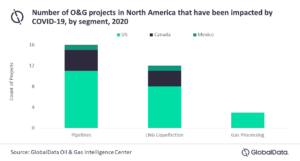

Around three quarters of North American midstream projects that have been impacted of late are in the United States, according to a Dec. 1 report from GlobalData. As a consequence, several oil and gas companies with midstream operations have had to revisit their business strategies and capex plans amid dwindling revenues. With LNG buyers’ preference shifting more towards short-term or spot contracts, bagging long-term supply contracts has become a challenge for LNG project developers. As most upcoming LNG supply projects secure financing through firm, long-term supply agreements, this has negatively impacted project finance, resulting in (FID) delays in several LNG projects, says GlobalData, a leading data and analytics company.

Haseeb Ahmed, Oil and Gas Analyst at GlobalData, comments: “The mounting uncertainty around the current economic scenario is also deterring prospective investors. One of the go-to strategies for LNG operators has been downsizing overall capital expenditure (capex) for 2020. For example, Royal Dutch Shell exited from the Lake Charles LNG project in the United States in 2020 as part of its capex reduction plans. [Meanwhile] Phillips 66 Partners has suspended additional capital spending on its Liberty Oil Pipeline project and the project has been put on hold. Withdrawing capex plans ensured that these companies had sufficient working capital, but it might dent their profitability in the long run.”

North American pipelines and LNG export projects have been the most impacted as their capex requirements are generally higher. The United States has the highest number of impacted projects in the region, including the Permian Global Access and Red Oak pipelines, as well as Driftwood and Rio Grande LNG projects.

Ahmed adds: “The sector has undergone significant losses, pushing companies to take desperate measures such as reducing capex or delaying final investment decisions (FIDs). However, these can only be short-term solutions, and, to be able to ensure future business sustainability, midstream companies need to work on long-term strategies to tackle any such future challenge.”