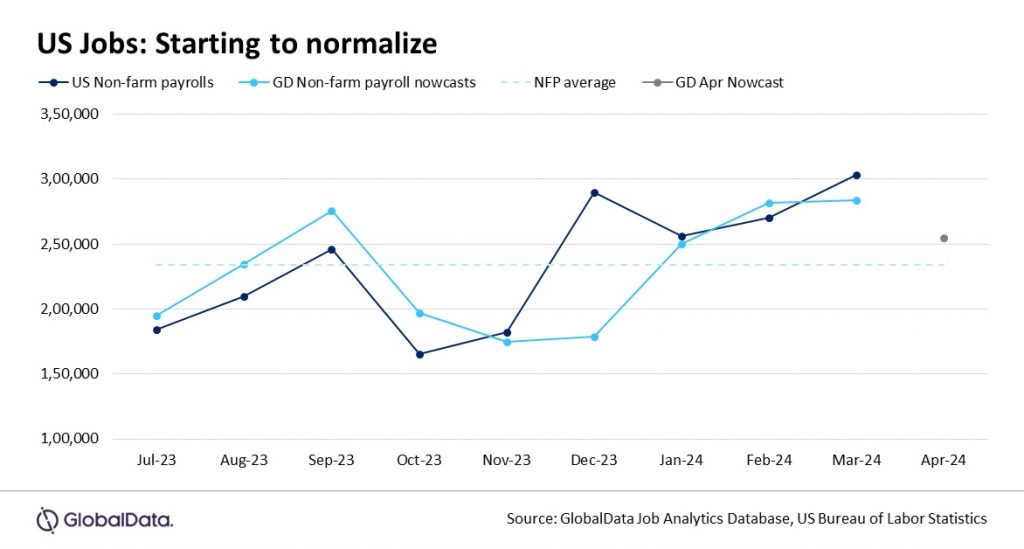

The non-farm payroll (NFP) report for April 2024 was viewed as normalizing downward, towards the average trend of the previous year, with 255,000 payroll additions, marginally ahead of the consensus expectation of 250,000, but below last month’s 303,000. This downward normalization is reflective of the recent U.S. Job Openings (JOLTS) for March, which decreased by 325,000 from February’s figures, says GlobalData, a data and analytics company.

GlobalData’s U.S. Active Jobs index, derived from high frequency company job postings dataset and available in near real-time, is well suited to detect labor market trends in real-time.

Adarsh Jain, CFA, Director of Financial Markets at GlobalData, comments: “2024 started strong with labor market witnessing an unprecedented three consecutive months (Jan-March) of 15%+ month-on-month growth in job postings, signalling robust jobs demand. It is natural to anticipate a pullback from this rapid pace as companies adjust their demand, given that job postings, indicating hiring intentions, experience their first double-digit decline in four months in April, with a 12 percent month-on-month decrease.

“In terms of sector trends, consumer driven sectors like retail, automotive, and consumer have been strong, despite persistent inflation, whereas tech sectors like telecom and IT have exhibited weakness. It will not be surprising if advances in AI continue to have a dampening effect on the demand for labor in these sectors.

“GlobalData expects that the jobs market may not return to the exceptional growth rates seen at the start of 2024 but anticipates a more subdued pace in the near term. Net-net, the persistent high inflation coupled with a reasonably vibrant jobs market will likely continue to push Fed towards delaying rate cuts for this year.”