AI has been at the forefront of daily investment news the past year. Nvidia this, OpenAI that. More recently, the power needs of AI have been getting column space and breathy podcast time too.

Globally, AI power demand needs have been putting pressure on utilities and governments to come up with more energy production. In Texas, the Permian Basin is about to become a prolific producer of the electricity that AI needs.

More Gas Fired Electricity

Flaring of natural gas in the Permian has been one of the complaints of environmentalists far and near. That refrain has endured even though flaring intensity in the Permian decreased by two-thirds from about 4 percent to 1.2 percent between 2019 and 2023. Flaring continues to decline.

The combination of pipeline infrastructure, new wells, better equipment, and other initiatives has been very successful ahead of new penalties. That captured natural gas can now be purposed.

Besides being transported to the Gulf Coast primarily, where much of the gas will be shipped out as LNG, using the natural gas to generate electricity is rapidly gaining adoption.

Texas has created a $5 billion low-interest loan program to support using natural gas for electric generation. Already, more than 150 notices have been filed with the Public Utility Commission (PUCT) for upwards of 60,000 megawatts of new electric power generation. While not all of that power will come online, other power projects, ones that have not filed ahead of the July 27th deadline for loans, will.

Texas power demand is set to increase by as much as 150,000 megawatts by 2030, according to the Electric Reliability Council of Texas (ERCOT). Increased power demand is being driven by oil and gas field electrification, AI data centers, crypto miners, broader electrification, and eventually EVs.

According to Enverus, without increased electric generation in ERCOT’s Far West load zone, which includes the Permian, energy prices could increase dramatically and stifle energy exports to East Texas.

The anticipated new natural gas fired electricity being proposed, much of it in the Permian, could supply about 40 percent of the new electricity demand statewide. Importantly, with gas takeaway still constrained in the Permian, using the natural gas near the source will improve pricing on what is taken away. I believe balance is coming.

Stocks That Stand to Gain

Not only does more natural gas fired electricity bode well for the Texas grid, it will help support jobs long-term. In addition, several companies and their stocks stand to gain more than the market currently seems to be pricing in. Here are two blue chips I have my eye on.

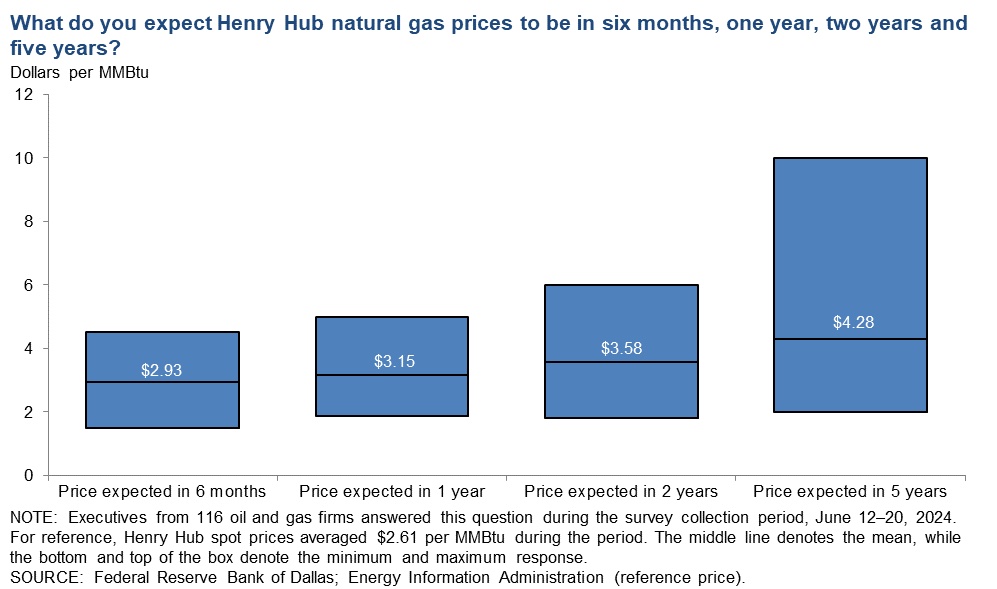

ExxonMobil (XOM) with its Pioneer merger has become the largest producer of both oil and gas in the Permian, beating out Occidental Petroleum (OXY). With a focus on transitioning the massive company to be future proof (see their move into lithium), the company stands to benefit from higher natural gas prices.

Under the idea of “things that make sense eventually happen,” I expect Exxon to partner with utilities or start its own utility with natural gas, solar, and wind assets. The combination of carbon capture incentives with need for electricity plays naturally into their gas and land assets.

Occidental Petroleum (OXY) is the other “blue chip” company to keep an eye on. With Berkshire Hathaway (BRK.B) approaching 50 percent ownership there are deep pockets behind Occidental. Berkshire also already operates in power generation.

Occidental is similar to Exxon in that it has all the resources and incentives to get into electrical generation. Their production of natural gas production is top three in the Permian and will be a winner however they choose to use it.

There are several other companies to think about as well. Producers in the gas rich Wolfcamp come to mind. Those include Devon Energy, Apache, EOG, and Diamondback on my short list.

My firm and I own stock in OXY. For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A change analyst and investment advisor, Kirk Spano is published regularly on Seeking Alpha, and has been featured on MarketWatch, Fox Business, CNN Money, Real Clear Markets, The Street, and other platforms.