In the second half of 2025, West Texas Intermediate (WTI) is expected to average around $66 per barrel, reflecting elevated geopolitical risk premiums—particularly due to tensions in the Middle East—while tempered by ample global supply growth. The U.S. Energy Information Administration (EIA) raised its mid-year forecast accordingly and now expects WTI to gradually decline to $59/bbl by December 2025, and slide further into the low $50s—ending at roughly $53/bbl by late 2026.

In a separate Reuters-conducted consensus poll among 37 analysts, the 2025 average price outlook remains near $64.60/bbl, with frontier risk from OPEC+ production increases and trade policy uncertainties keeping volatility elevated.

Within the Permian Basin, natural gas pricing at Waha continues to struggle, pinned deep in negative territory. The basis differential to Henry Hub remains wide, with prompt Waha strip trading between –$2.00 to –$2.50/MMBtu—and even Summer 2026 strip lingering around –$2.30/MMBtu—a direct consequence of sustained takeaway bottlenecks and pipeline constraints that are unlikely to ease until the second half of 2026.

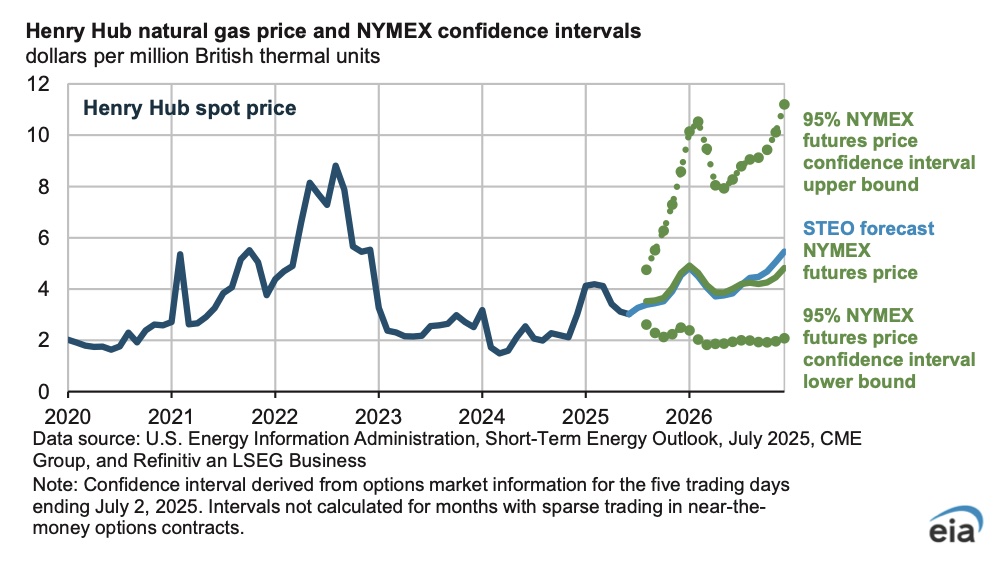

Meanwhile, Henry Hub futures for August 2025 settled near $3.08/MMBtu, with the 12-month strip around $3.75/MMBtu, and storage levels that remain elevated into the refill season, moderating further upside in gas spot prices. The EIA has lowered its Henry Hub forecast to approximately $3.40/MMBtu in Q3, and $3.70/MMBtu on average for 2025, citing stronger than expected inventory restocking.

On the drilling side, the Baker Hughes rig count report highlights a persistent pull-back in oil drilling across the Permian. Oil rigs have dropped to around 415, down sharply from year-earlier levels, while the number of gas rigs has actually increased to 122.

Crude profitability remains intact: With WTI in the $60–66/bbl range, many wells still cover breakeven costs, holding operator margins despite upstream capital discipline. But gas is a different story: at Waha, negative basis persists, squeezing cash flow and discouraging associated gas production. The disconnect between Henry Hub pricing and local LP gas value is a central headwind for drilling economics in gas-rich sections.

Producers continue to scale back drilling plans. According to a recent Dallas Fed survey, nearly half of regional energy executives plan to drill fewer wells in 2025, unless WTI recovers above the mid-$60s mark.

Key inflection points to keep an eye on include: completion of pipeline projects such as Gulf Coast Express and Blackcomb (expected 2H 2026), any movement or heightened tensions affecting OPEC+ output or global trade dynamics, and seasonal gas storage trends and industrial demand growth impacting Henry Hub pricing.

WTI Crude: Mid-$60s in 2025, sliding toward $59 by year-end, then drifting into the low-$50s by late 2026 amid growing global inventories.

Permian (Waha) Gas: Basis differentials remain deeply negative through 2026, even as Henry Hub prices moderate around $3.40–3.80/MMBtu.

Drilling Outlook: Operators tightening the belt—reduced rigs, deferred well completions, and capital spending discipline.

Jesse Mullins is editor of Permian Basin Oil and Gas Magazine.