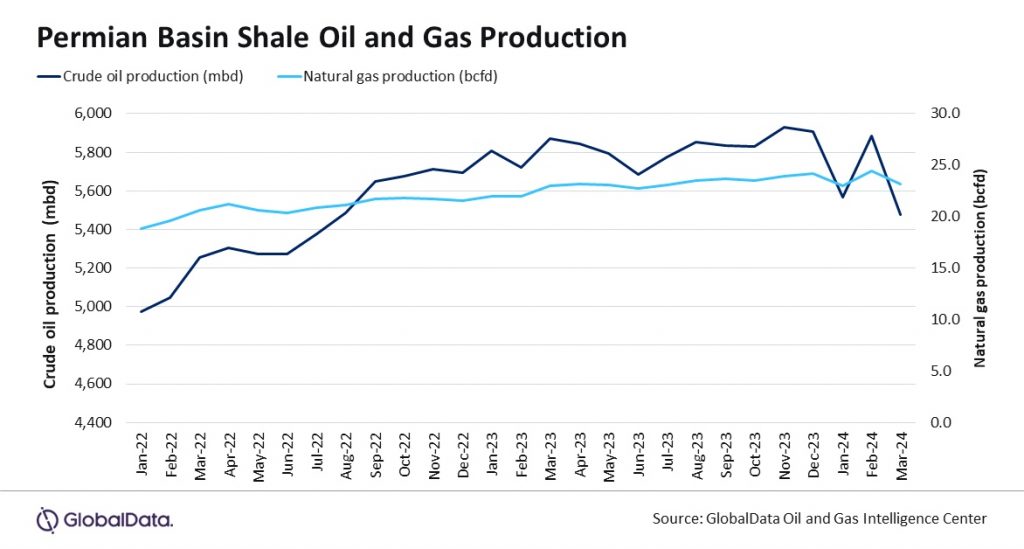

The global oil demand has been on the rise after the COVID-19 pandemic. Moreover, the Russia-Ukraine conflict caused major alterations in energy supply routes, which went in favor of U.S. shale drillers, including those in the Permian Basin. The Permian Basin remains the largest oil-producing shale play in the United States. Strong global demand and geopolitical shifts continue to support growth and competitiveness of this critical energy region, according to GlobalData, a data and analytics company. In a report issued July 16, GlobalData revealed that the crude oil production in the Permian Basin, benefiting from a dense pipeline network and Gulf Coast infrastructure, averaged 5.6 million barrels per day (mmbd) during the first quarter (Q1) of 2024.

Ravindra Puranik, Oil and Gas analyst at GlobalData, commented: “Europe’s strategic shift away from Russian energy exports has resulted in key changes to the global energy supplies. This is anticipated to benefit the U.S. shale oil and gas drillers as well as LNG producers that are positioned to reap from these evolving supply chain dynamics. The US shale oil production might also benefit from the Red Sea crisis that has added a risk premium to ship-based exports from the Middle East to Europe.”

The U.S. presidential election looms this year amid high inflation concerns, hence the presidential nominees are unlikely to pledge any new regulatory measures on shale drilling. This could bode well for the outlook for unconventional resource development in the country.

Puranik continued: “Recessionary pressures in major world economies, along with geopolitical headwinds, such as the Gaza conflict and its wider implications on energy supplies from the Middle East, are expected to keep the oil prices range bound this year.”

The merger and acquisition (M&A) activity in the Permian Basin is set to make the market more competitive in the long-term. On the drilling front, the permit activity in the shale play grew marginally for the first two quarters of 2024 as compared with the same period in 2023, indicating largely flat growth in hydrocarbon output.

Puranik concluded: “Exxon Mobil’s acquisition of Pioneer Natural Resources was the biggest deal in the Permian Basin shale play in the recent years. The deal worth $64.5 billion has put ExxonMobil on the top of the pedestal, surpassing competitors in this play, such as Occidental and Chevron. Continued investment and strategic acquisitions in the Permian Basin will be essential to maintaining its leadership in the US shale industry, especially as global energy dynamics shift and demand for reliable oil and gas supplies remains strong.”