by Jesse Mullins

MIDLAND, TEXAS—A packed house greeted the speakers and panelists at the 60th Annual Meeting of the Permian Basin Petroleum Association on Sept. 29, held here as customary in the Petroleum Club downtown on Wall Street.

The all-day activities of Sept. 29 followed an evening icebreaker event held on the 28th at the sumptuous Petroleum Museum, also in Midland.

With world geopolitical events all astir and domestic politics likewise roiled by rising inflation and anti-oil sentiment, there was no shortage of fodder for discussion and dissection.

On the pages that follow we share images and highlights of the day’s events.

At the event’s conclusion, PBPA Executive Vice President Stephen Robertson summarized the proceedings with his observation that this year’s meeting was much more focused on the policy and regulatory threats that are out there for our industry.

“Often at our Annual Meeting, we highlight our members by giving several of them an opportunity to get on stage and to talk about what their

The Texas Legislative Panel, moderated by PBPA Prsident Ben Shepperd, featured panelists Tom Craddick, Former Speaker of the Texas House (seen here on the left); Representative Phil King, who sits on the House State Affairs Committee and who represents the 61st District (center); and Representative Brooks Landgraf, who chairs the House Environmental Regulation Committee and Services District 81.

opportunities and challenges,” said Robertson. “But as an industry we’ve all been under threat from so many different sources that it was really important for us this year to be able to provide different speakers that could talk about those threats and for PBPA to detail the work we are doing to fight back. So having a panel that talked about the Texas legislative and regulatory issues, the New Mexico legislative and regulatory issues, the federal issues, the economic issues and allowing Ben to discuss the actions PBPA has taken on behalf of our members… It was really important for us to get that message out to our membership and I think we absolutely were able to do that today.”

Thursday, the 29th, began with a lavish buffet breakfast that segued into the day’s first speaker, Stuart Ingle, state senator for New Mexico’s District 27.

Ingle, who has been Minority Leader of the Senate since 2001, is the most senior member of the Senate. He sprinkled his talk with much good will toward oil and gas development.

“We have in New Mexico tremendous amounts of state land,” Ingle said. “Eighty-two percent of our oil and gas comes from state land, as you all know, I’m sure, much more than I do. But it is really beneficial for us.”

Ingle remarked, tongue in cheek, that he “still has some if you all are interested in leasing any of it in Roosevelt County.” It’s available and will go cheap, he quipped.

Senator Stuart Ingle of New Mexico opened the day’s proceedings with his remarks on the political climate for oil and gas in his state.

“I want to thank you for what you do for us because your industry really is such a huge part of New Mexico…. And you folks have done a magnificent job over the years of managing it, developing it,” he said. “Hopefully this year in the House of Representatives in New Mexico… the conservative side, which is the [pro-] business side, is going to pick up some seats. We’ve had some very liberal leadership in the House of Representatives. We certainly have it in the Senate, but we don’t run [for office] this year. But the House I think is going to change its complexion a little bit. So it’s going to be beneficial to you and all of us. Because there’s times in New Mexico where we go different ways.

“And we have a governor [Michelle Lujan Grisham] that I know very well. I’ve known her for years. She came in with the Johnson Administration and she was director of Agency on Aging. Then, she went to Congress and spent 10 years up there, came back a changed person and much more liberal than she used to be. But she and I still have a very good relationship. And we do often argue. In reality, she always knows I’m right. But she’s like so many women in my life—she’s never admitted it.”

Ingle said New Mexico has so much that is good because of oil and gas. He said he hopes that New Mexicans in the communities where Permian oil interests operate will “occasionally tell you how good they have it, because you truly are the foundation of New Mexico.”

Following Ingle’s talk, Texas Railroad Commissioner Jim Wright took the podium.

Among other topics, Wright spoke about the repercussions of Winter Storm Uri, from February of 2021.

Stating that he is passionate about always being proactive instead of reactive, Wright explained how that emphasis guides his strategy in defending the industry against unfair accusations dating back to the Uri debacle.

“I knew—the day I was sitting in my house freezing with no electricity—I knew who was going to get the blame for us not having electricity and freezing in our homes. I knew exactly who was going to get that blame. It was [a problem that held too much] good potential for the side that really wants to abolish this industry, that wants to take a stab at us. And they did. They came out and said it the oil and gas industry that caused the deaths in this state.”

Remarking that that accusation could not be further from the truth, Wright began to set matters straight.

“The reality is that our electricity was cut off,” he said. “And we have these air emissions concerns, which has forced our industry now to go from natural gas driven compressors, to electrical compressors. Those are all done because of air emission concerns. Well, what happens to gas going to where it’s needed to be used when you cut those compressors off? You don’t get gas. That’s the reality of what happened to us. But that’s not the reality of what’s being imposed on us today. The reality of what’s being imposed on us today is causing us to take further winterization efforts, because the media and the uninformed public did not understand the true story there. That’s an economic impact that I don’t feel any of us should have to undergo.”But you can’t sit there and just complain, you have to have a solution, Wright said.

The PBPA’s Mike Miller, left, moderated the day’s New Mexico Legislative Panel, which featured, from left, House Member Rebecca Dow, from District 38; House Minority Leader Jim Townsend, from District 54; House Member Larry Scott, from District 62; and House Member Greg Nibert, from District 59.

“And what is the solution is for the oil and gas industry at this point, in making sure that we have fuel available for reliable electrical generation sources? Now, my answer to that has always been to do the same thing we did last year. I was so proud of the industry last winter, whenever the governor called for to convene to the State Operational Center, which we referred to as the SOC Center…. I was part of the SOC Center three different times. And what I saw you guys do was communicate, communicate to your customers, those being your electrical generators, that ‘Hey, we’ve got issues in our pipeline or we got issues over here in this production, so we’re not going to be able to do that cause we’re impeded by the weather, or whatever the situation may be.’ And it was redirected.

“The electricity was then refocused where it was generated from, [and] it worked. It worked great. So when I talk about going into the Legislature and complaining about what they imposed on us and these winterization efforts, what I’m talking about doing is saying those things. Going in and telling them that we don’t need more regulation on top of us—we solved that problem. We solved that problem last winter. We solved it by coming together and communicating. And that worked.

“Did anybody go without electricity last winter?” he asked. “Raise your hand if you did. [No hands.] That’s the same answer I get all across the state. So what we did worked, and I think the fact [to be gained] there is [that we need to] to show them what exactly we did that worked. Which was nothing more than communicate. So when you look at the potential of this future legislation, and I think you’re going to see it this year, you’re going to see where electrical generators are going to want to fight the pipelines and mandate the direction of gas. Which is going to lead to [determine] what the price of gas is.

“Did anybody go without electricity last winter?” he asked. “Raise your hand if you did. [No hands.] That’s the same answer I get all across the state. So what we did worked, and I think the fact [to be gained] there is [that we need to] to show them what exactly we did that worked. Which was nothing more than communicate. So when you look at the potential of this future legislation, and I think you’re going to see it this year, you’re going to see where electrical generators are going to want to fight the pipelines and mandate the direction of gas. Which is going to lead to [determine] what the price of gas is.

“That’s because the electrical market is a very complicated market. There’s lots of different sources that are competing for that market. Some of those are solar, some of those are wind, natural gas, coal, and nuclear. They’re all competing for their share there. Except the market today in Texas is not really set on a level playing field. So who’s going to take the fall to make sure that that reliability is there? I don’t want it to be us, the oil and gas industry. And for us not to take that fall, we’ve got to be able to go in and tell them ideas and prove to them things we did that made sure that all that worked.”

He concluded: “So I can’t stress enough, the importance, and Ben knows what I’m talking about, of being ready to walk down to Austin and going to those offices and telling that story.”

The Texas Legislative Picture

Next came the Texas Legislative Panel, moderated by PBPA President Ben Shepperd. The four panelists were Tom Craddick, former Speaker of the Texas House; Representative Phil King, who sits on the House State Affairs Committee and who represents the 61st District; and Representative Brooks Landgraf, who chairs the House Environmental Regulation Committee and serves District 81.

During this panel, which was moderated by PBPA President Ben Shepperd, the conversation turned at one point to the issue of activist investors and their attempts to hinder oil and gas interests.

Said Shepperd: “I’d like to go to Senator-elect [Phil] King. One of the things we all recognize is that activist investors have targeted the oil and gas industry. Last session you led the efforts in the House to pass the bill prohibiting the state from investing in companies that boycott energy companies. How has that process worked and unfolded since the passing of the legislation?

King remarked that the controversy is almost completely enveloped in the phenomenon that is known as “the ESG score.”

“I’m sure almost everybody here is familiar with [ESG].” King said. “Basically, if you don’t have an ESG ‘score,’ which refers to your ‘Environmental, Social, and Governance’ [status], then they [activist investors who are pushing the ESG/climate agenda] are going to limit your access to capital and [to doing] business. By the way, the very next thing they are about to do… and I mean, just about to do… is to do that at the consumer level. So when you go to buy things, maybe you go into a Ford dealership to get a new vehicle, and they’re running your credit, well, soon there’s going to be a consumer credit ESG rating there as well. They’re going to get that rating based on your ACH and your credit card expenditures. They’re going to be able to track that. So they’ll look and say, “Well, wait a minute. At Citi Bank, [it shows] you drive an F-250 and it’s diesel, and look, you’ve bought this many guns in the last four years.” All the things that are not environmentally friendly will fit into social governance, and that can go into your consumer rating. That is just right around the corner.”

Someone else on the panel remarked, “That’s horrible.” And King rejoined, “It is horrible, and I hope people will really go crazy when it becomes public that they’re doing that. Wells Fargo and all the large banks say it’s the next thing. But on any given day, Texas invests hundreds of billions of dollars, upwards of a trillion dollars, in different markets. That may be the education fund, it could be in the pension fund, in local governments that do the same. So the idea was, if many of these large investment groups are going to be boycotting the oil and gas industry, then why would we want to invest extra dollars in those? Why would we want to let a city or a county invest their dollars in that?”

King said that he and his fellow supportive legislators were not sure if the measure was going to be effective, but they have been pleasantly surprised.

“Basically, [the measure] says that if you’re, say, Blackrock and you’re boycotting the oil and gas industry or if you’re requiring your investment companies to have a ‘Net Zero’ policy or something like that, then you’re not going to be a friend of the Texas economy, and we’re not going to be a friend to you and we’re not going to invest in you.

“So far, over 100 business have been put on this boycott list. I think it’s 160-something—on [this list] the Comptroller’s established. We have Blackrock and a number of the others working at the Capitol trying to get that undone. Other states are now picking that up. We’ve got a little bit further we can go, to inch a little bit further, but apparently it’s made a much bigger impact than any of us ever thought. It just needs a little bit of tweaking here and there. But the idea was to just say, ‘Look, if you’re not going to be friendly to the largest economic driver in the State of Texas, then we’re not going to invest our $800 billion or $900 billion that we have out here every day in any of your funds, any of your companies, any of your businesses.'”

And that remark brought what was probably the best applause of the day.

The New Mexico Legislative Picture

Following a short break, activity resumed in a separate banquet hall within the Petroleum Club as a panel of New Mexico parties convened to discuss conditions in their state. Panelists included House Minority Leader Jim Townsend, from District 54; House member Rebecca Dow, from District 38; House Member Greg Nibert, from District 59; and House Member Larry Scott, from District 62. The PBPA’s Mike Miller moderated the session.

At one point Miller asked Scott about the state’s Energy Transition Act, which has encountered controversy. Scott cited the recent closure of a large plant that was a casualty of carbon-obsessed activism.

“The Energy Transition Act has a goal,” Scott said. “There’s a public call in New Mexico to be carbon-free by 2045. Net Zero. We’re in a state that produces 1.3 million barrels of oil, and billions of cubic feet of natural gas. So, the closure of that plant, the direct effect of the closure of that plant, was a loss of 1,000 jobs in Four Corners. House Appropriations Chair Patty Lundstrom has seen her Escalante car plant close. And there has come a desperate need for any kind of economic development in those areas.

“I studied some of those bills coming through energy and [one] piece of legislation [was for creating] a new cabinet-level state agency with $50 million of funding to transition New Mexico away from a fossil fuel economy. And it was based on a UNM report that was done by a group of social scientists [dedicated to] ‘clean energy.’ I read the report. And it stated that the upside potential with respect to jobs was 8,530 created with the renewable energy economy. And for that, we would have to be willing to sacrifice 130,000 high-paid jobs in the old gas industry. It just made no sense.”

Scott spoke frankly.

“My progressive colleagues in the House, I think they believe we can run the state on unicorn manure and pixie dust. But there simply aren’t adults in the room, because this magnificent industry that provides over 40 percent of the state’s budget, and that funds virtually 100 percent of the school systems in the state—well, there is no plan, there is nothing on the horizon that would substitute for that. And it’s time for us as conservatives to stand up and be the adults in the room, and to say the cost of these programs far outweigh the benefits.”

Finding Clarity Amid the Confusion

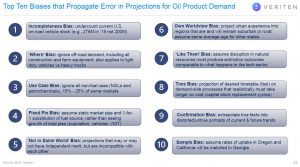

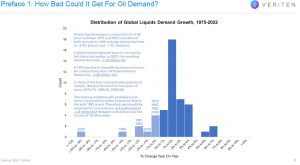

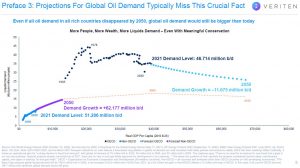

The luncheon keynote address was delivered by Colin Fenton, an analyst, forecaster, and [some would say] futurist who is a founding member and Partner/Chief Intelligence Officer for Veriten. Fenton was back by popular demand, having been a speaker here on more than one occasion.

Much of his talk focused on the macro level.

And of course inflation and [potentially] recession were topics as well.

“I believe that a recession has a very high probability of starting soon, if it hasn’t started already,” Fenton said. “And I mean north of 90 percent [probability]. So we’ll acknowledge it’s possible that we’ll still skip it, but it’s unlikely…. The worst year for demand growth for liquids, going back to 1975, was in 2020. In the Pandemic era. And that was a self-inflicted wound. Do we really need to shut down the world as badly as we did? No, that was a choice. That was a suppression, that was a global suppression. In the early stages probably justified, because we had no idea what we were doing. But as it went on and on and on, I think we can all agree, at some point enough was enough and now we’re through it.”

Continuing, he remarked that what is “most likely” to happen is as we go through the next 18 to 24 months, is that mobile liquid demand will fall by as much as two to three-and-a-half million barrels per day.

“That’s a big deal,” he said. “That is sufficient to get the oil price for West Texas Intermediate to be $65 or below. There is a prominent forecaster who has been calling for that, and that is certainly a price level that you should take seriously. However, because of the geopolitical overlay that we have in the marketplace, it is possible that even though the fundamentals are pushing that much in that direction [of demand], that supply can be in play. And there is a pretty good probability that we get weak demand behind price. That’s a scenario too, to keep in mind. So when you see… the forecast that the price could be a hundred dollars or above, there is a non-zero probability that that could prove to be right.”

The day concluded with a talk by Chris Kearney, PBPA’s Washington, D.C., consultant who is a part of the DC-based Ferguson Group. Kearney briefed members on sentiments and trends at the federal level.

All in all, organizers were pleased with the event’s results and the general tenor of the discussion and outlook. The next main gathering of the membership of the PBPA will be for the annual Top Hand banquet, which is set for Jan. 18, 2023, at the Midland Petroleum Club. Contact the PBPA (pbpa.info) for tickets or sponsorship opportunities.

PBPA Thanks Its Generous Sponsors

- Abel Oil Tools

- Caballo Loco Midstream

- CEHMM

- Chevron

- ConocoPhillips

- Continential Resources

- CrownQuest Operating, LLC

- Cudd Energy

- Diamondback Energy, Inc.

- Discovery Operating, Inc.

- Elevation Resources

- EnerVest, Ltd.

- Fasken Oil & Ranch, Ltd.

- Frost Bank

- Great Western Drilling

- H2O Midstream LLC

- Henry Resources, LLC

- Latigo Petroleum, LLC

- Lucky Family of Excellence

- Marathon Oil Corporation

- Oncor Electric Delivery

- OTA Compression

- Oxy

- Permian Resources

- Pioneer Natural Resources Co.

- Purvis Operating Co.

- Redfern & Grover Resources

- RK Supply

- Sivalls, Inc.

- Stage Completions

- Summit Petroleum LLC

- Tall City Exploration

- Tax Advisors Group

- Vencer Energy, LLC

- WaterBridge

- Weaver & Tidwell LLP

- West Texas National Bank

- XTO Energy