ExxonMobil announced April 2 that Karen T. McKee, president of ExxonMobil Product Solutions Company, was to retire effective May 1. The Board of Directors appointed Matt Crocker president, ExxonMobil Product Solutions Company and vice president Exxon Mobil Corporation. He succeeded McKee May 1. Crocker, who has been ExxonMobil’s President/Global Business Solutions since 2023, joined the […]

The Changing Landscape of Leasing and Minerals

Click here to listen to the Audio verison of this story! The flurry of merger and acquisition (M&A) activity over the last two years has changed the minerals landscape in the Permian Basin, along with most producing basins in the United States. Fewer operators control larger acreages. Also, the definition of what constitutes a […]

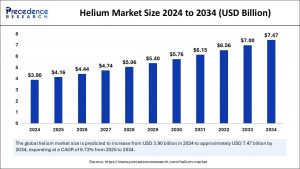

New Era Helium

As we discussed a few months ago, the Permian Basin is starting to feel the impact of AI data centers creating demand for natural gas fired electricity. Chevron and Diamondback Energy are two of the larger players engaging in projects to power AI data centers. For investors, those deals barely move the needle for a […]

Electrifying the Permian

There is a new sheriff in the White House, and with his administration embracing the oil and gas industry, excitement and relief has permeated throughout. Although the doors of possibility have now opened upon a gleaming prospect of four prosperous years ahead, certain of the industry’s lingering challenges will need solutions if growth is to […]

Tough Transitions

When it comes to managing, planning, and staffing during significant transitions—here are some things to ponder. In current times I feel a little like the character Alice, from Lewis Carroll’s Alice in Wonderland, wherein she says, “I wonder if I shall fall right through the earth! How funny it’ll seem to come out among the […]

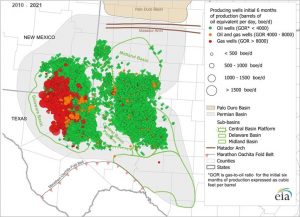

New Mexico: Taking Stock

Geographically, the New Mexico side of the Permian Basin seems small—only five of the region’s 54 counties are there. But those five—mainly Lea and Eddy—account for 29 percent of the Basin’s total production, according to figures from the U.S. Energy Information Administration (EIA). Lea and Eddy rank second and third in the Permian as well […]

How Low Could Crude Prices Go—Or Will They Fall at All?

President Trump is calling on OPEC to increase U.S. crude production, which could easily push crude prices lower into this second quarter of 2025, as supply would likely then outpace demand. Just how low could prices go—or will they fall at all? The answer depends on a confluence of factors, as supply is just one part […]

Pounding the Table on PR and CTRA

Volatility at the start of the Trump Administration might present the last chance to buy Delaware Basin oil and gas stocks on the cheap, in my opinion. The recent goal of maximizing oil production over gas production seems to be flipping and the investing public is not quite in emotional chase mode yet. That gives […]

Welded Together

As a whole, the oil patch is a tight-knit community, especially in the Permian Basin, where almost everyone is in the business one way or another. And the welding community seems to be particularly close-knit—or more precisely, welded together. Here are stories of two entrepreneuring welders—Daniel Rodriguez of Shadow Welding and Jaron Tuttle of Tuttle’s […]

Change Happens—and in 2025 it Happens Fast

In February, I asked a couple of questions about ethics. Later that month, President Trump fired the head of the Office of Ethics. No comment. Now, I am moving on to the ugly term: trimming the fat. Who and what will it hurt, and who and what will it help? When it is all said […]

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 33

- Next Page »