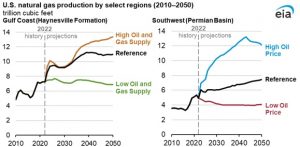

In its Annual Energy Outlook 2023, the U.S. Energy Information Administration (EIA) projects that U.S. natural gas production will increase 15 percent and liquefied natural gas (LNG) exports will increase 152 percent between 2022 and 2050. They expect natural gas production to rise to 42.1 trillion cubic feet (Tcf) by 2050. Production growth is largely driven by U.S. LNG exports, which we expect to rise to 10 Tcf by 2050. Natural gas production growth on the Gulf Coast and in the Southwest reflects increased activity in the Haynesville Formation and in the Permian Basin, which are close to infrastructure connecting natural gas supply to growing LNG export facilities.

In its report, EIA explores long-term energy trends in the United States and presents an outlook for energy markets through 2050. They use different scenarios, called cases, to understand how varying assumptions affect energy trends. The AEO2023 Reference case, which serves as a baseline, or benchmark, reflects laws and regulations adopted through mid-November 2022, including the Inflation Reduction Act.

In a Reference case, EIA projects that annual natural gas production from 2022 through 2050 will grow by 52 percent on the Gulf Coast and by 50 percent in the Southwest. Because the Haynesville Formation and the Permian Basin are close to LNG export terminals in Texas and Louisiana, the amount of natural gas produced in these regions has grown as LNG demand has grown. Associated dissolved natural gas from oil formations, another notable contributor to natural gas production, contributes to production growth in the Southwest.

EIA projects continued rising global demand for natural gas, which makes it economical to build additional LNG export facilities in the United States. New liquefaction facilities in Louisiana became fully operational in 2022, ahead of schedule. In addition, new LNG trains in Texas are scheduled to be online by 2025.

EIA also projects that across some side cases, production increases during the projection period. They project the most growth in U.S. natural gas production in the High Oil and Gas Supply case and High Oil Price case. In the Low Oil and Gas Supply case, U.S. oil production declines, which reduces associated dissolved natural gas and shale production and shrinks natural gas production on the Gulf Coast and in the Southwest. In the Low Oil Price case, they project a lower Brent oil price, which reduces LNG exports below current levels in the near term through crude oil-linked international LNG pricing and results in underutilized capacity by 2050. However, in this case, increased Gulf Coast shale production enables natural gas production in this region to grow through 2050, despite declines in all other regions.