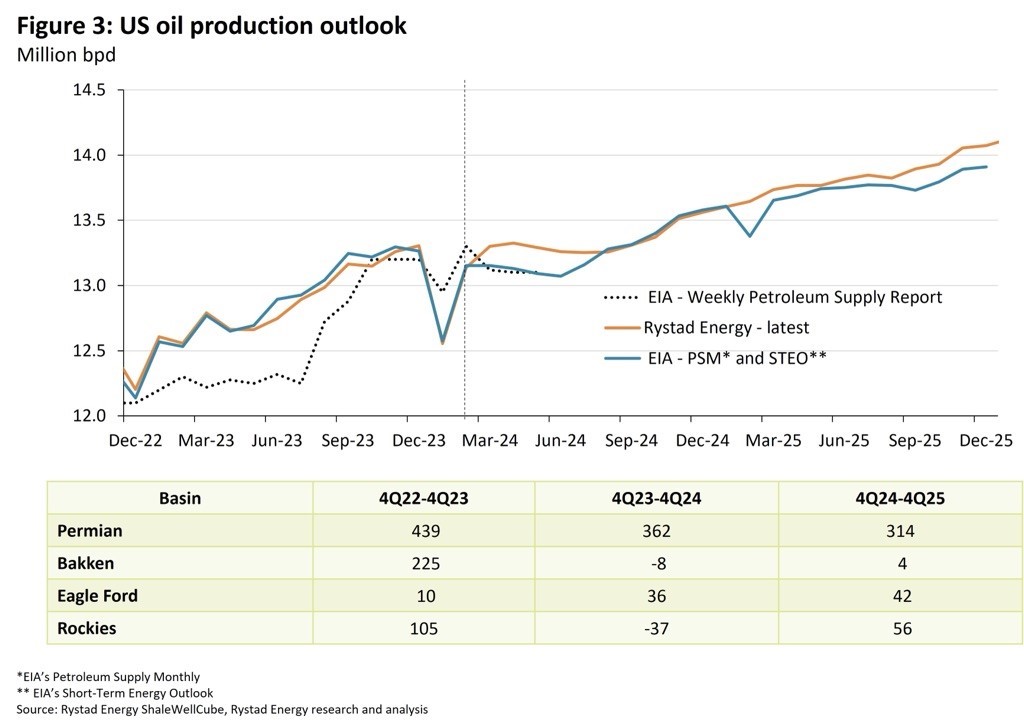

U.S. Production. Rystad Energy is out with a U.S. production forecast through 2025. Rystad Energy expects onshore U.S. Lower-48 production growth to be concentrated in the Permian. After growing

about 350K bpd between the fourth quarter of 2022 and the fourth quarter of 2023, this year Rystad Energy expects fourth quarter combined Bakken, Eagle Ford, and Rockies production to be flat year-over-year. In the Permian, however, rig counts remain supportive of growth even after trending down following several major acquisitions. The Permian looks likely to exit 2024 at 6.5 million bpd, up from about 6 million bpd earlier this year.

Power Hungry. “Texas’ ERCOT Power Needs to Nearly Double Over Next Six Years.” That was the headline. Remember when ESG first hit? Then it was a tsunami. A big tsunami. You couldn’t listen, hear, or read anything, in print, at a conference or meeting, that didn’t include ESG. If aliens would have landed, they would have thought we worship the god that was ESG, since it was the first words uttered by anyone, for some time. Now? It’s AI. Every marketing campaign for every product has touted how their business, and your satisfaction, is based on them embracing AI. AI is a chip that is significantly more complex than the previous generation of computer chips. The leading maker of AI chips just saw their market cap pass $2 trillion. Just like a computer, while there is a “chip” whose size, speed and capacity may vary, all of the other electronics are critical as well and even the manufacturing location, and then there is the software to run the chip. It is a more complex industry than just making a chip.

Headline versus Reality. U.S. utilities plan to build 133 new gas-fired power plants, and natural gas power generation is projected to increase 18 percent between 2024 through 2035.

Busy Days and Nights. In mid-May there was the Super DUG, the unconventional conference held by Hart Energy, and it was super. It was especially well attended by more than a couple thousand people. I hosted a panel of Russel Weinberg, Michael Bodino, and Stuart Weinman. The discussion was finance and funding. My question was that if no one is outspending cash flow, what is the need for lending? It was a softball. The answer? Acquisition financing. Working capital to a small degree but if I want to go buy someone, how do I pay for it, especially if I can’t offer an all-cash deal. There are a number of potential IPOs waiting in the wings, including water, compression, and E&P. We will see if the market improves. Great guys, great panel. If not private equity and banks? Family offices and diversified lenders. Granted debt was noted at 9-12 percent, which is expensive, but relative to what is for sale, maybe not. Expect the consolidation wave to continue in both large and small cap companies, and by everyone’s opinion, it should.

Headline. Men are happier at work than women, survey shows. No comment. I’m not stupid.

Quick Reversal. Tesla is rehiring some of the nearly 500 Supercharger team members Elon Musk fired in April. Super Chargers are back on the table?

Locked In? Recently ProPetro (PUMP) announced a three-year contract to supply its FORCESM electric frac fleet and other services to Exxon, who has been a big customer of PUMP’s for a decade. The company will provide two of its FORCESM electric-powered hydraulic fracturing fleets this year and a third next year, its Silvertip wireline and pump-down services and others. A three-year commitment by any oil company in the current market is impressive, but, without some term, few companies can afford to build E-fleets on spec. And that commitment has implications. As a result, PUMP has appointed Alex Volkov to its board of directors, a designee of Exxon’s. Volkov is currently the transition executive tasked with planning the integration of Pioneer Natural Resources and Exxon. Remember that in 2019, PUMP put Mark Berg on the board at the behest of Pioneer, and he will remain on the board. Nothing like starting at the top, and with the integration of boards, equipment and term contracts, the company is in a good place.

—Jim

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.