The journal entries below are excerpted from recent installments of James Wicklund’s “Things I Learned…” newsletter.

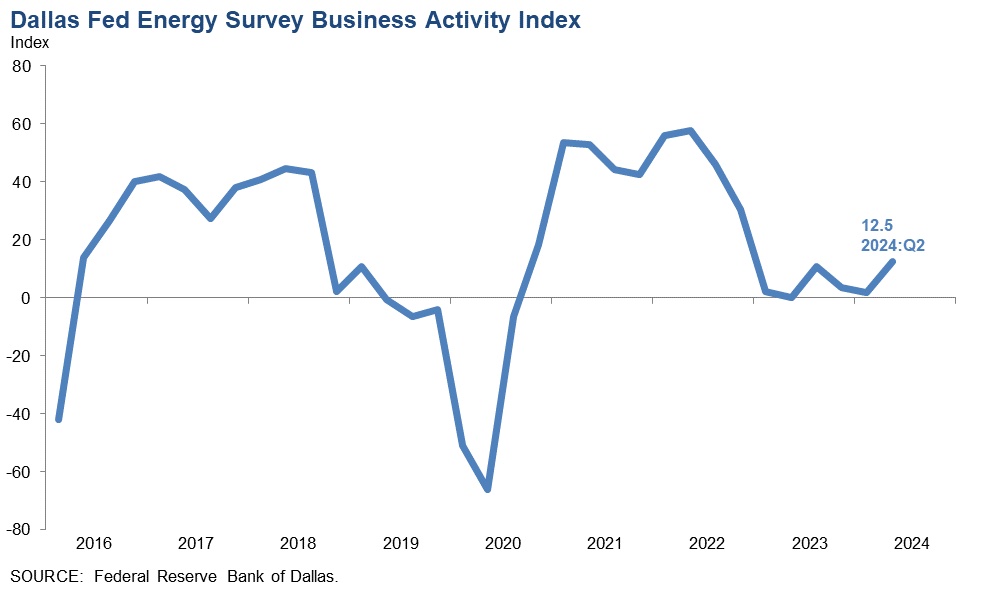

Perspective. The Dallas Federal Reserve Bank issued their 2nd quarter review of the oil and gas industry. Production was little changed; costs rose faster for OFS and still rose but more slowly for E&P. OFS utilization improved but margins were still negative, but not as negative as Q1, declining at a slower rate. Employment was little changed, but the slight change was positive, up 14 quarters in a row. There was a positive outlook by E&P and a neutral outlook for OFS. Operating in a flat environment generally leads to some slow price degradation. Expectations on prices had a very broad range, but it is my experience, from 15 years of hosting an annual December luncheon, that, as an industry, we are terrible at forecasting commodity prices, so I see no point in embarrassing anyone by publishing their estimates. In terms of overall price sentiment, many see more risk to oil prices over the next year, but most are much more optimistic five years out, which always seems to be the case.

Where’s Waldo. In discussions [in Madrid] about the industry’s great challenges, people were a real priority. WSJ in 2023 reported a 75 percent drop in energy and geoscience enrollment since 2014, with UT down 42 percent, A&M down 63 percent, both in petroleum engineering, Texas Tech down 88 percent, Colorado School of Mines down 88 percent. According to the Society of Petroleum Engineers, the average age of the Geoscientist is over 65. Retention ideas, automation, and AI were all discussed in some detail as the “solutions” to the problem. Automated drilling systems were discussed widely, with varying specialities for each system.

Getting Paid for Value. We made the point [also in Madrid] that rig contractors’ efficiencies, as well as ancillary services that aided them, has robbed them of revenues. If the average well used to take 20 days, we now drill it in 5-7. That is great for the operator but the rig contractor sees a 60 percent drop in revenues. We are doing more with less and unless drilling contractors are getting paid for the myriad of efficiencies seen, introduced, and used in the last several years, they lose out. Performance-based drilling was discussed by many as a potential solution. I think this is an excellent idea and it will weed out the weaker players and force further consolidation.

My Hometown. Buckley’s Grill, one of the best steak restaurants in Memphis, announced it was closing after over 30 years of operations. The owner posted the following message: “Love and appreciate you all and your kind comments. It is simple… Crime killed our business after 30 years. Folks are afraid to risk dining in East Memphis. Can’t blame them. Thank you all for thirty years of love.” To all of my high school classmates, very sorry. If they close the Rendezvous, it’s all over.

After All, We Are in Texas. So, it appears that on the list of things that Texans take the front-end risk on, we now have the Texas Stock Exchange. And no, Houston, you didn’t get it. Dallas did. It’s going to be an electronic exchange, and companies can list shares. It’s been backed by BlackRock and Citadel Securities, who both trade billions in securities every year. It’s been done before. This isn’t going to be your typical exchange in many ways in that it is purely electronic. No traders and no salesman. But trading algorithms are now taking up much of the market, not using specialists or research…. So far, $120 million has been raised for its funding. There could be different board compensation and requirements that would offer an attractive alternative to existing exchanges as well as being in a tax-friendly state. The geographic appeal has been mentioned more than once…. Considering the number of oil and gas and energy related companies in our state, the change would obviously be weighted in some way towards Energy.

—Jim

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.

Subscribe to Jim Wicklund’s full e-newsletter, “Things I Learned This Week at…,” distributed via email, by signing up for free at this webpage: https://www.pphb.com/newsletters. Jim is Managing Director / Client Relations and Business Development for investment banking firm PPHB. Leveraging deep industry knowledge and experience, Houston-based PPHB has advised on more than 180 transactions exceeding $11 Billion in total value. PPHB advises in mergers & acquisitions, both sell-side and buy-side, raises institutional private equity and debt and offers debt and restructuring advisory services. The firm provides clients with proven investment banking partners, committed to the industry, and committed to success.