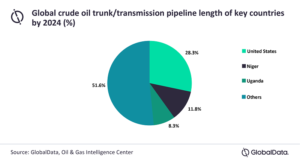

The United States is expected to drive global growth in crude oil trunk/transmission pipelines by 2024, according to GlobalData, a leading data, and analytics company.

The United States will account for almost one-fourth of the total pipeline length growth by 2024. With expected length additions of 4,900 km from projects that have received approval or are awaiting approval, the United States is far ahead of any other country in the world in terms of pipeline growth by 2024, says GlobalData.

GlobalData’s report, “Global Crude Oil Pipelines Industry Outlook to 2024 – Capacity and Capital Expenditure Outlook with Details of All Operating and Planned Crude Oil Pipelines,” reveals that the total global crude oil pipeline length additions are expected to be more than 17,000 km by 2024. Of the countries studied for pipeline growth, the US is on top with 4,895 km, followed by Russia with 2,040 km and Canada with 1,443 km.

Soorya Tejomoortula, Oil and Gas Analyst at GlobalData, comments: “The COVID-19 pandemic has resulted in project delays and capex cuts in the US crude oil transmission pipelines segment. However, the sector is expected to gradually recover from the pandemic impact if the recovery of crude oil prices continues, and any potential ramp-up of production by the US shale producers in the near future.”

Among the upcoming pipelines in the United States, Jupiter is a key announced pipeline with a total length of 1,094 km. With operations expected to start in 2023, Jupiter is being planned to carry crude from the Permian Basin to storage terminals along the Gulf of Mexico.

Capline Reversal is another key pipeline in the country and is expected to start operations in 2021 with a total length of 1,036 km. The pipeline will help to transport crude from the US Midwest to the Gulf of Mexico. Earlier, the pipeline was used to carry crude to the refineries in the Midwest from the Gulf of Mexico, but it is now being reversed due to the shale oil boom in the United States.

GlobalData also notes that Niger has the second longest crude pipeline additions globally, representing 11.8% of the total length additions by 2024. Only two pipelines are expected to start operations in the country by 2024 with Niger–Benin accounting for almost the entire additions with 1,950 km. The pipeline is expected to start operations in 2024 and will transport crude from the Agadem crude oil production field in Niger to the Port Seme terminal in Benin.

After the United States and Niger, Uganda occupies third place with an 8.3% share with one pipeline, East African Crude Oil (EACOP), accounting for the entire pipeline additions in the country. EACOP is 1,443 km long and is expected to start operations in 2024. Like Niger–Benin, it is a transnational pipeline carrying crude from Uganda to Tanga port in Tanzania.