This month, with the New Year just beginning, I’d like to take a brief look at things to expect in Permian developments for 2025. With political changes, there is a lot of anticipation that “drill, baby, drill” will make material impacts in oil and gas production. I think the impact will be minimal on production but will indeed add to profit margins.

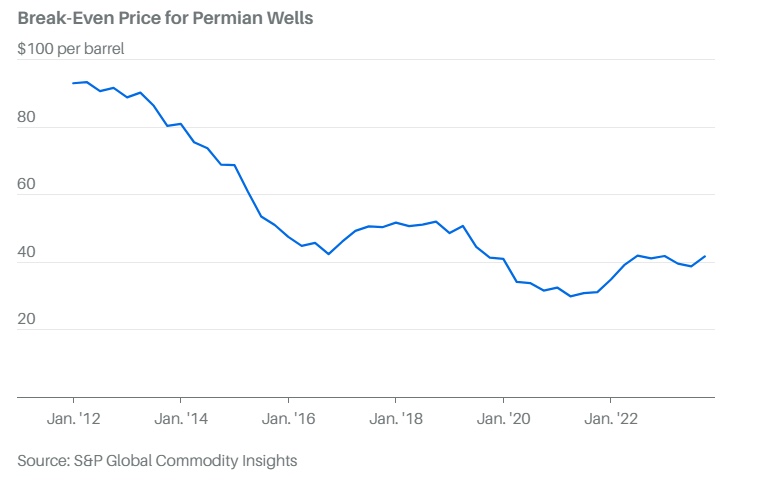

Permian production is up to more than 6 million barrels per day, accounting for nearly half of all U.S. oil production. The Basin first reached two million barrels per day in 2015. That is a meteoric rise in less than a decade. At the same time, rigs and manpower have dropped about 40 percent as operations have become more efficient.

Permian production is likely to rise about 5 percent in 2025 and not much more than that in the next several years. Years of high grading have depleted the easiest-to-get-at oil. AI, though, is suddenly adding another wave of efficiency.

From a regulatory perspective, what producers are most likely to get from the new Trump administration is some relief on methane requirements. Under President Biden, the EPA’s final methane rule included:

- increased methane leak detection

- stricter flaring and monitoring

- zero-emitting pneumatics at new facilities, including a phase-in for existing facilities

- significant costs associated with monitoring

- a “waste emissions charge” of $900 per metric ton of methane emissions in 2024, increasing in coming years

According to those I talked with at the Hart Energy conference in May, those regulations put a lot of financial pressure on smaller and mid-tier producers. The result could be less production and a clear advantage to the larger players who can afford the costs involved.

Under the Trump administration, I expect some loosening of the EPA’s rules in 2025. That will help a bit with production. The most powerful impact will be on profit margins that analysts are not factoring into models yet. That means upside surprises on some stocks.

Many will look to Chevron (CVX) and Exxon (XOM) to lead, but it is hard to move the needle for either of them, given their size and diversified operations. Dividend investors can sleep easy knowing their dividends are safe; however, getting significant growth from either is unlikely.

Occidental Petroleum (OXY), Diamondback (FANG), and Permian Resources (PR) are the companies I am most interested in, again. I have mentioned all three companies since last summer.

Diamondback, recently merged with Endeavor, is the third largest oil producer in the Permian behind the majors. Their focus on the Permian makes them a focused beneficiary of the best oil economics in America.

Their stock price has been choppy for nearly three years and currently rests just above a support level in the $160-170 per share price range. With a forward price-to-earnings (P/E) ratio of about 11, the stock is almost a bargain and yields a 4.6 percent dividend to boot. I am looking for a spot to buy Diamondback shares below $170.

Occidental, newly merged with CrownRock, isn’t as focused as Diamondback, but is very heavily weighted to the Permian after years of strategic positioning. Their stock has fallen from nearly $70 to the $50s in the past year, as buying pressure from Berkshire Hathaway (BRK.B) paused while Warren Buffett accumulated cash into a stretched stock market.

With Berkshire authorized to buy 50 percent of the company and warrants priced at $59.62, any price below that level seems a buy. The wildcard here is carbon credits. If those remain in place, as Exxon and Chevron want, then Occidental could be a cash cow in the next decade as they are a leader in carbon capture, sequestration, and uses. I have a small position in Occidental that I might add to, depending on the carbon capture outlook.

Permian Resources (PR), recently merged with Earthstone, is a Permian pureplay that has been expertly cobbled together in the past decade. They are now in the top 10 for Permian production, heavily focused on the Delaware after acquiring some strategic acreage from Occidental. Their share price continues to be undervalued by the market as a less-known name, treading in the teens, with a forward P/E also around 11.

You’ll notice all three companies recently underwent M&A. With the new administration and Lina Khan being replaced at the FTC, I expect very little resistance to one more wave of M&A. Permian Resources will be in play. It is a top holding of mine that I add to on dips.

My firm and I own stock in Permian Resources. For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A change analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.