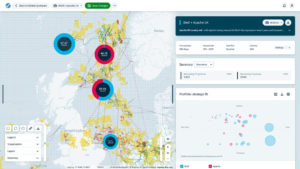

Wood Mackenzie, an international research-and-consultancy in natural resources, has launched a new program, called Lens Upstream Optimization, that is designed to transform how E&P companies, banks, and institutional investors conduct their upstream M&A deal ideation and analysis, as well as portfolio high-grading.

As John Dunn, head of the company’s Upstream Product Management service, said, “This will have a profound impact on our customer workflows, transforming economic deal analysis from the domain of specialist economic modellers to a task that any E&P professional or banking analyst can perform with confidence, and freeing data specialists to focus on value-add activities rather than data wrangling.” Dunn added, “Our cloud-hosted valuation engine processing large volumes of upstream economic data at speed has enabled us to bring our customers a range of significant business workflow efficiencies, from key insights generated in seconds, to eliminating manual error-prone tasks through automated data ingestion via our Lens Direct API service.”

To continue to attract capital, portfolios must be built around core advantaged assets—low-cost, long-life, low carbon-intensive barrels. With 2020 being the year many of the oil Majors committed to net-zero carbon goals, it is anticipated that the coming decade will see a rise in M&A activity as the Majors’ non-core assets find new buyers.

Greig Aitken, Head of Wood Mackenzie’s M&A service added, “With Lens Upstream Optimisation you can build your own custom portfolios to assess strategic fit and value-driven synergies for potential M&A activity on-the-fly. The time to result is up to 20 times faster for assessing opportunities, testing ‘what if’ scenarios or scanning the market for potential buyers and sellers. Within Wood Mackenzie’s M&A research team, we are already realising massive efficiency gains for our own analysis. It’s game-changing.”

Over the last 45 years, the Wood Mackenzie brand has become synonymous with delivering insights critical to achieving sustainable and resilient business performance, but more recently the company has been investing in the best-in-class data analytics platform, Lens. Wood Mackenzie’s renowned expertise in research and data analytics is now augmented by technology to bring the most accurate and impactful intelligence.

Chris Grieve, EVP of Strategy & Corporate Development, said, “From my prior roles in upstream business development and investment banking, I know first-hand just how laborious analysing potential upstream deals can be. The time and effort to model different scenarios when screening and valuing opportunities is significant. Whether actively working on a portfolio or getting to understand competitor bidding strategies, the initial screening using Lens Upstream Optimisation can be done in just a few clicks. By having deal notes turned around in seconds, leveraging the latest weekly asset model updates from Wood Mackenzie, E&P and investment professionals alike can spend more time on detailed due diligence of highly prospective deals instead of hours and days screening deals only to find them unsuitable for a company’s portfolio. It’s changed our workflows for good and delivered new analytical benchmarks.”

Wood Mackenzie has announced plans to support sectors across the natural resources value chain. “As we scale Lens capabilities across new sectors, our aim is to provide tailored user experience that reflects our customer workflows and further improve their operational efficiency,” he said.