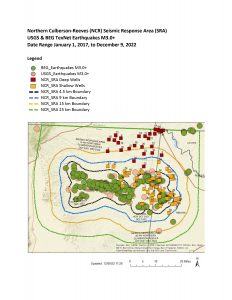

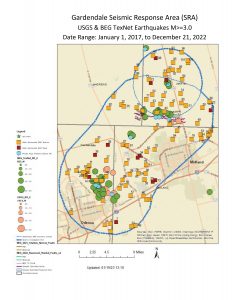

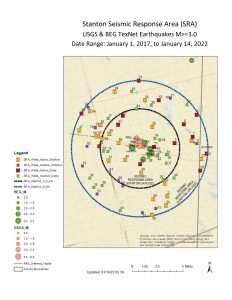

Making the jolts felt in places like Gardendale, Stanton, and northern Culberson County in recent years “leave and go away” is the goal of the Texas Railroad Commission (RRC), producers like Chevron, and others. Anthropogenic, or human-caused, earthquakes—specifically from injection activities including saltwater disposal wells (SWD) and, to a lesser extent, hydraulic fracturing, have increased to the point of great concern in recent years. The University of Texas’ Bureau of Economic Geology’s (BEG) Jackson School of Geosciences also studies seismic activity extensively.

For the purpose of analyzing and ending those tremblors, the RRC has placed three Permian Basin areas on the agency’s Seismicity Response List. Being on the list allows the RRC to place limitations on SWD injections in the area and to require more frequent monitoring of injection volumes and pressures. That data goes into the Tex Net Injection Reporting Tool database for analysis and recommendations on how to mitigate the quakes.

The Railroad Commission has also created an Operator-Led Response Plan (OLRP) for that purpose.

The areas include: Gardendale (Midland-Odessa); Northern Culberson-Reeves; and Stanton. In each, the RRC cites greatly increased earthquake activity, both in number and intensity (reaching as high as 5.4 in December 2022 in Gardendale), as being the impetus for inclusion.

In an email interview agency geoscientist Sean Averitt shared his thoughts on how the OLRP’s recommendations are faring. “Early indications are that actions taken in all Seismic Response Areas (SRAs) are effective. According to the UT-BEG TexNet’s Earthquake Catalog, Texas has not had a 4.0M or greater event since February of this year.” UT-BEG refers to the University of Texas’ Bureau of Economic Geology, which hosts the catalog.

On the program’s overall success, Averitt is encouraged. “RRC staff and industry’s time and effort dedicated to seismicity over the last few years has been significant. To show for it, we have a collaborative framework for industry and staff, new industry data and insights, and a science-based plan for responding to seismicity.”

When deciding what types of wells to control—deep or shallow—Averitt said it depends on the location’s data. “Seismicity analysis first determines if there are possible correlations with injection activities, and if so, actions will be designed to address specific conditions of a real event.”

So where is the water going that was formerly designated for these areas? Some water midstream companies with far-reaching pipeline networks are diverting it to currently tremor-free areas in Upton and Reagan counties. Averitt said that the RRC monitors all areas and will take action there should tremor activity warrant it.

When OLRP actions are successful in an area, what does that mean for the future? Will some SWD activity resume? Averitt responded, “Commission staff anticipates that, as seismicity decreases within the SRAs, some aspects of shallow injection disposal will return to prior levels. However, deep disposal is likely to remain curtailed to some degree depending on local conditions. It is important to understand that seismic events need to be studied based on the specifics of the location, e.g., depth, faults, etc.”

Chevron: The E&P’s Point of View

As one of the leading producers in the Permian, Chevron is a member of the OLRP, said Cody Comiskey, earth science advisor for the company, by email. In that role, “Chevron curtailed deep injection volumes in the Northern Culberson-Reeves SRA to less than 75,000 barrels of water per day. This represents a 75 percent reduction of our deep injection volumes in that SRA.”

Comiskey added that Chevron is “the only company voluntarily reporting daily injection volumes to the Texas Railroad Commission on a monthly basis for all of its company-operated saltwater disposal wells in the Permian.” He also noted that the company supports all reasonable efforts to collect data for monitoring and controlling tremors.

Reuse Options

As do many operators, Chevron treats and reuses more than half of its produced water for hydraulic fracturing. In 2022, said Comiskey, the recycle percentage in the Permian rose to an average of 60 percent used in that capacity, up from 45 percent the previous year.

The company is also spearheading efforts to expand the available reuse options. Comiskey said, “This year Chevron and three companies that operate in the Permian Basin formed a Joint Industry Project to pilot three desalination technologies to determine their viability for long-term beneficial reuse of treated produced water. We are also working through produced water consortiums created by Texas and New Mexico to advance solutions for the treatment and reuse of produced water generated by the oil and gas industry. We expect to see progress in development of technical capabilities and regulatory standards needed to implement large-scale reuse of treated produced water for industrial and other applications outside the oilfield. Chevron’s priority is for any beneficial reuse process implemented to protect the environment and all relevant communities.”

The hope is to find non-oil related options including agriculture use, among others.

Water reuse joins a long list of other environmental challenges faced by the energy industry in the next few years, and Comiskey noted that at this time “it is difficult to estimate how long this process will take.”

To create a level playing field, they’re looking for the creation of “clear standards for beneficial reuse of treated produced water for use outside the oil and natural gas industry.” Ideally these guidelines would enable practical and feasible systems, and would clarify standards for each type of reuse.

With development, the company looks to improve performance, enable scalability and, drive down costs.

It is noteworthy that costs to recycle water for fracturing use have already dropped drastically over the last 10 years, in many cases making it less expensive per barrel than fresh water. Therefore, in addition to reducing SWD injection rates, frac reuse also relieves demand on fresh water resources.

School’s In for Seismic Homework

Research Scientist Katie M. Smye at the BEG co-leads the Center for Injection and Seismicity Research (CISR). Her group’s studies concur that actions taken in the SRAs have already had an effect. “These changes in injection practices already appear to be having an impact: in 2022 there were an average of 205 earthquakes of M2.0+ and 18 of M3.0+ per month in the Permian Basin. In the first half of 2023, the average monthly earthquake rates were 176 of 2.0+ and 13 of M3.0+. This reduction in the earthquake rate is meaningful and is likely a direct result of action taken by operators and the RRC,” she said by email.

Location, Location, Location: How and Where Does Seismicity Happen?

One of the top research revelations involves the fact that deep injection close to the geologic basement—crystalline rocks below sedimentary section in the basins—can be a problem. This is especially true when that basement is seismogenic, or an area that hosts earthquakes, she said. Injections there are much more likely to start an event of any type, but large-magnitude events are even more common there. This is because faults in those areas are “relatively large and the host rocks are stiff.”

One of the top research revelations involves the fact that deep injection close to the geologic basement—crystalline rocks below sedimentary section in the basins—can be a problem. This is especially true when that basement is seismogenic, or an area that hosts earthquakes, she said. Injections there are much more likely to start an event of any type, but large-magnitude events are even more common there. This is because faults in those areas are “relatively large and the host rocks are stiff.”

Smye continued, “Geology plays an important role, with many large earthquake sequences in the Permian Basin falling along a basement suture zone—that is, a zone of preexisting crustal weakness. Moving injection from deep to shallow or away from seismogenic regions is likely to decrease earthquake rates.”

Whether that means completely stopping deep injections on those zones or just limiting them to lower rates and volumes is still to be determined, she said.

The other possibility, simply injecting into shallower formations, creates its own set of challenges. “Specifically, we see evidence of surface uplift of more than 10 cm in some areas of the Delaware Basin recent years due to shallow injection.” Also, pressurization of shallow zones near those wells “correlates strongly with orphaned wells that are or have been actively leaking to the surface,” Smye said.

And there is yet another “location” issue. The fact that “the formations being injected into are not the same formations fluids were removed from, mean that it presently poses the greatest risk of seismicity from oil and gas operations,” along with the massive total amounts of wastewater injected in those formations over the years.

Smaller Faults in Fracturing and Enhanced Oil Recovery (EOR)

Smye concluded with this summation of seismic connections involving two other kinds of injection.

“Hydraulic fracturing is implicated in some seismicity in the Permian Basin region—specifically the southern Delaware Basin –but the rate of these events has decreased and the magnitudes are consistently below 3.5. Enhanced oil recovery using water or gas is also causally implicated in seismicity in some areas of the Permian Basin region, but this type of operation poses less risk if reservoir pressures are maintained. However, cases of induced seismicity associated with EOR operations have implications for induced seismicity potential with large-scale CO2 injection.”

As injection rates are monitored and controlled, trackers are seeing positive effects. Plus, as Chevron’s Comiskey noted, there is a rush on to develop cost-effective treatments that would render produced water a useful commodity instead of a waste product. Once those methods are developed, questions of how much and where to inject produced water could gradually be eliminated. So Joltin’ Joe may still be here, but producers and regulators are hoping to hit a home run with their research and prevention efforts.

Paul Wiseman’s email is fittoprint414@gmail.com.