Enverus Intelligence Research, a part of Enverus, a leading global energy data analytics and SaaS technology company, released on March 21 a new report examining the likely responses by U.S. oil producers, both public and private, to high oil prices and increased concerns about energy security in the wake of Russia’s recent invasion of Ukraine. Included are regions that are likely to boost output and identifies the barriers and costs of adding production.

“The E&P industry can grow while remaining profitable and environmentally responsible. Private operators have been and will continue to take advantage of the outsized returns, and we believe continued drilling activity increases from large U.S. independent are likely and warranted,” said Farzin Mou, lead report author and vice president at Enverus Intelligence Research.

Jen Snyder, co-author, managing director and head of North America Macro Intelligence Research, added, “Once operators lock in new long-term midstream and services commitments, they are handcuffed with off-balance-sheet leverage during a price downturn. The trajectory of the 2024-25 WTI strip therefore will be an important driver of operators’ 2022-23 capital commitments even if wells earn attractive returns by year-end 2023.”

Key takeaways from the report:

- Russia’s invasion of Ukraine and the subsequent sanctions on Russian energy fundamentally changed the oil market, highlighting the potential of an increased long-term call on U.S. oil barrels.

- The U.S. upstream sector already had transformed from one of the least-profitable industrial sectors across the S&P 500 to one of the most profitable, with improved environmental stewardship.

- Public shale oil producers went from reinvesting nearly 100 percent of operating cash flow from 2018-20 to less than 35 percent in 2022 at current strip prices.

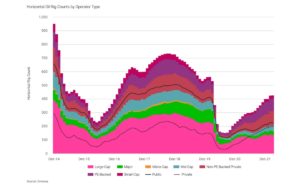

- Private operators are taking advantage of the outsized rates of return and raising their share of horizontal drilling to near-record levels.

- Large U.S. independents’ drilling activity already is up ~15 percent since November, and we believe continued moderate increases are likely—and warranted—based on pre-war price expectations.

- Should long-dated prices move over $90/bbl, another step-change in activity would be justified. The E&P industry can return to strong growth while remaining profitable and environmentally responsible.