Wherein we share some O&G news from beyond the Permian’s borders—news that, in some way, touches the Basin.

EIA

July 21

Higher and more stable crude oil prices are contributing to increased drilling in the United States, which may slow the pace of production declines… The Lower 48 states’ onshore oil active rotary rig count, as measured by Baker Hughes, stood at 336 rigs on July 15, 29 rigs above the end-June number. While declines from existing wells are expected to result in a net decrease in production, increased drilling and higher well productivity are expected to soften the decline.

Primary energy consumption fell slightly in 2015 as a decline in coal use exceeded increases in natural gas, petroleum, and renewables use. In most cases, changes between 2014 and 2015 reflect longer-term trends in energy use.

July 18

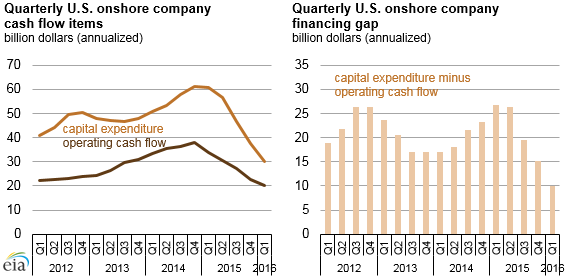

Although the crude oil price decline since 2014 has led to significant reductions in operating cash flow for U.S. oil companies, their immediate financial situations are improving. As oil companies’ spending falls and crude oil prices increase, the need for oil companies to find external sources of funding may decline, which could reduce financial strain in the coming quarters. First-quarter 2016 financial results from U.S. onshore producers reveal an improving balance between capital expenditure and operating cash flow. Although operating cash flow was the lowest in any quarter in the past five years, larger reductions to capital expenditure brought these companies closest to self-finance (when capital investment can be paid for entirely from operating cash flow). With crude oil prices such as the global benchmark Brent price averaging over $45 per barrel in the second quarter—a 34 percent increase from first-quarter 2016—cash flow may improve and help offset declining revenue from lower production.

July 13

In the July edition of the Short-Term Energy Outlook (STEO), EIA forecasts that the U.S. retail price for regular gasoline will average $2.25 per gallon (gal) this summer (April through September). The forecast price for this summer is lower than the 2015 summer average of $2.63/gal, but higher than the forecast from the April 2016 Short-Term Energy and Summer Fuels Outlook. The change in the forecast since April is largely attributable to increases in crude oil prices.

July 12

Adam Sieminski’s Short-Term Energy Outlook (STEO):

Gasoline/Refined Products:

“EIA expects U.S. drivers will see gasoline prices gradually decline from their June level through the end of this year.”

“A combination of lower crude oil prices, high gasoline production, and rising gasoline inventories pushed gasoline prices down this year.”

Crude Oil:

“Record gasoline demand will contribute to a nearly 1 percent increase in U.S. oil consumption this year.”

“India and China are expected to account for much of the growth in global oil consumption this year and in 2017.”

“EIA expects China’s oil output to fall by 150,000 barrels per day in 2016 and by an additional 80,000 barrels per day in 2017 because of continued investment cuts and fewer new offshore developments.”

“The United Kingdom’s decision to leave the European Union could lead to a drop in European oil consumption if there is a reduction in business investment and consumer spending.”

Natural Gas:

“For the first time since 1957, the United States is on track to export more natural gas than it imports; this will occur during the second half of next year as more liquefied natural gas export capacity comes online.”

“Although U.S. natural gas exports are increasing, there are still abundant supplies to meet domestic demand as natural gas inventories are expected to be at a record high for the start of the upcoming winter heating season.”

Electricity:

“The amount of U.S. electricity generated by coal continues to decline, as power plant operators cut their use of coal by more than 20 percent during the first half of this year in favor of more natural gas for generation.”

“Sustained low natural gas prices, resulting from record high natural gas production and growing gas inventories, have led to increased use of natural gas for electricity generation.”

Coal:

“While more U.S. electricity will still be generated by natural gas than coal in 2017, coal’s share of electricity generation is expected to increase next year in response to rising natural prices.”

Renewables:

“The amount of electricity generated by hydropower is expected to increase in 2016 for the first time in five years.”

Platts

July 13

Platts Analysis of EIA Data

U.S. distillate and gasoline inventories both rose in early July, overshadowing eight straight weeks of decline in crude stocks, causing oil futures to fall sharply after the release of Energy Information Administration (EIA) data, according to an analysis from S&P Global Platts.

Distillate stocks increased 4.058 million barrels to 152.997 million barrels the week ended July 8, EIA data showed. It was the largest build in distillate stocks since the first week of January, and far exceeded analysts’ expectations of a 375,000-barrel increase.

The distillate market emerged this spring as a source of strength in the oil complex. Steady declines in distillate stocks led New York Mercantile Exchange (NYMEX) ultra-low sulfur diesel (ULSD) futures higher, with the front-month contract even trading above RBOB this month.

That prompted speculation that refiners could respond by shifting yields away from gasoline and toward distillates.

ULSD futures tumbled, though the prompt contract was holding onto a slight premium over RBOB. NYMEX August ULSD was down 7.81 cents at $1.3851 per gallon (/gal) while NYMEX August RBOB was 5.93 cents lower at $1.3708/gal.

Implied* demand for distillates plunged 727,000 barrels per day (b/d) to 3.206 million b/d, its lowest level since the week ended February 5.

Stocks of low and ultra-low sulfur diesel on the Atlantic Coast rose 820,000 barrels to 53.589 million barrels, a 73.7 percent surplus to the five-year average for this time of year.

The U.S. Atlantic Coast (USAC) is home to the New York Harbor, the delivery point for the NYMEX ULSD futures contract and NYMEX RBOB futures contract.

USAC gasoline stocks also saw a build, up 212,000 barrels to 72.064 million barrels. The surplus to the five-year average has been around 22-to-23 percent for the last three weeks.

Gasoline imports have cushioned Atlantic Coast inventories, keeping the region well-supplied despite EIA estimates of record-high weekly gasoline demand in mid-June.

USAC gasoline imports rose 42,000 b/d last week to 722,000 b/d, versus a year-to-date average of 631,000 b/d.

Total gasoline stocks showed a build of 1.213 million barrels last week to 240.089 million barrels, EIA data showed. Analysts were looking for a draw of 125,000 barrels.

By region, builds were seen everywhere except for the U.S. Gulf Coast (USGC), where inventories dropped 514,000 barrels to 79.301 million barrels.

USGC gasoline stocks fell even though the region’s utilization rate ticked 0.6 percentage points higher to 92.6 percent of operable capacity.

Refinery Run Rate Falls

Total refinery utilization fell 0.2 percentage points to 92.3 percent of capacity, versus analysts’ expectations of an increase of 0.5 percentage points.

“The drop in refinery runs, yet builds in refined products, is probably the most worrying aspect of the report,” said Anthony Starkey, energy analysis manager, Platts Analytics, a forecasting and analytics unit of S&P Global Platts. “The implications are that implied demand for both edged lower. In sum, this is one of the poorer reports we have seen in some time, and prices are reacting as such.”

A year ago, the refinery run rate equaled 95.3 percent of capacity. A relatively weak RBOB crack spread has discouraged refiners from running harder, analysts say.

The prompt-month RBOB crack against Intercontinental Exchange (ICE) Brent has fallen below $12 per barrel (/b) this month, down from over $20/b in May. In July 2015, the RBOB crack spread traded in a range of around $20/b-$27/b.

While crude oil stocks have been drawing, sluggish refinery activity has mitigated the size of those declines.

Total commercial crude oil inventories fell 2.546 million barrels last week, versus an average draw of 5.3 million barrels from 2011-15 for the same reporting period.

Analysts surveyed Monday by S&P Global Platts were looking for a draw of 3.25 million barrels last week.

Crude stocks equaled 521.804 million barrels, exceeding by 34.7 percent the five-year average for this time of year.

A drop in imports helped crude stocks draw lower last week. Imports decreased 522,000 b/d to 7.841 million b/d, nearly matching the year-to-date average.

By country of origin, drops were seen from Colombia, Iraq, Mexico, and Kuwait. Canadian imports rose 259,000 b/d to 2.877 million b/d.

Crude output in the Lower 48 states dipped 14,000 b/d to 8.074 million b/d. Output has decreased 18 straight weeks, and now stands on the brink of falling below 8 million b/d for the first time since June 2014.

That decline has persisted despite drillers returning more rigs to work. The U.S. oil rig count had increased five of the last six weeks, to 351 rigs, up from a trough of 316 in late May, according to Baker Hughes.

EIA estimated total U.S. crude production increased 57,000 b/d , mostly due to Alaskan output rising 71,000 b/d to 411,000 b/d.

* Implied demand is the amount of product that moves through the U.S. distribution system, not actual end consumption.

China Oil Demand Fell 2.7 Percent

Apparent* Demand from January-May

China’s apparent oil demand contracted by 2.7 percent in May 2016 from a year earlier to 10.88 million barrels per day (b/d), according to an analysis of Chinese government data by S&P Global Platts, the leading independent provider of information and benchmark prices for the commodities and energy markets.

Refinery throughput in May averaged 10.46 million b/d, data from the China’s National Bureau of Statistics (NBS) showed June 12. This was a 0.04 percent decline year over year and a 4.3 percent drop month over month.

However, net imports of key oil products slumped 41.4 percent from a year earlier to an average 423,000 b/d in May, as exports of transport fuels climbed higher, data from China’s General Administration of Customs showed.

The contraction in oil demand in May represented the fourth consecutive month of negative growth and was due to declines in gasoil and fuel oil demand, amid slowing economic growth.

Over the first five months of 2016, apparent oil demand averaged 11.1 million b/d, down 0.8 percent. In contrast, apparent oil demand had increased by 9.1 percent during January-May 2015, when lower fuel prices incentivized end users to boost consumption.

China’s oil demand growth is expected to moderate significantly in 2016 as gross domestic product growth slows on the back of economic rebalancing. China’s government data shows the economy expanded by 6.7 percent in the first quarter of this year, a decline from 6.8 percent in the fourth quarter of 2015.

China’s 2016 apparent oil demand is forecast to grow by less than 2 percent, according to Platts China Oil Analytics, an on-line platform for supply/demand and trade data, of S&P Global Platts.

Gasoil

Apparent demand for gasoil in China contracted by 13 percent year-over-year in May and this was partly reflected in exports of the fuel hitting a new record high volume of 356,000 b/d during the month as refineries grappled with domestic oversupply and stagnant consumption levels.

The fuel is used in the industrial and heavy transport sectors. Demand has taken a hit in recent years on the slowdown in the manufacturing sector, amid China’s transition towards more service-sector-led economic growth.

Over January-May this year, gasoil apparent demand has fallen by 8.5 percent to an average 3.3 million b/d. This volume is the lowest level since the same five-month period of 2010.

“Platts China Oil Analytics forecasts gasoil apparent demand to fall by more than 3 percent in 2016, although more stimulus measures in the form of monetary easing and infrastructure investment could provide some upside to consumption,” said Song Yen Ling, senior analyst with Platts China Oil Analytics.

Gasoline

Bucking the wider trend this year, apparent demand for gasoline in May fell by 1.3 percent to average 2.68 million b/d, which was also a 7.1 percent month-on-month decline, according to S&P Global Platts calculations. The contraction in the apparent demand figure was due to a 105.7 percent year-on-year increase in gasoline exports.

China’s gasoline market has witnessed intense competition this year following increased refining activity by independent refiners, as well as higher production by fuel blending companies. This has resulted in higher supply in the domestic market and led to state-owned companies exporting significantly more volumes of gasoline compared with 2015.

However, data on gasoline sales by independents and fuel blenders is not readily available and is likely not fully captured by the official government statistics. This helps explain why China’s gasoline apparent demand this year has risen only 5.9 percent from January to May, compared with 9.4 percent over the same period of 2015. Passenger vehicle sales however remained strong, rising 9.8 percent year-over-year in May, suggesting consumption growth is still very robust.

Fuel Oil

China’s fuel oil apparent demand continued its downward trajectory as independent refiners which now have access to imported crude oil no longer need fuel oil as a primary processing feedstock. This has been happening since the second half of last year, when the government deregulated crude oil import rights and started giving out import quotas to independent refiners in China.

In May, fuel oil apparent demand fell 17.3 percent year-over-year for the fourth consecutive month, bringing demand during the first five months of 2016 to an average 737,000 b/d. This is an 18.6 percent contraction from the same period of 2015. To date, a total of 1.2 million b/d of crude oil import quotas have been approved for these refiners.

With fuel oil not as popular with refiners as processing feedstock, consumption is mainly focused on the bunker market, with some buying by petrochemical plants as feedstock. In contrast, independent refiners’ appetite for crude oil has surged significantly in 2016.

China’s crude oil imports between January and May surged 15.7 percent to 7.62 million b/d, surpassing growth of 8.8 percent seen in 2015. Meanwhile, fuel oil imports into China have slumped nearly 40 percent to just 307,000 b/d over the same period.

Monthly China Oil Data In ‘000 B/D

| May ’16 | May ’15 | % Chng | Apr. ’16 | Mar. ’15 | Feb. ’16 | Jan. ’16 | |

| Net Crude imports | 7,623 | 5,465 | 39.5 | 7,897 | 7,562 | 8,018 | 6,287 |

| Crude Production | 3,989 | 4,314 | -7.5 | 4,053 | 4,108 | 4,167 | 4,167 |

| Apparent Demand | 10,881 | 11,184 | -2.7 | 11,364 | 11,111 | 11,101 | 11,035 |

Sources: China’s General Administration of Customs, National Bureau of Statistics, S&P Global Platts

Month-to-month demand in China is generally viewed to be subjected to short-term anomalies which are of interest and important to note, but often fail to reveal the country’s underlying demand trends. Year-to-year comparisons are viewed by the marketplace to be more indicative of the country’s energy profile.

*S&P Global Platts calculates China’s apparent or implied oil demand on the basis of crude throughput volumes at the domestic refineries and net oil product imports, as reported by the NBS and Chinese customs. S&P Global Platts also takes into account undeclared revisions in NBS historical data.

The government releases data on imports, exports, domestic crude production, and refinery throughput data, but does not give official data on the country’s actual oil consumption figure and oil stockpiles. Official statistics on oil storage are released intermittently.

In view of some significant shifts in Chinese consumption and trade patterns in recent years, S&P Global Platts has revised its methodology starting July 2015 to include production and net imports of liquefied petroleum gas (LPG), as well as imports of petroleum bitumen blend, a popular imported feedstock for China’s teapot refineries.

S&P Global Platts has also refined its calculation of exports of jet fuel and fuel oil to exclude international marine bunker sales and aviation fuel delivered to international flights. This also impacts net imports, and hence apparent demand calculations. All historical figures used for comparison have also been calculated using the new methodology to ensure consistency.

July 11

Likely: Crude Stocks Draw of 3.25 Million Barrels

With the annual driving season peak already passed, U.S. crude oil inventories will soon face upward pressure from a seasonal slowdown that could be exacerbated by stunted demand in view of global economic concerns, according to a Monday preview of the U.S. Energy Information Administration (EIA) data by S&P Global Platts.

Crude oil stocks have fallen the last seven reporting periods, consistent with normal drawdown for this time of year when refinery utilization increases to meet driving demand. But recent weekly stock draws have been well below levels needed to clear the 33.5 percent surplus that inventories hold over the five-year average, according to U.S. Energy Information Administration data.

Analysts surveyed in July by S&P Global Platts expected a 3.25-million-barrel decline in crude oil stocks for the week ended July 8. Crude oil stocks have shown a 5.3 million-barrel decline on average over the same reporting period from 2011-15.

EIA data showed crude stocks declined 2.2 million barrels the week ended July 1. But because that draw came well below what the market had been anticipating, prompt New York Mercantile Exchange (NYMEX) crude oil futures tumbled to a near two-month low of $45.14/b on Thursday.

And with the U.S. Fourth of July holiday already in the rear-view mirror, the oil market is likely focusing on other bearish price factors keeping demand in check; at least until autumn refinery turnarounds are able to tighten refining product markets.

The U.S. dollar has soared following the U.K.’s decision to exit the European Union, as investors flock toward assets perceived as safe havens.

A stronger dollar makes fuel imports more expensive for holders of other currencies, and is often cited as a headwind for oil demand.

The dollar’s appeal has been further heightened by divergent central bank policies. While Federal Reserve officials are discussing a possible interest rate hike, other major central banks appear committed to keeping rates low for the time being.

A number of economists expected the Bank of England to slash interest rates when its monetary policy committee gathered July 14 following the Brexit vote.

And fresh off a victory in parliamentary elections, Japanese Prime Minister Shinzo Abe recently unveiled a fresh round of fiscal stimulus, which sent the yen lower against the dollar.

A dollar-induced drag on global oil demand could prolong the oil market’s rebalancing act, which appeared to be on track until crude prices stalled around $50/b over the last month.

One of the main culprits has been a gasoline glut that has weakened refinery profits and suppressed utilization rates, analysts said.

Diesel Crack Outperforming RBOB

On the U.S. Atlantic Coast (USAC), home to the New Harbor-delivered NYMEX reformulated blend stock for oxygenate blending (RBOB) futures contract, gasoline stocks have remained bloated despite what the EIA tallied as record-high weekly demand in June.

USAC gasoline stocks sit 22.7 percent above the five-year average for the same time of year at 71.9 million barrels.

That surplus has pulled the RBOB crack spread lower, to the point where Philadelphia Energy Solutions and Delta Air Lines reportedly cut rates last week at their respective refineries in Pennsylvania.

The RBOB crack against NYMEX crude has been around $12 per barrel (/b)-$13/b, down from more than $20/b in late May.

In light of this, analysts’ expectations for gasoline stocks to have fallen 125,000 barrels last week could provide some upside, if the data bears that out.

A decision by refiners to cut runs would help alleviate the surplus in gasoline stocks, but also shift the burden onto crude inventories.

Another possibility is that refiners—eying a stronger diesel crack—shift yields to maximize distillate supplies, which could play into analysts’ expectations of a 0.5 percentage point increase in U.S. refinery utilization rates, putting them around 93 percent of capacity.

The ultra-low sulfur diesel (ULSD) crack spread against NYMEX crude has been around $14/b-$15/b, surpassing the gasoline crack, which is atypical for this time of year.

With the need for heating oil still months away, additional distillate supply could end up in storage, or refiners could try and export more diesel to Europe.

Spot arbitrage economics for selling U.S. cargoes into Europe have worked on a case-by-case basis, with around 1.05 million metric tons (mt) of distillate from the Gulf Coast discharged or en route to Europe so far (as of July), according to an analysis by S&P Global Platts.

In June, Europe imported 1.69 million mt of distillate from the United States. Analysts expect U.S. distillate stocks rose 375,000 barrels.