A keynote address by Bobby Tudor,

chairman, Tudor, Pickering, Holt, and Company

What follows below is the text (with slides) of Bobby Tudor’s keynote address to the Permian Basin Petroleum Association membership in its virtual (online) Annual Meeting held on Oct. 1, 2020. This transcript is presented minus a minute or so of his opening remarks, which we were unable to capture. We take up with his message as he begins explaining his first slide:

Bobby Tudor:

Regarding slide 1: Current Lay of the Land in Energy

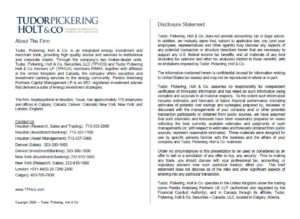

I’ve got four bullet points on the left here, basically all say the same thing, which is this: “Investor and capital sentiment towards the industry.” Nevermind what you read in the newspapers, and nevermind what you hear from politicians. Capital sentiment is very challenged. That’s driven by some broad kind of macro concerns in particular around demand and how demand is, or is not likely to bounce back from COVID. But, it’s primarily driven by what has been relatively poor returns by the industry over the course of the past decade or so. And I’m going to show you some numbers quite specific to that.

I’ve got four bullet points on the left here, basically all say the same thing, which is this: “Investor and capital sentiment towards the industry.” Nevermind what you read in the newspapers, and nevermind what you hear from politicians. Capital sentiment is very challenged. That’s driven by some broad kind of macro concerns in particular around demand and how demand is, or is not likely to bounce back from COVID. But, it’s primarily driven by what has been relatively poor returns by the industry over the course of the past decade or so. And I’m going to show you some numbers quite specific to that.

If you look on the right-hand side of the page, you’ll see that the energy weighting in the S&P500 is brought from 12% in 2010 to 2.3% today. It’s hard to overestimate how important that is, because what it means is if you’re a money manager, you can basically now afford to ignore energy and not be worried about whether it’s going to cause you to underperform the broader market. That’s actually quite a relevant fact. That’s something we hear a lot about from our investing clients all the time.

The middle section there on the right shows you what’s happened to Upstream Equity Issues in the sector and basically it’s dropped to zero. So we really haven’t had any fresh equity issues in the sector now for basically two years. And on the debt side in the lower piece, there has been debt issues, but it’s been almost exclusively to the higher quality investment grade rated companies and in quite a small group of them. So capital flows have shrunk and shrunk dramatically driven by what are macro concerns around demand and also driven by the poor returns that we’ve had as a business.

If you can flip to the next slide.

Recent Commodity Price Data Points

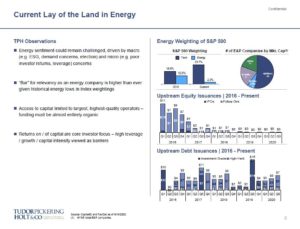

You always have to talk about the macro backdrop about the state of energy and I have oil here on top and gas on bottom. But, the bottom line is the system to work oil right now is pretty negative, which is to say, people expect us to be sort of range bound for the next five years. The gray line in the middle of there shows you the five-year forward shift on crude. And what you can see, and this is actually a week old… What you can see is it looks fairly flat. We don’t get above $50 for five years, according to the current shift. This has all kinds of implications, not the least of which is that at $47 long-term, people’s… [untapped?] inventory, or their undeveloped locations have relatively little value because of the five-year price. To get that much value we’re going to need a five-year price that’s in the low and mid 50s. And only with that five-year price in the low and mid 50s will we have a functioning A&D market and a functioning capital market.

You always have to talk about the macro backdrop about the state of energy and I have oil here on top and gas on bottom. But, the bottom line is the system to work oil right now is pretty negative, which is to say, people expect us to be sort of range bound for the next five years. The gray line in the middle of there shows you the five-year forward shift on crude. And what you can see, and this is actually a week old… What you can see is it looks fairly flat. We don’t get above $50 for five years, according to the current shift. This has all kinds of implications, not the least of which is that at $47 long-term, people’s… [untapped?] inventory, or their undeveloped locations have relatively little value because of the five-year price. To get that much value we’re going to need a five-year price that’s in the low and mid 50s. And only with that five-year price in the low and mid 50s will we have a functioning A&D market and a functioning capital market.

So, price remains quite low primarily because they’re really a very large demand concerns. And because the market generally is not yet confident about the industry’s ability or willingness to really be disciplined around the amount of growth and production that they show. Gas is a slightly different story. We’re seeing a five-year gas spike to about 250, that’s a pretty economic price. And we at TPH are actually using a longterm gas prices up to 75. But, that also has a lot of volatility around it and COVID certainly hasn’t helped there.

So we flip to the next slide.

Upstream Private Equity Observations

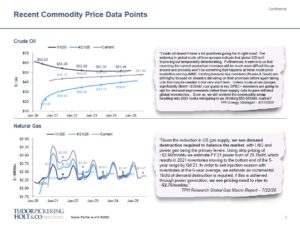

I mentioned before that a big part of our problem in the industry right now is that returns have been quite poor. I think those of you working in the Permian Basin and particularly those of you kind of living and breathing the A&D market every day know that the whole private equity world has been a really, really critical component of what’s happening in the Permian, in the past decade. And in particular, the growth that has happened in the Permian in the past decade. However, at the end of the day, the returns that have been generated via all of that investment has been quite poor.

I mentioned before that a big part of our problem in the industry right now is that returns have been quite poor. I think those of you working in the Permian Basin and particularly those of you kind of living and breathing the A&D market every day know that the whole private equity world has been a really, really critical component of what’s happening in the Permian, in the past decade. And in particular, the growth that has happened in the Permian in the past decade. However, at the end of the day, the returns that have been generated via all of that investment has been quite poor.

So if you look at the lower part of this page, these bars, what these bars show is, these are about 40 or so upstream dedicated private equity funds oriented by size. All of these are at least a billion dollars in size. If you’re a red bar, over the period of your fund you have lost money, and if you’re a green bar, you’ve made money, but in most cases you’ve made very little money. And so over here on the right, that little table shows you that if you’re in the top 25%, you’ve had an IRR of less than 10% and a multiple on invested capital of just 1.26 times. And if you’re in the bottom 25% you lost about 10% at an IRR level.

And keep in mind that the target that investors are looking for when they lock the money up in private equity funds, that it needs a 15% return net of fee. So the reason they’re looking for that return is of course because they’re giving up liquidity. Their money is tied up typically for at least 10 years. And in return for that lack of liquidity, they’re looking for higher returns and they just have not gotten higher returns. And so what that means is a lot less capital is flowing into the sector. Up on the right, the top right here, you’ll see these are new upstream private equity from business by a year, going back to 2010. And you can see that starting in about 2014, we were in a range of a hundred to 130 new commitments per year. You’ll see how that’s just fallen off the cliff. And then in 2020 year-to-date, we only have nine. So what that tells you is that private equity investors have lost confidence that the strategy that they employed in the big onshore unconventional boom, is not a strategy that will work today. [And so they have gone down]

So, flip to the next page.

U.S. Upstream A&D Market Observations

And, that has implications also for the A&D markets. 2019 is a very, very slow year, you’ll also see that… on the top right… we probably had 18 A&D transactions year-to-date. Typically it was somewhere between 80 and 150 transactions a year from 2014 to 2018. And that market is generally dried up. And it’s dried up for a couple of reasons. There’s a lot less capital available to buy things, number one. Number two, the outlook for commodity prices mean you don’t get paid for inventory. And if you don’t get paid for inventory, then you’re only getting paid for PDP, it’s very hard to get your arms around why you should sell. So, we’ve ended up with quite a large gap between buyers and sellers. Therefore the deals that have gotten done, if you look on the lower right hand side of the page, you’ll see what’s happened due to production multiples and the transactions that have in fact happened. And they’ve obviously dropped and dropped really dramatically. The commodity price backdrop is central to all that.

And, that has implications also for the A&D markets. 2019 is a very, very slow year, you’ll also see that… on the top right… we probably had 18 A&D transactions year-to-date. Typically it was somewhere between 80 and 150 transactions a year from 2014 to 2018. And that market is generally dried up. And it’s dried up for a couple of reasons. There’s a lot less capital available to buy things, number one. Number two, the outlook for commodity prices mean you don’t get paid for inventory. And if you don’t get paid for inventory, then you’re only getting paid for PDP, it’s very hard to get your arms around why you should sell. So, we’ve ended up with quite a large gap between buyers and sellers. Therefore the deals that have gotten done, if you look on the lower right hand side of the page, you’ll see what’s happened due to production multiples and the transactions that have in fact happened. And they’ve obviously dropped and dropped really dramatically. The commodity price backdrop is central to all that.

On the left hand side of the page though, in the bottom part of it, the bottom three bullet points, I make reference to kind of the change in strategy that you’re seeing, which is that private capital is more attracted to just PDP focused or income focused deals. Whether they feel they can get their return via distributions over time, instead of depending on the A&D markets to pay a multiple for inventory. So, what’s become interesting is the capital that is out there is, free cashflow generating businesses often [are actually in] conventional production, but even if it’s from tight oil, it needs to be free cashflow generative so that the capital can be returned to investors. And then they can get their return.

Next page please?

Drilling Down in the Permian

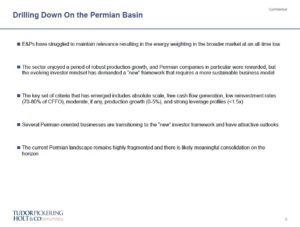

So, let’s talk a little bit more specifically about the Permian. I’ve already kind of laid out these top two bullet points, which is that E&Ps are struggling to maintain their relevance due to the energy weighting in the broader index. The sector really enjoyed a period of very robust production growth, and Permian companies were in particular rewarded for that. Right in the middle of it. And I’ll show you a chart in a bit that shows what happened at Permian production over time. But given that returns turned out to be so poor, we have a new kind of set of criteria that’s emerged that is being required of the companies, and that is they need absolute scale. They need to generate free cash flow. They need to have lower reinvestment rates, which is to say about 70 to 80% of cashflow from operations. They lost more moderate growth, if any, so call it zero to 5%, and then much lower leverage on the company.

So, let’s talk a little bit more specifically about the Permian. I’ve already kind of laid out these top two bullet points, which is that E&Ps are struggling to maintain their relevance due to the energy weighting in the broader index. The sector really enjoyed a period of very robust production growth, and Permian companies were in particular rewarded for that. Right in the middle of it. And I’ll show you a chart in a bit that shows what happened at Permian production over time. But given that returns turned out to be so poor, we have a new kind of set of criteria that’s emerged that is being required of the companies, and that is they need absolute scale. They need to generate free cash flow. They need to have lower reinvestment rates, which is to say about 70 to 80% of cashflow from operations. They lost more moderate growth, if any, so call it zero to 5%, and then much lower leverage on the company.

So, what’s happening is that the Permian oriented businesses are transitioning to this new investor framework. You ultimately have to answer to shareholders and that’s what the shareholders want, and that’s what Permian companies are doing. And several of them are well on their way in that regard. That being said, the Permian landscape remains really, really highly fragmented. There are tons of companies out there and in our view, there’s likely meaningful consolidation on the horizon in the Permian, as investors get more and more focused on G&A per barrel and the need to drive down costs in order to generate cashflow.

So, if you look to the next page,

Total Returns

These are total returns for three groups. One is the mega cap companies. That’s kind of a lighter blue color. The darker one is the broader E&P index. And then the red line is the Permian index. And the Permian index [is] really the Permian focused independents. And what you can see is that the Permian index was really the champion during those go-go years. This just goes back to 2015, but in 2015, until March of 2018, the Permian based-and-oriented companies dramatically outperformed everything else. When commodity prices fell out of bed, money rushed to safer investments, which tended to be larger cap integrated companies or the biggest companies in the group. And you can see, since that point, the bigger companies have really kind of dramatically outperformed. So those are [unintelligible] scale. And the Permian companies have underperformed. I think importantly, in all three groups, if you invested a dollar in September of 2015, you’d have less than a dollar today. And in the case of the broader E&P index, you’d have about 50%. And in the case of Permian companies, you’d have about 60 cents on the dollar. So, it’s just been a very, very tough investing environment.

These are total returns for three groups. One is the mega cap companies. That’s kind of a lighter blue color. The darker one is the broader E&P index. And then the red line is the Permian index. And the Permian index [is] really the Permian focused independents. And what you can see is that the Permian index was really the champion during those go-go years. This just goes back to 2015, but in 2015, until March of 2018, the Permian based-and-oriented companies dramatically outperformed everything else. When commodity prices fell out of bed, money rushed to safer investments, which tended to be larger cap integrated companies or the biggest companies in the group. And you can see, since that point, the bigger companies have really kind of dramatically outperformed. So those are [unintelligible] scale. And the Permian companies have underperformed. I think importantly, in all three groups, if you invested a dollar in September of 2015, you’d have less than a dollar today. And in the case of the broader E&P index, you’d have about 50%. And in the case of Permian companies, you’d have about 60 cents on the dollar. So, it’s just been a very, very tough investing environment.

Next slide please.

What Investors Care About

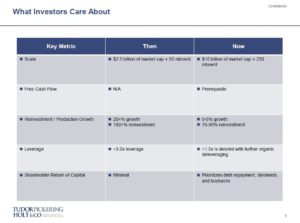

So if you ask, what do investors now care about? Well, it used to be that “scale” meant, well, call it two and a half billion dollars of market cap and about 50,000 barrels a day. Today it means 10 billion the market cap in 250,000 barrels a day. Free cash flow… well, back then didn’t matter so much to many. Today is a prerequisite. I mentioned the difference in reinvestment rates and production growth. We’re now looking for much lower production growth levels and much slower reinvestment rates, much lower leverage. And then ultimately the prioritization of shareholder return of capital through dividends to share buybacks and… debt repayment as well. So, what the point here is, is what investors want has fundamentally changed.

So if you ask, what do investors now care about? Well, it used to be that “scale” meant, well, call it two and a half billion dollars of market cap and about 50,000 barrels a day. Today it means 10 billion the market cap in 250,000 barrels a day. Free cash flow… well, back then didn’t matter so much to many. Today is a prerequisite. I mentioned the difference in reinvestment rates and production growth. We’re now looking for much lower production growth levels and much slower reinvestment rates, much lower leverage. And then ultimately the prioritization of shareholder return of capital through dividends to share buybacks and… debt repayment as well. So, what the point here is, is what investors want has fundamentally changed.

If you look on the next slide…

Upstream Company Businesses with Permian Exposure

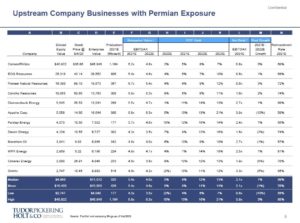

You have here the list of all the largest companies with Permian exposure. And what you’ll see is that if you look on the far left hand column, column B, I mentioned before investors want scale, well, we only have four companies actually with equity value of $10 billion or more. But some of the larger companies like Parsley or Apache or Diamondback or Devon or WPX, they all have market caps of $5 billion or less. And I would argue that was one of the main drivers for the Devon /WPX deal that just got announced. Scale is getting increasingly important to investors.

You have here the list of all the largest companies with Permian exposure. And what you’ll see is that if you look on the far left hand column, column B, I mentioned before investors want scale, well, we only have four companies actually with equity value of $10 billion or more. But some of the larger companies like Parsley or Apache or Diamondback or Devon or WPX, they all have market caps of $5 billion or less. And I would argue that was one of the main drivers for the Devon /WPX deal that just got announced. Scale is getting increasingly important to investors.

We don’t need to spend a lot more time on this page, but it will just show you what has happened in particular on the growth front. So if we go to column M over on the far right-hand side, you can see that the year over year projected production growth for these companies is actually quite small, right? It’s basically flat in the aggregate with a low being down 10% and the high being up only 3%. So that tells you that the companies, because they’ve gotten this direction from investors, they’re a lot less focused on growth and a lot more focused on generating free cash that can be returned to investors. Now, part of the problem here is… it’s where commodity prices are, right? Because to generate free cash at $40 WTI doesn’t allow much money to invest in growth. And that just happens to be where we are at the moment.

If you flip to the next page…

16:51:

Permian a Key Driver

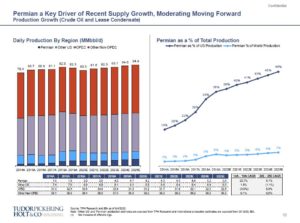

You will see that the Permian has been a key driver of recent supply growth. Though it’s more moderate going forward, it’s still meant to be quite substantial, actually. So if you look on the lower part of the page on the table, it’ll show you the Permian, we’re showing 4.2 million barrels out of the Permian in 2020, and that’s compared to 1.6 million barrels in 2014. So as all of us know, the Permian has just had a fantastic growth story for the industry. It’s just amazing what you guys collectively have done, and a fantastic story for the industry and for global energy security, for sure. And we’re actually suggesting that the Permian will continue to grow. So, we’re showing 5.6 million barrels out of the Permian in 2025.

You will see that the Permian has been a key driver of recent supply growth. Though it’s more moderate going forward, it’s still meant to be quite substantial, actually. So if you look on the lower part of the page on the table, it’ll show you the Permian, we’re showing 4.2 million barrels out of the Permian in 2020, and that’s compared to 1.6 million barrels in 2014. So as all of us know, the Permian has just had a fantastic growth story for the industry. It’s just amazing what you guys collectively have done, and a fantastic story for the industry and for global energy security, for sure. And we’re actually suggesting that the Permian will continue to grow. So, we’re showing 5.6 million barrels out of the Permian in 2025.

Bobby Tudor:

So it’s not as if we think the Permian is going to fall off the cliff. It’s not. The growth rate is going to moderate. And part of the question becomes, who generates it? Does it become a lot more concentrated and fewer and fewer companies? And we think actually that it’s likely that there will be pretty meaningful consolidation around companies in the Permian and the larger companies will be the consolidators. And that’s for the reasons that we’ve been talking about, access to capital, the market’s demanding scale and return of capital. And for smaller companies, that’s just a very, very hard thing to do.

Let’s flip to the next page.

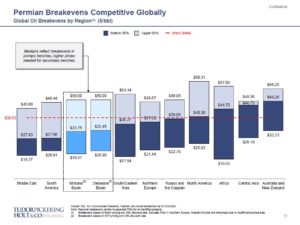

Permian Breakevens

This is another bright point in the story. And what this tells you is that the Permian Basin breakevens are competitive globally, and basically as good as just about anything other than perhaps the very best of the Middle East and the very best of South America. But, generally speaking, the Permian is highly, highly competitive. And so our view would be that where you sit on the cost curve really, really matters, and the Permian sits in a good place, at least the best parts of the Permian sit in a good place. And we can tolerate oil prices at 40 to $45 and still see some moderate growth out of the Permian over time.

This is another bright point in the story. And what this tells you is that the Permian Basin breakevens are competitive globally, and basically as good as just about anything other than perhaps the very best of the Middle East and the very best of South America. But, generally speaking, the Permian is highly, highly competitive. And so our view would be that where you sit on the cost curve really, really matters, and the Permian sits in a good place, at least the best parts of the Permian sit in a good place. And we can tolerate oil prices at 40 to $45 and still see some moderate growth out of the Permian over time.

So what this chart tells you is the Permian competes very effectively globally. Capital, to the degree any capital flows to the industry, and it HAS to flow into the industry, because, given a time when capital doesn’t flow in, we’re setting up for some very, very large price hikes. But, that capital that does flow in is going to be reasonably concentrated in the Permian Basin because you guys have got the best rock. You got the best rock, you’ve got the best infrastructure, you got the best regulatory environment. And for all those reasons we think the Permian Basin will continue to compete very effectively.

If you flip to the next page…

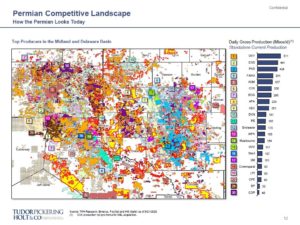

Permian Competitive Landscape

This is just a quick look at how the Permian looks today. And on the right hand side, you can see daily gross production by operator. And this map, it’s not as possible to read with so many colors and small boxes, but that’s actually the point. The point is that it is a highly, highly fragmented basin, much more fragmented than any other producing basin in the US, and for that matter it’s more fragmented than any producing basin in the world. And one of the scary things to think about, and one of the things investors don’t like is that if you can think about all the G&A per barrel that these companies represent on this map, is an awful lot of G&A per barrel, and would imply that a lot of efficiencies can be wrung out via consolidation.

This is just a quick look at how the Permian looks today. And on the right hand side, you can see daily gross production by operator. And this map, it’s not as possible to read with so many colors and small boxes, but that’s actually the point. The point is that it is a highly, highly fragmented basin, much more fragmented than any other producing basin in the US, and for that matter it’s more fragmented than any producing basin in the world. And one of the scary things to think about, and one of the things investors don’t like is that if you can think about all the G&A per barrel that these companies represent on this map, is an awful lot of G&A per barrel, and would imply that a lot of efficiencies can be wrung out via consolidation.

And so if you’ll flip to the next page…

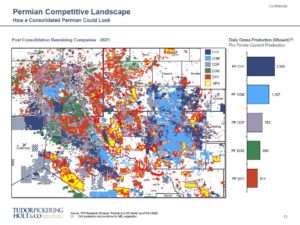

Permian Competitive Landscape – How a Consolidated Permian Could Look

You can see what the colors would look like in a much more consolidated world where, we picked Chevron, Exxon, Conoco-Phillips, EOG, and Oxy, the leading technology leaders of the basin. And this is obviously kind of big on numbers, it’s not at all clear that when consolidation happens, if it happens, that it will look like this. So, the point is, the G&A per barrel picture would look very, very different in the highly consolidated Permian Basin. And our expectation is that in fact, that’s what’s likely to happen over the course of the next several years.

You can see what the colors would look like in a much more consolidated world where, we picked Chevron, Exxon, Conoco-Phillips, EOG, and Oxy, the leading technology leaders of the basin. And this is obviously kind of big on numbers, it’s not at all clear that when consolidation happens, if it happens, that it will look like this. So, the point is, the G&A per barrel picture would look very, very different in the highly consolidated Permian Basin. And our expectation is that in fact, that’s what’s likely to happen over the course of the next several years.

If you flip to the next page….

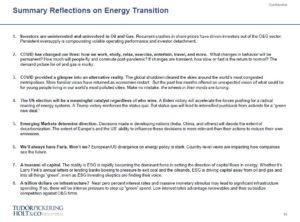

Summary Reflections on Energy Transition

I was asked to say just a few things about energy transition and ESG. And I’ve got over the course of these next few pages I’ve got what I call 14 bullet points, and I’m not going to go through every bullet point. I’m happy to share all of these slides with all of you. And the PBPA is free to distribute these to all of you, as far as I’m concerned, and you can read them at your leisure. So it’s a handful of comments I’d like to make about ESG. Clearly is affecting capital flows into the business.

I was asked to say just a few things about energy transition and ESG. And I’ve got over the course of these next few pages I’ve got what I call 14 bullet points, and I’m not going to go through every bullet point. I’m happy to share all of these slides with all of you. And the PBPA is free to distribute these to all of you, as far as I’m concerned, and you can read them at your leisure. So it’s a handful of comments I’d like to make about ESG. Clearly is affecting capital flows into the business.

Now, in my view, it is not affecting capital flows into the business as much as poor returns for effecting capital flow into the business. The bigger issue is poor returns. I have a friend who says “The industry problem is more red than it is green.” Which is to say, the lack of profitability that the industry has generated in the past decade versus ESG pressures that are driving the exodus of capital. That being said, ESG does matter. It is clearly an issue that investors, broadly speaking, have become more focused on. And it’s an issue, therefore, that energy companies have become more focused on. And I think all that is actually quite healthy. I think the industry, the upstream industry in particular, it is responding and responding appropriately, which is to say working very hard to lower their own part of the footprint to make their operations cleaner. And to be viewed as partners in driving towards lower global CO2 emissions, as opposed to being a hurdle, I guess, in driving toward lower CO2 emissions. So, we’re on our way.

That being said, what’s very clear is that at the end of the day, emerging markets really determine the outcome, here because that’s where the global ambition lies. It doesn’t lie in the US. And while what we do in the U.S. and Europe matters on the margin, what really matters is what kind of influence we’ll have over what goes on in China, in India, and in much of the developing world. It is also clear that there’s a tsunami of capital that is flowing into all things, quote, ESG related. I’m kind of cynical about that because my view is it’s flowing in because the big capital aggregators have figured out that’s a way for them to raise money and they’re doing it. Whether it ultimately will result in higher return for their investors, I think very much remains to be seen.

Go to last slide: Summary Reflections on Energy Transition (2)

But, I would say that the fact that globally, and certainly in the U.S. and in Europe, the general populace believes that the climate change is a real present danger and that we need to lower global emissions, and that is driving behavior. And then, ultimately, I think it’s going to result in [unintelligible] emissions, which I think we can all agree… would be a good thing for the world. The question of course is how do we provide affordable energy to the world while we are in this period of trying to do it at a much cleaner, lower CO2. It’s a big challenge. And I think it’s really, really critical that the energy industry, the US energy industry, is that upstream in particular be seen as partners in helping to drive to lower emissions, as opposed to increased. And I do think we’re on the right path there. I think there’s a very long slow path because of the nature of this transition is that it’s extraordinarily difficult to do it without real breakthroughs in technologies to drive down cost.

But, I would say that the fact that globally, and certainly in the U.S. and in Europe, the general populace believes that the climate change is a real present danger and that we need to lower global emissions, and that is driving behavior. And then, ultimately, I think it’s going to result in [unintelligible] emissions, which I think we can all agree… would be a good thing for the world. The question of course is how do we provide affordable energy to the world while we are in this period of trying to do it at a much cleaner, lower CO2. It’s a big challenge. And I think it’s really, really critical that the energy industry, the US energy industry, is that upstream in particular be seen as partners in helping to drive to lower emissions, as opposed to increased. And I do think we’re on the right path there. I think there’s a very long slow path because of the nature of this transition is that it’s extraordinarily difficult to do it without real breakthroughs in technologies to drive down cost.

Bobby Tudor:

I remind my friends that in the Obama administration, U.S. onshore production went from 4 million barrels to 8 million barrels, even though clearly the Obama administration was not friends, if you will, with the US upstream business and US upstream onshore business in particular. And the reason that production went from 4 million barrels to 8 million barrels is that the technology and the economics of it drove it, and the capital was available to do it. So, my view would be that we need to continue to have improvements… And if that comes, those sorts of businesses will take share. And until those economics improve, they’re unlikely to take that share. So will the industry continue to be under pressure on ESG related issues? Yeah, I think it will be continued to be under pressure, but I think that that pressure could be very effectively met by companies being very clear about what they’re doing with their oil operations to make them cleaner.

There are some people – some politicians, and a segment of the general public – that you’re never going to make happy. They’re only going to be happy, or they think they’re going to be happy, with you as the oil and gas business goes out of business. We all know that that is not happening. It’s certainly not happening in our lifetimes because the world needs what we’re doing. And in particular, the world needs what was the Permian Basin is doing. So we believe that there is a bright outlook for the Permian Basin. It’s likely to be different at the end of the day, than all of us are expecting. But, you’ve got great jobs, you’ve got great people, you’ve got great companies, you’ve got a great regulatory environment, you’ve got low break evens. The Permian Basin will continue to be a really, really critical part of the world’s global energy.