The business of gas has become a bigger factor than most expected when the Shale Revolution reinvigorated the Permian Basin. What’s the latest for this commodity?

In 2023, natural gas has been fairly steady, not making the surge some expected, but not going into collapse, either. In the United States, the hot summertime has put a downward pressure on supply, because natural gas is used to fuel power plants, and warmer temperatures call for greater air conditioning demand, thus consuming more natural gas. But the earlier winter and spring were relatively mild, thus not stimulating greater burning of natural gas for heat. So the result has been something of a wash, in terms of supply ups and downs. And as we near the end of the injection season for natural gas, with reserves getting topped off, demand will hit another lull. Then we get winter and the cycle starts anew. But as we stand today with gas at $2.77, and not much upward or downward pressure, conditions are stable and, as one commentator remarked, “natural gas is sitting in the comfort zone.”

But there is some upside.

On Aug. 30, Christopher Lewis, in his article for FXempire.com, “Natural Gas Markets Continue to Walk Along the Moving Average,” explored that upside.

“The natural gas markets continue to march along the 50 Day EMA [Exponential Moving Average] indicator, an indicator that a lot of people will be paying close attention to if they are technically inclined. Above, we have the $3.00 level, a value that stands out as a prominent, whole-number milestone with psychological importance. Moreover, it also serves as a focal point for the accumulation of options barriers, adding to its significance. In other words, I don’t think that we blow through the $3.00 level very easily, but once we do it almost certainly means something. With that being the case, I’m looking at this through the prism of a market that is building up a base for the winter.”

Lewis, reminding his readers that it’s a well-known cycle, this cycle of natural gas picking up toward fall. But, he adds, we must view the phenomenon through the prism of whether or not there is going to be enough natural gas for the demand that is coming.

“While I do think that large portions of the earth will be fine, one particular area of trouble will be the European Union, as they no longer have Russian gas anymore, and African gas may be a problem as well,” Lewis remarked. “With that being said, it looks like we are building a bit of a base in this market, and I think that given enough time we probably have a break above the $3.00 level, reaching toward the 200-Day EMA. After that, then it’s likely that we go looking to the natural gas market toward the $5.00 level. I have no interest in shorting natural gas, and I do think that a pullback from here only adds more value that people will be willing to take advantage of.”

For more on his thoughts, go here: https://www.fxempire.com/forecasts/article/natural-gas-price-forecast-natural-gas-markets-continue-to-walk-along-the-moving-average-1371271

Swing Factor

Meanwhile, the research firm HFI Research, publishing an article on SeekingAlpha.com, cited the so-called “Comfort Zone,” and stated that Lower 48 gas production is likely to remain flat through the end of the year as associated gas production slows.

Said HFI: “U.S. shale oil producers continue to shed rigs and with servicing cost inflation starting to bite into capex budgets, we believe more rigs will be slashed. And looking at our real-time U.S. oil production proxy, we see downward pressure on U.S. oil production going forward. This means that for the natural gas market, the slower production will prove to be a tailwind just as demand starts to outpace 2022. LNG gas exports will be a big swing factor going forward.”

HFI remarked that as demand outpaces supply growth, markets should tighten into the end of the injection season.

What then?

“All of this means that natural gas has an upside until a certain point,” their authors remarked. “Given the bloated storage still, we see an upside to $3.25/MMBtu, but that’s about it. One of the main limiting factors continues to be the bloated South Central gas storage levels we see. While we will avoid another 2020 scenario by November, traders will still see no incentive to bid prices well beyond $3.25. For now, the natural gas market is in a comfort zone. Storage injections over the next few weeks will come in below the 5-year average, fundamentals are tightening, but because overall storage levels remain bloated, prices will be capped. The dark days are definitely behind us, but we still have ways to go before the bulls can celebrate much higher prices ahead.”

For more from them, see this article: https://seekingalpha.com/article/4619704-natural-gas-is-sitting-in-the-comfort-zone

EIA Weighs In

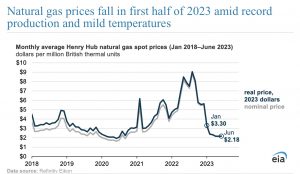

Lastly, we go to the Energy Information Administration for this report on EIA.gov from Jul 24, entitled “Natural gas prices fall in first half of 2023 amid record production and mild temperatures.”

EIA stated, “U.S. natural gas consumption averaged 103.0 billion cubic feet per day (Bcf/d) between January 1 and April 30, 2023, down 1.0 Bcf/d from the same period in 2022, according to EIA’s Natural Gas Monthly…. U.S. dry natural gas production has outpaced demand so far in 2023, contributing to lower natural gas prices. Dry natural gas production has remained at record highs in 2023, averaging over 101.0 Bcf/d each month. In the first quarter of 2023, dry natural gas production increased 7 percent, or 6.9 Bcf/d, from the same period in 2022.”

Then their conclusion:

“We forecast Henry Hub prices will increase from the current price between July and December 2023, averaging $2.83/MMBtu through the end of 2023, according to our July Short-Term Energy Outlook. We expect the price to peak at $3.44/MMBtu in December, up from $2.18/MMBtu in June. We expect consumption will rise to 107 Bcf/d in December 2023, a 2.1 Bcf/d decrease from December 2022. We expect dry natural gas production to average 102.6 Bcf/d (from July to December).”