particular, large numbers of postsecondary teachers, teacher assistants and elementary teachers will be needed.

The percentage of the population which has completed high school is higher in the Midland area than for the state but is somewhat below the U.S. A slightly higher proportion of people in the area have attained a Bachelor’s degree than the statewide rate, but the percentage lags the nation.

The Study’s detailed occupational forecasts were compared to degrees and certificates awarded by regional universities and colleges. In most categories, the projected need for workers with certain skills is larger than the number of awards. Some of the most notable projected education gaps include degrees in the categories of business, management and marketing; transportation and materials moving; engineering; computer/information sciences and support; and health services and sciences.

Health & Wellness

While Midland County has experienced 28 percent growth in physicians over the past ten years, it falls behind the 39 percent growth experienced in the state. The county is experiencing a shortage of medical professionals, including primary care physicians, dentists and mental health professionals, compared to the rest of the state and nation.

The detailed forecast of demand for additional workers indicates strong growth in demand for healthcare occupations, especially registered nurses and licensed practical/vocational nurses. An estimated 922 additional workers across all healthcare fields will be needed by 2025, and 1,304 by 2030, under baseline oil price assumptions when growth and replacement needs are considered, with even more demand if prices are higher.

Quality of Place

Quality of place is critical to workforce retention and recruitment. It includes community features like entertainment and cultural amenities, parks and green space, low crime rates, restaurants and strong university enrollment.

Midland has a variety of entertainment and cultural amenities, with even more in development. Some of these include performing arts groups and facilities, museums, world-class venues and sports facilities, a planetarium, skate and BMX parks, a wildlife preserve, and acres of neighborhood, community and regional parks.

The crime rate in the City of Midland has generally fallen since 2010, though there have been fluctuations year-to-year. In general, Midland has less violent crime per 100,000 residents than Texas, though the area reported more property crime in 2017. Compared to similarly-sized metropolitan areas and the state as a whole, Midland currently employs fewer persons in protective services occupations – firefighters, detectives and police officers. Midland’s need for additional workers in this area is projected to be led by police and sheriff’s patrol officers.

Over 25 percent of new jobs demanded through 2025 and 2030 will require at least some form of postsecondary award or degree. It is projected that the area will need 14,820 workers with a bachelor’s degree through 2030. Meeting this need will necessarily involve attracting new workers from other areas of the state and nation. Nearly 70 percent of new jobs demanded will involve short-term to moderate on-the-job training.

As a center for regional business activity, the Midland economy currently employs more food service workers per 100,000 residents than many areas. Over the next few years, thousands more food preparation workers will be required.

Additional information on the Study can be found at prioritymidland.com. The complete study will be made available by mid-month.