The oil and gas industry has long reigned as an industry that finds success in innovation. Technological advancement and a pioneering spirit have catapulted the industry forward. Decade by decade, the industry refines itself by seeking new solutions, putting tools and processes to the test in the field, and embracing each fresh advance as the go-to solution. Of the highly specialized niches that we find in oil and gas, perhaps none is as well known to the public as hydraulic fracturing. While it has weathered differing opinions, finding much support and also finding detractors, fracturing has continued to evolve. The practice, like so many other processes in oil and gas, achieves ever-increasing efficiency and decreasing operational costs.

Hydraulic fracturing, commonly known as frac’ing, employs diverse methodologies that focus on the design and operational aspects of the technology. With nearly all areas of the oil and gas industry seeing improvement and new development, frac’ing experiences the same success in both the design and operation areas.

Frac’ing depends upon multiple components, such as proppant, which is conveyed downhole via a foam, gel, or slickwater-based frac’ing fluid. Slickwater hydraulic fractures have come to be seen as the typical solution. Still, Charles Hager, owner of Synergy Exploitation Solutions, LLC, notes shortcomings he associates with slickwater frac’ing and suggests an alternative solution to boost efficiency and financial savings.

Taking a Hybrid Approach

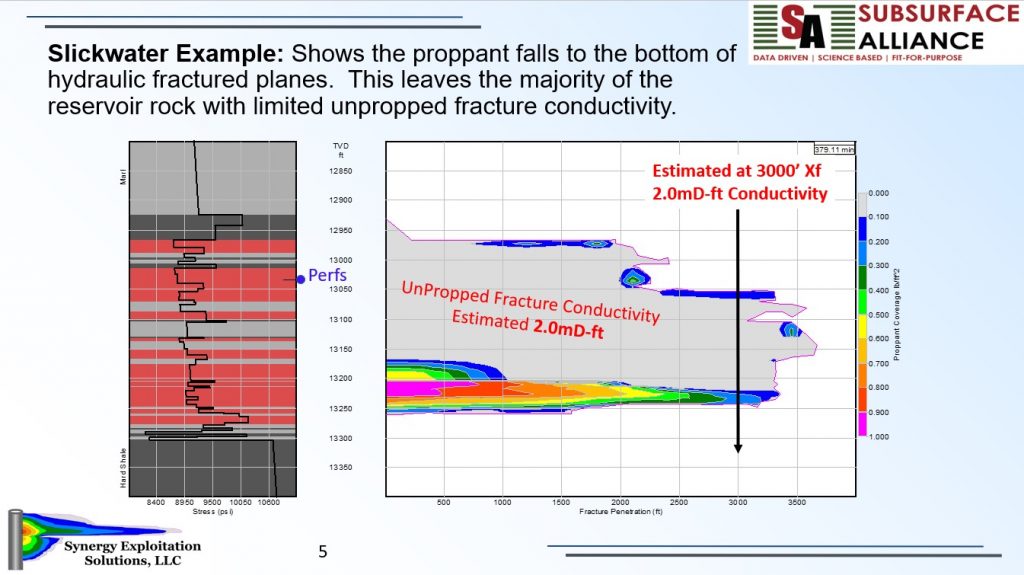

“When we inject the fluids, we create a planar fracture [that is, along a plane], and it may be 300 feet high, 2,000 feet from the wellbore to each tip, and a quarter-inch wide,” says Hager. “The problem with the slickwater is the proppant falls to the bottom of the crack, and you may have the bottom 30 or 40 feet [as a zone] where all the proppant is lying. When the fracture closes, you have no conductivity over the majority of your pay zone.”

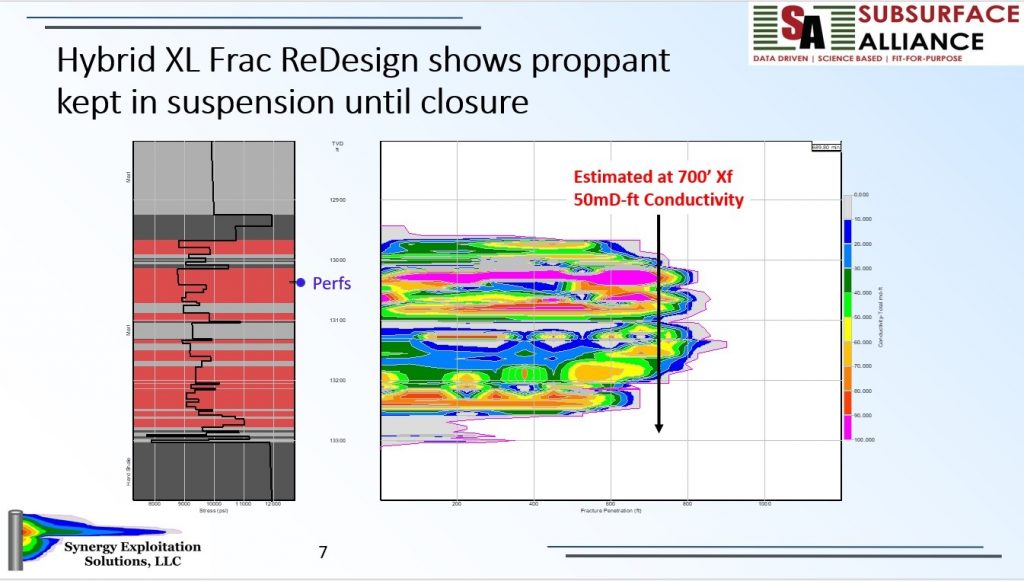

According to Hager, the “hybrid” frac’ing concept presents itself as a solution to proppant loss found in slickwater fractures. Using crosslink fluid, the proppant remains in suspension until the fracture naturally bleeds off and closes. Proppant is held permanently in place. When the proppant falls to the bottom of hydraulic fractured planes in slickwater fracs, most reservoir rock is left with limited unpropped fracture conductivity.

While proppant plays a critical role in frac’ing, water carries equal significance. Voluminous quantities of water are pumped downhole during the frac’ing process, and with the increasing number of stages associated with hydraulic fractures, the demand only grows. Securing the needed water proves a daunting task. Water transfer systems and ponds of supply water consume sizable portions of budgets, and operators continue to explore avenues for supplying needs while trying to avoid prohibitive costs.

After the water is pumped down, much of it flows back to the surface as produced water. That water is often removed from the location, but the process can be costly. Processed water is usually treated on location to be reused, but Hager reasons that water issues can be avoided when an operator adopts the hybrid fracturing methodology.

“The hybrid fracture technology can not only reduce the number of stages in the process, but it can significantly decrease the amount of water used per stage—by up to two-thirds,” says Hager. “It provides dramatic improvement with the ability to cut water needs in half.”

According to Hager, the hybrid frac’ing solution provides multiple benefits, such as increasing efficiency and reducing costs. With the ability to reduce well count by nearly 40 percent, E&Ps can redirect investments in development and infrastructure back to the coffers of profitability. An excessive cut in water needs across a field accomplishes the same. The overall energy reduction gained adds to the increased efficiency factor while bringing reduced costs and gains in profitability.

Making Bottom Hole Pressure Your Friend

Frank Bufkin, III, owner of Premier Pressure Pumping, offers insight based on experience gained through an extensive oilfield career. While challenges like water supply potentially hinder operations, efficiency provides the roadmap to successful operations.

“When you have an area that has already been produced or frac’d into, the bottom hole pressure is going to be less, so if you can [manage] what I call ‘break the glass all at one time,’ it is easier to get it to shatter better [at higher bottom hole pressure] than to shatter at lower pressure,” says Bufkin.

According to Bufkin, he and many throughout the industry see the need to increase efficiency by reducing costs wherever possible. By increasing the number of wells to frac simultaneously, rig up and rig down costs can drastically decrease, but other potential savings can be realized. Frac’ing multiple wells together can prevent strikes when frac’ing a new well near a producing well. Simultaneous frac’ing can remove that threat.

While avoiding that costly outcome would seem well advised, the chances of being able to do so are only sometimes realistic. Bufkin reasons that minimal capital investment and water supply challenges often deter companies from participating in SIMOPS [simultaneous operations] activities. For all the effort thrown at conserving and treating produced water for reuse, supply needs cannot be met.

“You don’t ever get all your water back after sending it downhole,” says Bufkin.

Despite the challenges, Bufkin still promotes that savings factor associated with the hydraulic fracturing of multiple wells in one site visit. The process simply demands a commitment to necessary funding, which is often only available to larger players in the industry. Still, even those who have the means must weigh the concerns and determine if those risks, financial or otherwise, are acceptable.

Frontiers of the Electric Frac

The gains of energy reduction, however, carry over into the operational aspects of hydraulic fracturing development. With the push to electrify, frac’ing companies have sought similar solutions. The impetus here also comes from lessons learned during the busts of oil and gas cycles.

“Every downturn brings efficiency when we emerge from it,” says Evolution Well Services Director of Business Development Chris Cook.

Evolution Well Services provides customers such as EQT with the latest technology in pressure pumping. By electrifying its equipment fleet, relying solely on field gas with no third-party gas processing, and reducing its footprint on a hydraulic fracture location, Evolution Well Services brings benefits from reduced costs—benefits found predominantly in fuel allocation.

“The cost savings is associated with fuel,” says Cook. “We save on 90 percent of operating costs.”

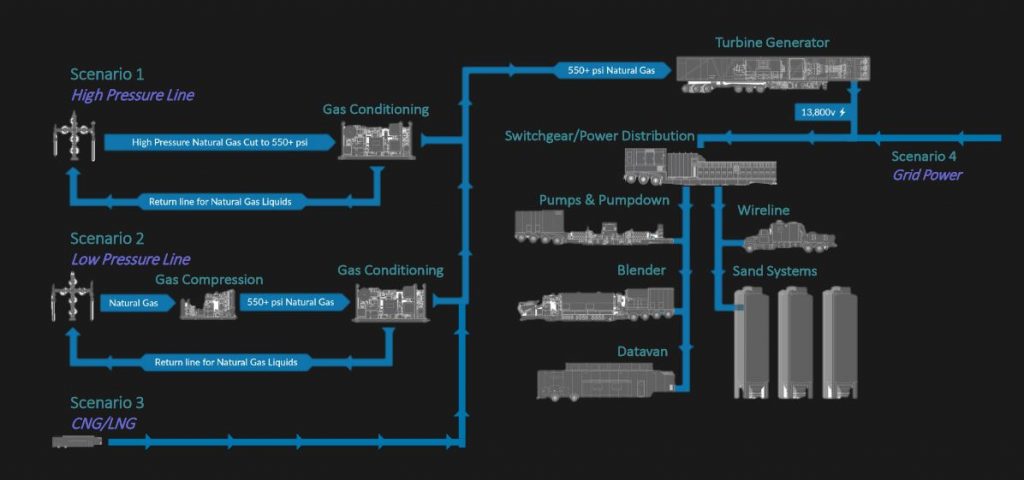

Electric fracturing, or e-frac, depends on electrically driven pumps powered by natural gas turbine generators. Electrically powered pressure pumps replace conventional diesel-powered units and are fueled by modular gas turbine generators, which make electricity by using CNG, LNG, or field gas produced on location.

Evolution strives for multiple levels of improvement by providing an electric hydraulic fracturing solution. While pressure pumping has historically produced loud noise levels that potentially endanger the workforce and make communication challenging, Evolution only experiences 85 dB at the well site. Conventional methods produce more than 115dB of damaging sound levels.

While hearing loss potential decreases, additional safety enhancements benefit the company and its staff. By utilizing electric equipment, operators can see fueling needs diminished during and between stages, and the potential associated with hot fueling becomes a problem of the past. Evolution’s electric frac’ing system additionally benefits from remote operations. Exposure to high-pressure components can be avoided by removing personnel from potential danger.

According to Cook, these improvements benefit workplace safety, drive efficiency, and reduce costs. Each of these aspects significantly improves the hydraulic fracturing sector overall.

The oil and gas industry shows remarkable enthusiasm as it continues to evolve and grow more robust. The industry has not just sought to change or improve in response to opposition or regulation but also for the greater good of the overall bottom line. Profitability has driven the direction of the industry, but not to the detriment of one particular area. Instead, identifying areas that would benefit from improvement has been the primary focus.

The hydraulic fracturing industry of oil and gas has shaped how fossil fuels are derived from the earth, and inevitably, the process will only improve in the future. As the world looks to electrify and seek clean energy solutions, hydraulic fracturing offers the same desire with its clean energy solutions found in electric frac’ing technology. Reduction of fuel use reduces costs and proves better for the environment with less loss-of-primary-containment incidents. Emissions rates additionally fall accordingly.

The responsible use of proppants in hybrid frac’ing scenarios conserves energy while reducing product costs. Salvaging proppants and keeping them suspended retains value instead of losing it in formation. Costs see reduction as does the energy expenditure of drawing additional supplies of proppant needed.

These latest advancements in the hydraulic fracturing process point to a bright and sustainable future, but fear of the unknown must be overcome. As it always has, new processes must be ventured and explored and proven effective before operators will commit their carefully allocated funds. It’s an old story. Companies often subscribe to the “you first” perspective.

“We need companies to step up and try the concept,” says Hager.

Nick Vaccaro, owner of Vaccaro Group LLC, services the energy industry as an HSE consultant and freelance writer. A contributor to numerous industry publications, Vaccaro holds a BA in photojournalism from Loyola University. He can be contacted at 985-966-0957 or nav@vaccarogroupllc.com.