Click here to listen to the Audio version of this story! While there will always be pollution associated with hydrocarbon production, the Permian Basin is on the forefront of many technologies and operational practices that are reducing emissions at scale—innovations that often lead the way globally, even amid intense scrutiny. The Environmental Landscape: Hard […]

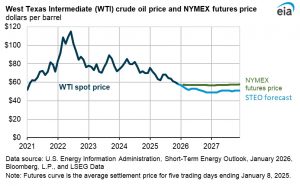

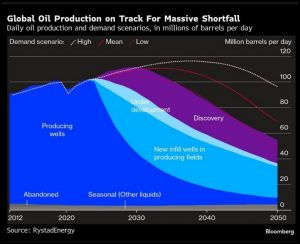

How Low Can Crude Oil Go?

The dip we’ve seen this past fall and winter in prices was “prophesied” some months previous. But has it been as bad as advertised—and what should Permian Basin decision-makers watch next? As January 2026 winds down, West Texas Intermediate (WTI)—the benchmark that matters most to Permian Basin operators and service firms—has certainly been soft, but […]

Outlooks, Forecasts, Earnings, and BBQ

Crystal Ball. Morgan Stanley put out their overview [late November] of the U.S. Oil and Natural Gas outlook in reference to 2026 intentions and activities. Some of their comments: Preliminary 2026 messaging from U.S. E&Ps points to flat oil production for –2 percent lower spending year over year, reflecting further efficiency gains, while majors continue to plan […]

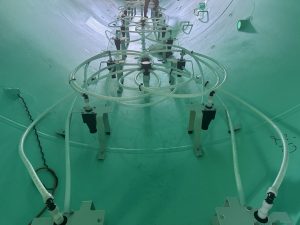

Cleaner is Better

Click here to listen to the Audio verison of this story! Permian Basin methane emissions have dropped by 20 percent since 2022, even as production has increased, according to a S&P Global study, as reported on this magazine’s website (tinyurl.com/yc6jd2pt). That good news is a result of many different approaches, and three of them […]

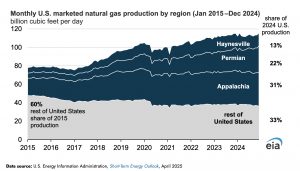

Natgas In Ascendancy

By the time 2026 arrives, the Permian Basin will again be producing more natural gas than any other region in North America. Whether that abundance translates into “bright prospects” depends on where one stands in the value chain—but the consensus among analysts is that natural gas will play a larger strategic role in the Basin’s […]

Grounded in Grit, Driven by Trust

Click here to listen to the Audio verison of this story! In the heart of West Texas and southeastern New Mexico, the Permian Basin isn’t just oil-country. It’s banking country too. Here, financial institutions don’t simply lend, they live the energy business, and they know that raising the next generation of bankers and customers […]

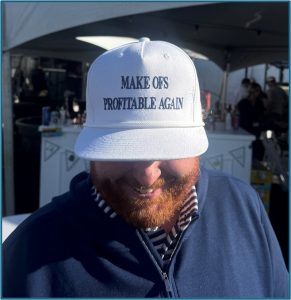

OFS—the Backbone of the O&G Industry

Click here to listen to the Audio verison of this story! For today’s oilfield service companies—called OFS for short—improving or adding services is a necessity. E&Ps are pushing for more efficiency and more accuracy, and OFS companies must equal that or be left in the dust. The author of the article you are about […]

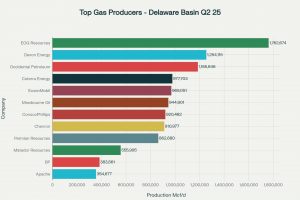

Multiple Factors To Boost Delaware Gas Producers

Click here to listen to the Audio verison of this story! Delaware Basin natural gas prices have suffered versus gas from other regions for years. The gap between Henry Hub and Waha Hub pricing is well known, by now. The primary factor driving Waha Hub discounts has been insufficient pipeline takeaway capacity relative to rapidly […]

AI, Data Centers, Rig Counts, and No Complaints

There is a huge amount of news lately pertaining to our industry. Okay, it is really all about AI and the explosion of data centers. The #1 most talked about topic these days is data centers. There is no one in second place. Nothing else seems to matter. Power for data centers will need be the greenest form of […]

It’s a Changing World… and Then There’s the Whole AI Thing

Baseload Fuel. The output of Spanish gas-fired power plants has jumped 58 percent since the April 28th nationwide outage. The hope is to better stabilize the network after record usage of air conditioning has been seen this year across Europe. You know, the more reliable power generation. Soar Like an Eagle. We have all been told […]

- 1

- 2

- 3

- …

- 12

- Next Page »