Merger and acquisition (M&A) activity across the United States surpassed an eight-year high in 2021, marking a dramatic recovery from the pandemic-led price crash in 2020. Yet, the last time oil prices were as consistently over $100 per barrel, in 2012-2014, the rig count was dramatically higher than it has been to start 2022.

S&P Global reports that the total value of U.S. M&A in 2021 was “$59.6 billion… with the majority of the deals occurring in the Permian.” The report shows that the Permian Basin made up 62 percent of all deals. A distant second was the Haynesville Shale, at approximately 12 percent, with Denver-Julesburg and Appalachia accounting for about 6 percent each.

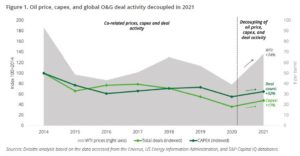

But, adds a report from Deloitte, 2021 was the year that M&A activity levels decoupled from commodity prices. “Despite a 75 percent rebound in prices, deal activity increased by only 32 percent and capex grew by only 17 percent,” the report said.

Deloitte’s report also shows a divergence of U.S. M&A from that of the world as a whole. Worldwide transaction totals rose 70 percent from historically low 2020 numbers, but are still at a 15-year low if the abnormalcy of 2020 is removed from the equation. Upstream and oilfield service sectors led the way in activity levels.

Estimates released by many organizations in January expected M&A activity in the United States to continue its growth, but a new international roadblock to predictions arose with the Russian invasion of Ukraine. Now it is likely that buyers and sellers alike may pause, as commodity prices see-saw. “Because of all the price volatility, [that situation] does create uncertainty and uncertainty makes it difficult to transact,” said Melinda Yee, a leader with Deloitte’s oil and gas merger and acquisition services. Yee’s focus is on due diligence, helping companies consider M&A options in the pre-acquisition phase.

She continued: “Buyers and sellers have a hard time determining what price is the appropriate price, [and] financial institutions have a hard time projecting out what commodity prices might be.” As commodity prices relate to asset values, those fluctuations create risk for both parties in a transaction.

Among the indicators for the M&A marketplace, one centers on oil and gas price spreads between markets and hubs, explained Amy Chronis, who is Deloitte’s U.S. oil, gas, and chemical leader. That spread is important to transactions because “spreads reflect supply chain problems and geopolitical uncertainty, which is really front and center right now. We’re also keeping an eye on drilling activity and the changes in drilled but uncompleted wells in the U.S. shales, to make sure whether U.S. players are breaking or maintaining discipline on how they discuss. We’re also looking at hedging positions of oil and gas companies. We know that higher hedging means that producers are expecting higher volatility.”

A significant portion of activity was basin-specific. While they did not analyze basin specifics, Chronis said, “You have had some in-basin consolidation in various basins across the U.S., the DJ being one of them and I’m sure the Permian being another. It’s just the level of activity that we’re seeing. That’s something that we saw picking up a couple of years ago, not just in 2021.”

Oil and gas joint ventures and partnerships worldwide, especially in Europe, are also on Deloitte’s radar due to the conflict’s direct influence on supplies and pricing in the latter region.

Cash Flow as King Redefines M&A Models

Already toward the end of 2019 both public companies and private equity-backed firms were changing from the “buy, grow, sell” model to a cash flow plan, choosing to limit growth in order to return cash to investors. The pandemic further crushed the growth model, and producers have been reluctant to return to it since then, even with decade-high prices. Uncertainty and ESG concerns are among the top dampers on drilling.

Yee noted one of the main changes in the approach of PE investors in recent months. “For a while there they were looking to acquire acreage and amass that and then sell on that acreage, potentially with some development.” Often, however, there was no development, just an effort to aggregate acreage and sell to a larger in-basin player, or an adjoining operator.

She continued, “You had a smaller team that was focused more on that exploration side. Where, when prices started to fall, then private equity had to pivot their strategy and rely more on actual operations and being able to go and develop projects, and getting their returns from those cash flows rather than from an exit to a larger party and a larger gain. That does require a different skillset, a different management team, different experience.”

Interest Rates and Other Funding Concerns

With inflation growing, governments, including that of the United States, are looking to raise interest rates, which would affect the cost of money used in acquisitions in particular. Chronis said this adds further uncertainty to the market. She pointed out that rising interest rates increase the cost of debt financing, while reducing the value of future cash flow, more of which must be assigned to debt reduction. “That’s also widening the evaluation gap between buyers and sellers and slowing M&A activity.”

A further capital squeeze has come due to major banks that are shying away from hydrocarbons due to ESG agendas. Chronis noted that there has also been a lack of energy IPOs in recent months. Chronis added, “That lack of capital has forced PEs who would have sold to rethink, and to reinvest in what they had rather than sell to a market that could not raise capital for a purchase.”

The Effects of Renewables and ESG

Every week there seems to be news about one of the majors investing in wind, solar, green hydrogen, or something on the green spectrum. Efficiency technologies are another popular investment, says Yee. “You’re not going to see everybody invest in renewables. You may see them invest in newer technologies, research and development, or cleaner production. A lot of companies now have ESG mandates and are evaluating how to consider ESG when it comes to transacting, and what does that mean for them, what does that mean for the market, and how are they communicating that to their stakeholders?”

Chronis added that efficient operations and emissions reductions are other values that are gaining traction.

One point in question, however, is how to evaluate ESG scores in the M&A process, Yee noted. “When it comes to ESG you don’t have one single standard, so which one do you follow?”

Last year’s COP 26 conference birthed a committee tasked with creating a single ESG standard. Until then, however, “It does make it difficult to understand or compare each company’s footprint against another.”

Even then, assigning exact values to ESG scores is a negotiating point. Yee sees an increasing number of companies doing due diligence in that realm, to better understand the metrics, their dollar value, and how to compare numbers between companies before buying or merging.

Sometimes even more important is the values proposition—do the two companies share values for ESG, safety, and other governance issues? Are they similar enough to mesh well from the start?

Top Permian Upstream Deals for 2021

One of the largest Permian deals was Pioneer Natural Resources’ $6.4 billion purchase of Double Point Energy, noted elsewhere in this publication.

The largest was ConocoPhillips’ September purchase of Shell’s entire Delaware Basin position for $9.5 billion. In November Pioneer sold some Permian acreage to Continental for $3.25 billion.

Midstream and Service Sectors

Deloitte reports that midstream M&A activity globally has been steady, due to its “take or pay” model. This stability is characteristic of all basins, all geographies, asset categories, and deal sizes.

In fact, Yee believes, midstream will be a focus for M&A as it also has a role in energy transition. “Midstream has always been an area that private equity and a subclass of PE, infrastructure funds, have liked because they like the steady cash flow aspect of it. That’s been an area where we continue to see interest in building out the infrastructure to support the energy transition—whether that’s through additional gas pipelines or LNG storage facilities. We’re seeing interest in tanks and terminal storage facilities.”

For service companies, 2020 was a bloodbath of red ink. The sector was a leading source of bankruptcies that year. In 2021 things settled out, with three transactions accounting for 60 percent of the sector’s U.S. M&A dollar amount. Yee observed, “Now you’re also seeing an increase in demand for services from oilfield service companies as commodity prices have risen and there’s more demand for drilling.”

For at least the near future, three things are expected to drive everything energy companies do, up and down the stream. Those would be, in no particular order, ESG, energy transition, and cash flow. Financial influences will include market instability, worldwide demand, inflation, and interest rates.

And, of course, a new world crisis could change everything in a moment.

________________________________________________________________________________________________

Paul Wiseman is a freelance writer in the oil and gas sector. His email is fittoprint414@gmail.com.