Wherein we share some O&G news from beyond the Permian’s borders—news that, in some way, touches the Basin.

Energy Information Administration (EIA)

June 29

Favorable investment terms led to Colombia’s crude oil production doubling within the past 10 years, reaching 1 million barrels per day (b/d) in 2013. However, the drop in global crude oil prices since mid-2014 has led to a slowdown in drilling activity and in new investments. As a result, Colombia’s oil production has been stagnant at 1 million b/d in recent years, and its production is expected to remain flat in upcoming years.

***

Stripper wells, or wells that produce small volumes, represent an important but decreasing share of total U.S. oil and natural gas production. These wells are characterized as producing no more than 15 barrels of oil equivalent per day (boe/d) over a 12-month period. EIA estimates that there were about 380,000 stripper oil wells (so called because they are stripping the remaining oil out of the ground) in the United States operating at the end of 2015, compared to about 90,000 non-stripper oil wells.

June 28

Azerbaijan is one of the world’s oldest oil producers, and oil and natural gas production and exports are central to Azerbaijan’s economy. Azerbaijan’s oil production has been relatively stable over the last few years, but oil revenues declined about 40 percent from 2014 to 2015 due to lower oil prices. Natural gas production and exports will increase significantly in the coming years as the Stage 2 development of the Shah Deniz natural gas and condensate field will more than double Azerbaijan’s natural gas exports by the end of the decade.

June 27

Proposed fuel economy and greenhouse gas emissions standards would increase fuel economy and reduce diesel consumption in medium and heavy-duty vehicles. Unlike light-duty vehicles, which have been subject to fuel economy standards since the 1970s, the first phase of medium and heavy-duty vehicle standards was recently implemented, starting with model year 2014. The proposed Phase 2 standards—issued jointly by the U.S. Environmental Protection Agency and the National Highway Traffic Safety Administration—would take effect in model year 2021 for most medium and heavy-duty vehicle classes and increase in stringency through model year 2027. These standards are projected to reduce diesel consumption by 0.5 million barrels of oil equivalent per day by 2040.

June 23

On June 26, the Panama Canal Authority, the body that operates the Panama Canal, will inaugurate a third set of locks, which will allow for the transit of larger ships. This is the first such expansion since the canal was completed in 1914. With the exception of U.S. propane exports, the expansion of the Panama Canal is not likely to drastically affect crude oil and petroleum product flows.

***

Key points from EIA’s Issues in Focus brief:

- The most significant effect of the Phase 2 Standards is a reduction of diesel consumption—the most commonly used fuel—in medium and heavy-duty vehicles, which is 18 percent lower by 2040 than in EIA’s reference case.

- As the average fuel economy of conventional vehicles increases in the Phase 2 Standards case, there is also less incentive to pay high capital costs for natural gas and propane vehicles despite their lower fuel costs, and there is a shift away from natural gas and propane toward conventional diesel and gasoline fuels.

- Cumulative CO2 emissions from 2021-to-2040 in the transportation sector are 1,200 million metric tons (3 percent) lower in the Phase 2 Standards case than in the EIA’s reference case. In 2040, total transportation sector CO2 emissions are 6 percent lower in the Phase 2 Standards case than in the Reference case.

June 22

From September 2015 to March 2016, the United States added 34 million barrels (6 percent) of working crude oil storage capacity, the largest expansion of commercial crude oil storage capacity since EIA began tracking such data in 2011… Despite the large expansion in crude oil storage capacity, the net effect of capacity growth and increased inventories resulted in high storage utilization rates. Storage utilization at Cushing, Okla., averaged 87 percent over the past four weeks (for the week ending June 10), compared with 81 percent for the same period last year. U.S. Gulf Coast region storage utilization rates averaged 72 percent over the past four weeks (for week ending June 10), after never being more than 70 percent in the previous four years.

June 15

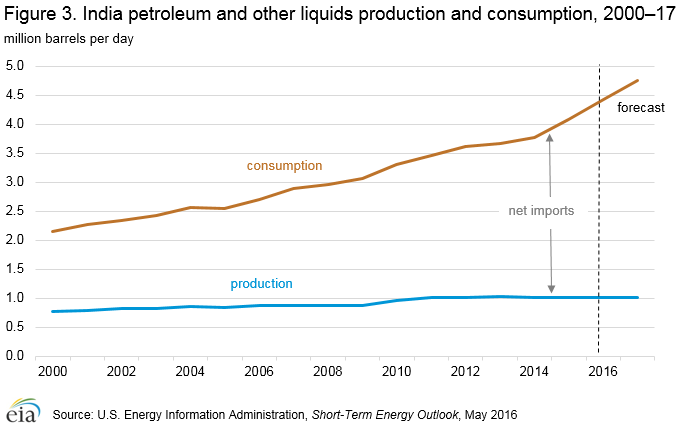

India was the fourth-largest consumer of crude oil and petroleum products after the United States, China, and Japan in 2015, and it was also the fourth-largest net importer of crude oil and petroleum products. The gap between India’s oil demand and supply is widening, as demand in 2015 reached nearly 4.1 million barrels per day (b/d), compared to around 1 million b/d of total domestic liquids production. EIA expects demand to accelerate in the 2016 through 2017 timeframe as India’s transportation and industrial sectors continue to expand under economic development, oil price declines since mid-2014, and recent government policy initiatives to increase highway and road infrastructure and promote Indian manufacturing.

June 9

Unplanned global oil supply disruptions averaged more than 3.6 million barrels per day (b/d) in May 2016, the highest monthly level recorded since EIA started tracking global disruptions in January 2011. From April to May, disruptions grew by 0.8 million b/d as increased outages, largely in Canada, Nigeria, Iraq, and Libya, more than offset reduced outages in Kuwait, Brazil, and Ghana. Along with other factors such as rising oil demand and falling U.S. crude oil production, the rise in disruptions contributed to a month-over-month $5 per barrel increase in Brent crude oil spot prices in May.

June 8

The United States added 34 million barrels (6 percent) of working crude oil storage capacity from September 2015 to March 2016, the largest expansion of commercial crude oil storage capacity since EIA began tracking such data in 2011 (Figure 1). At the same time, reported weekly U.S. commercial crude inventories have increased by more than 72 million barrels (16 percent) since September, which implies crude oil storage capacity utilization at a record high of 74 percent for the week ending June 3.

***

While evacuees from the ongoing fires in Fort McMurray have begun to return to the city, a state of emergency remains in place throughout Alberta, Canada, and the temporary shutdown of the area’s oil sands production sites continues. EIA estimates that disruptions to oil production averaged about 0.8 million barrels per day (b/d) in May, with a daily peak of more than 1.1 million b/d. Although projects are slowly restarting as fires subside, it may take weeks for production to return to previous levels. EIA expects disruptions to average 400,000 b/d in June.

June 7

Adam Sieminski’s Short-Term Energy Outlook (STEO):

Gasoline/Refined Products:

“Even with higher crude oil prices passed on to consumers at the pump, summer retail gasoline prices are still expected to be the lowest in 12 years. Despite the recent rise in gasoline prices, summer gasoline demand is forecast to reach a record 9.5 million barrels per day.”

Crude Oil:

“Low oil prices continue to cut into domestic oil production, with U.S. monthly oil output not expected to start steadily increasing until the end of 2017. The decline in U.S. May oil production is expected to be the largest drop in monthly output since Hurricane Ike knocked out a big chunk of offshore oil production in September 2008. Oil consumption in India is expected to increase by 350,000 barrels per day this year, the country’s largest annual volume growth ever, based on EIA data that goes back to 1980. Global oil inventories are expected to continue increasing through mid-2017, which could help moderate oil prices during that period.”

Natural Gas:

“U.S. natural gas production is forecast to remain mostly flat through the summer before output picks up at the end of this year and into 2017 in response to an expected rise in natural gas prices.”

Electricity:

“Expected cooler weather for most of the country this summer will contribute to a nearly 2 percent drop in total U.S. electricity sales to the residential sector this year.”

Coal:

“U.S. coal inventories are higher because of less coal use as a generating fuel for electricity and warmer-than-normal temperatures this past winter. The decline in coal use by the electric power sector is expected to contribute to a nearly 8 percent drop in U.S. carbon dioxide emissions from coal during 2016.”

Renewables:

“The U.S. power sector’s reliance on hydropower, wind, solar, and other renewable energy sources for electricity generation is expected to increase in 2016.”