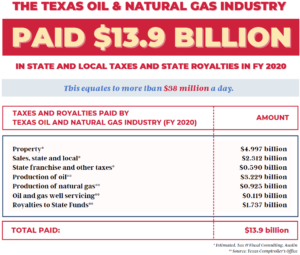

According to just-released data from the Texas Oil and Gas Association, the Texas oil and natural gas industry paid $13.9 billion in state and local taxes and state royalties in fiscal year 2020, funds that directly support Texas schools, teachers, roads, infrastructure, and essential services. TXOGA President Todd Staples hosted a media briefing recently to share the Association’s Annual Energy and Economic Impact Report and outline a policy Roadmap to Recovery ahead of the 87th Texas Legislature that was to convene in January.

“Even in an extremely difficult year, the Texas oil and natural gas industry continues to contribute tremendously to state and local tax coffers, while fortifying our energy security and leading the way in innovation and investment that is advancing environmental progress,” said Staples. “The ongoing recovery of the oil and natural gas industry is essential to the state’s continuing economic improvement.”

Staples noted that the pandemic reinforced the fact that oil and natural gas are essential and irreplaceable.

“While oil prices plummeted in the wake of the pandemic, the need for products made from oil and natural gas skyrocketed. Nearly every in-demand product we need to be safe, to save lives and to power our economy—from face shields and hand sanitizers to high-speed internet connections and computers—is made possible by oil and natural gas,” he said.

Staples detailed how oil and natural gas tax and royalty revenue is used to support education, transportation, healthcare, and infrastructure through the Economic Stabilization Fund (commonly known as the Rainy Day Fund), the Permanent School Fund (PSF), and the Permanent University Fund (PUF)—all of which are funded almost exclusively with taxes and state royalties paid by the oil and natural gas industry.

In 2020, 99 percent of the state’s oil and natural gas royalties were deposited into the Permanent School Fund and the Permanent University Fund, which support Texas public education. The PUF received $771 million and the PSF received $942 million. The Rainy Day Fund received $1.657 billion from oil and natural gas taxes.

In 2020, Texas school districts received more than $2 billion in property taxes from mineral properties producing oil and natural gas, pipelines, and gas utilities. Counties received $688.4 million in these property taxes.

Property tax totals for each county

Property tax totals for each ISD

Some counties and ISDs saw dramatic increases in oil and natural gas property tax revenue in 2020. Pecos-Barstow-Toyah ISD in West Texas ranked #1 receiving $167.6 million from mineral properties producing oil and natural gas, pipelines, and gas utilities – an increase of 53 percent from fiscal year 2019. Reeves County ranked #1 with $74.5 million paid in oil and natural gas property taxes—an 80 percent increase from last year.

In addition to its economic impact, Staples noted that the oil and natural gas industry has taken the lead in developing environmental solutions that are working to reduce emissions and flaring.

“The oil and natural gas industry is the nation’s leading investor in emission-reducing technologies and as a result, Americans are breathing the cleanest air in decades, the United States leads the world in reducing energy-related carbon dioxide emissions and methane emissions from oil and natural gas systems are down 23 percent since 1990,” he said.

According to data from Railroad Commission of Texas, the percentage of natural gas flared out of all the natural gas produced in Texas decreased 80 percent between June 2019 and May 2020. The Commission announced that less than one half of one percent of the natural gas produced in Texas was flared or vented, as of May 2020. 99.5 percent of natural gas produced went to beneficial use.

“All this, while the United States enjoys more energy security than ever before and American-made energy is powering economic prosperity and environmental improvements around the world,” said Staples. “This progress—and ways to build on it—must be part of more rational discussions about the future of our energy, the environment, and the economy.”

In closing, Staples detailed a three-part policy Roadmap to Recovery “to drive greater investment in all aspects of the oil and natural gas industry that will power Texas’ economic recovery and provide critical state and local tax revenue every Texan needs.”

First, TXOGA is urging lawmakers to ensure continued, responsible development of the essential energy infrastructure that is needed to meet the demands of our booming population. “Every Texan relies on electric transmission lines, roads, high-speed internet, drainage and flood control, and pipelines for water, oil, natural gas, and transportation fuels, and the expansion of this infrastructure is essential to the state’s continued growth and success,” Staples said.

Staples said the Legislature should also embrace smart tax policy such as renewing the economic development program known as Chapter 313, which attracts investments and jobs to Texas, and resisting calls to increase severance taxes on an industry that pays 6.3 times more in taxes on a per job basis than the average of the rest of the private sector.

Finally, TXOGA is urging lawmakers to maintain their commitment to science-based policy and rational discussions related to environmental issues, with the leading oil and natural gas innovators at the table.